A survey by Bankrate found that two out of five Americans (40%) are not prepared for the next recession.1 Now is the time to create a dental practice that is recession-proof. I was in the dental industry during the great recession of 2008–2009, and the most important takeaways for me were to create a predictable recurring revenue stream (cash flow on steroids) and use a percentage-based budget. Due to the recent events surrounding COVID-19, I think it is appropriate for dentists to evaluate their practices and learn how to prepare for a recession now before it is too late.

Definition of a recession

A common definition of a recession is two consecutive quarters of economic decline, as reflected by gross national product (GNP) in conjunction with monthly indicators such as a rise in unemployment.2 Another way to think about a recession—one often occurs when the economy stops producing goods for a minimum of six months. Recessions come and go like clockwork, and it is best practice for dentists to have a strategy to thrive during a recession.

Cash flow, cash flow, cash flow

What is cash flow? Cash flow is the timing of money—in other words, when it comes in and when it goes out of your business bank account. Ultimately, cash is king. You have probably heard that thought often in your business career, and it emphasizes the need to have solid cash flow systems, from accounts receivable to insurance claims.

Consider dropping PPOs

PPOs attack the sacred business systems of cash flow and profit margin. To prepare for an economic downturn, consider cutting out any bad deals you may have made with any PPOs. Ask yourself which PPOs are killing your profit and messing up the cadence of your practice’s cash flow. Look at the data, and then enlist the guidance of an expert to help you get rid of bad PPOs.

Membership program

A dental membership program is an alternative to dental insurance, where patients pay your practice a monthly or yearly subscription fee to gain access to certain benefits and savings in your dental practice. You are in control of the benefits and pricing. A membership plan gives your practice the opportunity to create automatic recurring revenue to help recession-proof your practice.

I highly recommend you pick up a copy of John Warrillow’s book titled The Automatic Customer: Creating a Subscription Business in any Industry. It explains that a dental membership program can give you a predictable recurring revenue stream that automatically collects the subscription fees each month and each year. I recommend starting the program with your existing patients who are uninsured. If you sign up 300 patients who pay $35 per month, that translates to $10,500 per month in automatic revenue.

Marketing should not be cut

If you end up needing to cut marketing, you should think about how you will replace it. When you cut a critical component of your business, such as marketing, the lead generation for a business, it can be devastating. Understanding and tracking the return on investment (ROI) on your marketing should be a top priority. If you have to let your marketing agency go, you then need to move it in-house, an option that I would avoid because marketing is your growth engine. All businesses have attrition and if you cut off the “new oxygen” to your business, you can suffocate.

In any type of economic downturn marketing and advertising deals may become more affordable. For example, companies such as Google and Facebook have been known to slash their advertising prices, which gives you opportunities to continue promoting your practice at a better rate.

Marketing and lead generation should be the top priorities for your practice, even if you already have a busy office. Every practice must face patient attrition, and by focusing on building the new-patient funnel you set up your practice for continued success.

I highly recommend you read the book by Gabriel Weinberg and Justin Mares titled, Traction–How Any Startup Can Achieve Explosive Growth. It will give you a framework for understanding marketing and how you know which marketing channels would be successful for your practice.

Use a percentage-based budget

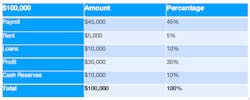

This is by far one of the most important concepts of recession-proofing. You will drive revenue with your membership program and marketing, but how will you manage the funds once they are in your business account? I recommend using a percentage-based budget and purposely adding profit and cash reserves to your budget. This concept is discussed by Michael Micalowitz in his book, Profit First. Figure 1 is an example of what a budget looks like.

In this example, the practice is generating $100,000 per month. You can see that once you have everything laid out it is simple to manage the money. Once the funds are deposited in your bank account, transfer 30% for profit into a savings account labeled “profit” and 10% into a cash reserves savings account. You can choose any percentage for reserves and profit. It may be a small percentage at first. Once you start, continue to increase the percentage you allocate to profit and cash reserves.

Conclusion

Is it too late to recession-proof your practice? No! It is never too late. The strategies I’ve listed here will help your business regardless of the current state of the economy. But implementing them now will help you weather any storms that may occur in the future.

References

1. Foster S. Survey: 2 out of 5 Americans aren’t ready for next recession. Bankrate. October 16, 2019. https://www.bankrate.com/surveys/financial-security-poll-october-2019/

2. Chappelow J. Guide to economic recession. Investopedia. Updated April 20, 2020. https://www.investopedia.com/terms/r/recession.asp

JORDON COMSTOCK is the founder of BoomCloud Apps, a software company that allows dental offices to easily create, organize, track, and automate an in-house membership program. You can download a free e-book about membership programs or watch a free demo. Contact him at (801) 753-8586 or [email protected].