Cost control strategies to grow your practice out of high overhead

This will come as absolutely no surprise to anyone running a dental practice, but the cost of doing business is still a challenge. Salaries are on the rise. Supply costs remain elevated. Rent is up. Reimbursements are flatlining.

But here’s the thing. We’re now in year three of this inflationary cycle, with no end in sight. Maybe it’s time to reframe the conversation about dental practice cost control and accept that costs are no longer high. Practice owners have entered “new normal” territory, at least for the foreseeable future.

By the same logic, we can also reframe how we approach managing overhead and maximizing profitability. Rather than cutting out so much fat that we lose muscle, we focus on dental practice cost control strategies that will help practices grow out of their overhead problem.

To do this, Cain Watters & Associates (CWA) advisors look at the three phases of dental practice growth. But before diving into each one, let’s establish where overhead currently stands across the national averages.

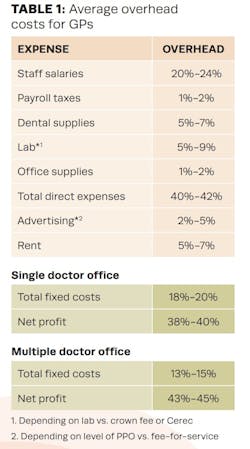

Each year, the CWA team compiles client data across six specialties to create a benchmarking tool for doctors to compare their numbers against similar practices nationwide. Called the How does your practice compare? Report, the latest edition shows that the average overhead for a GP should fall into the following ranges. See Figure 1.

Now that we know the averages, let’s look at how a practice can meet or beat them. There are three phases of the journey, and understanding where your practice falls within them will help determine where to optimize your practice for growth.

Phase 1: Getting your cost structure in place

Cost structure is synonymous with overhead. It’s essentially how a dentist structures operations to minimize business expenses and maximize efficiency and profits. This includes things you can control, such as fees, vendor agreements, and staff salaries (to an extent), and things you can’t easily control, such as the interest rate on that new equipment or the rent payment in year two of a 10-year lease.

This is where consulting an advisor well in advance to make these big decisions can make a huge difference. Due diligence is crucial for startup dentists looking for a new building, or a practice within two years of renegotiating their lease. A misstep here can set your cost structure back five years or more.

An advisor can also run pro formas to show the ROI of investing in that new equipment and connect practice owners with companies such as Elite Dental Alliance to help you find significant product savings for every aspect of your practice.

Regarding costs you can control, here’s a good place to start to continue your due diligence to control variable costs:

- Optimizing staffing levels and salaries

- Renegotiating supplier contracts

- Streamlining administration processes

- Consistently raising fees to keep up with inflation

Again, to get a range of where these costs should be per practice size and specialty, download the How does your practice compare? Report.

Next, you need to look at your PPO insurance reimbursements. This is the biggest deterrent for practices trying to grow out of high overhead. No matter if a dentist raises fees 10%, profitability is handcuffed by the insurance contracts. To make matters worse, some big providers have actually lowered reimbursement rates. So, not only are owners hit with rising costs, but their revenue is capped by flat or lowered rates.

The solution for some practices is to transition to a fee-for-service (FFS) model. Note that this isn’t for everyone. Some practices need insurance plans to build up patient flow, and that’s OK. Others may have a good

reimbursement rate and no need to make a move. But for those considering it, there are strategies for optimizing the FFS transition, starting with talking to an advisor who can run pro formas and map out a transition plan.

Phase 2: Stabilization

With a cost structure set and a business seeing double-digit growth for a number of years, practices typically move into the stabilization phase. In this phase, practice owners typically see 4%–7% growth as the business maximizes its footprint and earnings potential.

This is a great place to be! Many dentists choose to stay in this phase until retirement. In that case, the focus shifts to financial planning. CWA optimizes tax and investment strategies to make the most of the cash flow coming in.

Adding a new associate during this phase can help lighten the load and adequately position the practice for a transition when the time is right. Planning for this should start at least five years before the transition. Partnership negotiations are often complex and emotionally charged, so be sure you have the right team of practice transition experts and financial advisors in your corner.

Phase 3: Expansion

For those dentists looking to expand their business by adding locations, make sure the practice has reached the stabilization phase before executing any expansion plans. This is the foundation, and you want to make sure to protect it.

Step one is to get crystal clear on your expansion goals and create a timeline. So often, we see owners with three locations, and they’re working 12-hour days to keep up. But what really happened is, locations two and three aren’t profitable because the owner didn’t take the time to get the second location into the stabilization phase before opening the third. Expansion is a process, and it takes a team of advisors to make sure it’s executed flawlessly.

Step two is hiring a rockstar associate to take over the existing practice. A consultant like NDP can help find the right associate who can maintain your practice while you focus on growing the new location. Just keep in mind, the associate will need time and guidance to keep your existing location positioned in that stabilization sweet spot. This can be a two-year process, so plan accordingly.

Whether you’re in phase one of structuring your practice and looking for ways to lower business expenses, comfortably enjoying the stabilization phase, or have grand long-term expansion goals, the key is to make sure your cost structure is ready to make those plans a reality. Having a team of trusted advisors in place to help you plan and execute your ambitions is key.

To learn more about the three phases of dental practice growth, dive into the numbers in the latest How does your practice compare? Report. To get deeper insights into your business or personal financial plan, set up your complimentary consultation with a CWA advisor today.

Editor's note: This article appeared in the September 2024 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.