Cash flow can be a mystery. When you have good months, you ride the wave. When you have poor months, you tighten the belt. Because many dentists do not understand why they have such erratic swings, they are helplessly pulled by the winds of chance. You don’t have to be. You can control your cash flow, and with it your practice, lifestyle, and financial future. Cash-flow management is as simple as gaining knowledge, which gives you control over your practice, which leads to profits. Do you know what production level will allow you to live the lifestyle you desire, secure your financial future, provide you the wherewithal to deliver state-of-the-art dentistry, and allow your staff to be compensated fairly? Do you know how to reach that production and collections level? This article offers six key ways to secure your financial future by controlling what is arguably the least understood and most dreaded subject for dentists: cash flow.

Let’s first define cash-flow management. Derived from the Latin word manus for hand, management is the art of getting your hands on something. Cash flow means the money and resources flowing through your practice. Therefore, cash-flow management literally means getting your hands on the cash flowing through your practice. Far from being boring, dreaded, or mysterious, cash-flow management is an essential tool for success.

Let’s define another key term, entrepreneur. This is someone who assumes risk for an expected reward. If you’re a practice owner, you have likely gone into debt for your education, practice purchase, and start-up expenses. Besides your financial risk, you’ve invested time and creativity (sweat equity) in your practice. Your life now depends on generating the reward from your investment. I never met a dentist who was not willing to put his or her whole heart and soul into the practice. I’ve met many who have not demanded the reward. It’s up to you to demand a proper return and to trust yourself ethically to apply the art of cash-flow management in a way consistent with your values and highest standard of patient care.

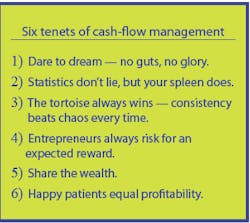

Getting the return on investment is as easy as applying the following six tenets of cash-flow management. If you’ve ever paid yourself last, or found bills at the end of the month instead of a paycheck for you, or figured you’ll save for retirement after you are debt-free ... read on.

Step 1: Dare to dream - no guts, no glory

Know where you’ve been and where you want to go. When it comes to analyzing how they spend their money, many dentists are like Cleopatra, Queen of “de Nile” (denial - get it?). One way that some dentists avoid taking personal responsibility for understanding their financial health is by putting their cash-flow management in the hands of a CPA, bookkeeper, or spouse. If you do this, you will be giving that person more knowledge and control over the practice’s financial future than you have. Entrepreneurs must have their hands on their money.

Before you can decide what a realistic goal is for financial success, you need to understand your cash-flow history. For example, let’s assume that you never monitored how much your employees cost you as a percentage of total office production. Let’s also say that the range norm for employee expense in your area is 25 to 32 percent of total office production. When you examine your statistics, you discover that employee expense has been running 34 percent. What do you do? Hold off the Reign of Terror to knock off the excess 2 percent; there’s a better way. Very often, by analyzing your expenses, you discover that a $2,000 to $3,000 increase in monthly production will move excess employee expense percentages into a healthy range. The knowledge of your employee expense being higher than the range norm gives you the power to change your production goals, which gives you the power to improve your profitability.

Once you know where your expenses have been, it is time to decide where you want them to be. Unfortunately, dentists’ budgets often look like diets. I’ve seen them vary from the anorexic (“I’ll buy nothing ... ever!”) to the bulimic (“I’ll buy everything and save later.”). Neither approach is good. A proper cash-flow budget should reflect what you want to spend and not merely what you have to spend. You’ve got to dare to dream. As authors Kouzes and Posner of “The Leadership Challenge” put it, leaders are possibility thinkers, not probability thinkers. Spending to reach your dreams, however, needs to be forecasted and strategically planned. In projecting your ideal cash flow, you will need to examine everything, including staff salary increases, investments in new technology and CE, ideal savings, debt retirement, and of course, a doctor paycheck that might not land you in the lifestyles of the rich and famous, but certainly will make you feel well compensated.

The next step is to determine the production and collections needed to support the forecasted spending. When you have determined the amount of money you want to spend during the next 12 months, then you can back into the production and collections goals needed to fund your forecast. Now all you need is a strategy to achieve your dream.

Step 2: Statistics don’t lie, but your spleen does

If you do not have a statistical interpretation of your practice’s success, you are left with only your gut reactions. Subjective feelings and knee-jerk, crisis-driven reactions won’t allow you to control and profit in the future. Dentists relying on their guts are gripped by despair when they have a bad production day or by uneasiness when they are doing well, because they don’t quite know why. Say for example that a patient who needs a three-unit bridge cancels, which triggers fears of failure in the dentist, which injects panic into his or her decisions and actions. The only way to keep any momentary successes or failures in proper perspective is to have a black-and-white statistical interpretation of success overall.

We get phone calls from dentists saying, “Help me, I’m having a horrible month.” When we ask them to add up what they produced and scheduled for the month, we very often get a sheepish “never mind.” If the doctor hadn’t called and hadn’t done the calculations, but continued to feel unsuccessful, would that have affected the final outcome for the month? The answer is an absolute yes!

When doctors manage by the stomachache, they also tend to downplay success. I have named this “yeah, but” management: “Yeah we had a great month, but it might never happen again.” This warped perception leads to missed opportunities to capture, acknowledge, and celebrate the achievements of themselves and their staff.

Either approach - panic or put-down - is not statistically accurate and results in burnout for the doctor and team. The only way to be in control of your destiny is to be sure that you have given your goals a clear, specific statistical interpretation. For example, take the goal, “I want to be productive.” Do you want to be $50,000, $60,000, or $90,000 a month productive, and how much will it cost you to achieve that production level? Knowing what production and collection numbers will support your wish list of expenses takes the panic out of your day-by-day reactions.

Step 3: The tortoise always wins - consistency beats chaos every time

I have found throughout my career that consistent cash flow ultimately wins over peaks and valleys. This holds for expenses, production, and collections. There’s nothing worse for a dentist and team than to have a $5,000 production day, followed by a $200 production day, followed by a $1,500 production day. It is much easier to control and manage a $3,200 production day, followed by a $3,170 day, followed by a $3,320 day. Consistency in daily production levels allows for balance and quality, reduces stress, and provides a controlled, steady feeling of progress toward the finish line.

The tortoise principle applies to expense management as well. For example, if we do not have a system for monthly set-asides, it never fails that quarterly, yearly, and bi-yearly payments sneak up on us, generating a short-term, cash-flow scarcity. If you have a bill that must be paid quarterly, it is much more effective to establish a monthly set-aside than to wait for the bill to hit and hope the additional collections are there to pay it. An attempt at radical debt reduction or paying in cash for major expenditures can create that same problem of scarcity, making you feel unsuccessful. This leads to reduced savings and to feeling ineffectively compensated for your efforts. Financial success comes from the tortoise approach of long-range planning and predictable cash flow. The hare gets you there first, but with no money to show for it.

Step 4: Entrepreneurs always risk for an expected reward

An entrepreneur’s investment of time, money, and creativity in a business makes no sense unless there is return and reward. Whether purchasing new technology, bringing in an additional staff member, or introducing a new model of clinical care, any money spent must have a formulated return on investment. At Pride, we believe that any practice investments can have a return of up to 40 to 60 percent gross profit. Assume you want to invest $10,000 in new equipment. What additional production must be generated to have a significant return on your initial investment? Over the time period that you project for this return, you will need to generate the $10,000 in purchase price, plus the expenses tied to the additional production, plus any interest you will pay on the purchase, plus the 40 to 60 percent profit. This could mean: $10,000 plus $1,500 in direct expenses (lab and supplies), plus $2,500 in interest, plus $4,000 to $6,000 in profit (40 to 60 percent of the purchase price), equaling $18,000 to $20,000. This is the amount you need to produce over time to give you a proper return on your original investment. The formula holds true for a $595 CE course or a $32,000 additional employee expense. Using this formula eliminates the fear that some doctors have of spending any money, or the wild spending that others engage in without forethought. When you have analyzed your potential purchases and seen that they will yield a return, then you can go ahead and make your purchases with confidence. You’re being an entrepreneur, and it feels great.

Step 5: Share the wealth

In a small business, it is essential that staff share an entrepreneurial-like relationship in the practice with the owner. We hear so many doctors lament: “My staff members don’t care about the bottom line!” My first response is that they don’t care because they don’t know. It is vital in a dental practice to have what’s called open-book management - full disclosure of the key statistics for business success. Failing to share your numbers is like asking your team to play in a sporting event without knowing the score. The reason that goals are so vital is that they give the staff a finish line to strive for, a way to pace their efforts. Sharing numbers provides critical information that aligns actions to ultimately crossing the finish line and winning the game. Without goals to enhance their work-life experience, staff members feel they are in a never-ending marathon race with no signposts of challenge and success. Staff members deserve the opportunity to win.

If you are hesitant to share your numbers with your team because you are afraid they will discover your salary, I’ve got news for you. Your staff already thinks they know your salary, and it’s probably your production number. A basic tenet of effective leadership of self-directive team members is trust. Obviously, there are professional boundaries in what you share with your team. We do not advocate sharing anyone’s salary figures; however, it is vital to share other practice statistics and expenses. A knowledgeable, trusted team will want their leader to be as monetarily successful as possible.

When you share your numbers with your team, there must be creative compensation, reward, and recognition programs that provide opportunities for each individual staff member to earn more as the practice becomes more profitable. Your staff’s meeting practice goals makes you successful. They individually need to understand that pools for salary and rewards are based on their efforts. Invite them to participate in these programs based on their individual, demonstrated skills and abilities. The staff want to be part of a big achievement. Goals allow them to feel like champions. Finish lines create new challenges and a feeling of personal growth when staff members stretch the limits to reach them.

Step 6: Happy patients equal profitability

How many of you have hesitated to raise your fees for fear your patients may find someone else who charges less? Here’s some news: Patients will pay any fee if: ①they like you, ② they value and are committed to the treatment, and ③ you can make it affordable for them through financial arrangements. If you think a $30 variance on your $950 crown fee will make or break your success, think again. The most profitable practices realize that when patients accept comprehensive treatment plans and pay their bills on time, it is applause for a job well done. I challenge you to put an ad in the Yellow Pages announcing you are the most unprofitable dentist in the area and see how many new patients call you. The goal is to have patients who are proud of their dental care, who willingly pay the fees that the practice deems appropriate, and who enthusiastically refer friends and family. You need to charge the fee that mirrors your vision and values, as well as the quality of care and service you deliver. Happy, satisfied patients will always support and promote the practice’s goals for success.

Unraveling the mysteries of cash flow and bringing this huge life-determining tool called cash-flow management under your control makes the realization of your dreams for your practice and lifestyle possible. As an entrepreneur, you’ve already taken the risk; now it’s time for the reward.

For the cities and dates of the author’s flagship seminar, “Staff, Systems & Numbers,” call Pride Institute or visit www.prideinstitute.com. To help gain control of your numbers, Pride is offering its $595 Fee and Profitability Analysis of your practice complimentary until Oct. 1. To take advantage of this offer, practice owners should call Pride Institute at (800) 925-2600 and ask for Pat or Annie.

Amy Morgan is CEO and lead trainer of Pride Institute, the practice-management firm that helps dentists better their lives by mastering the business side of their practices. For information on Pride Institute’s seminars, management programs, and products, call (800) 925-2600 or visit www.prideinstitute.com.