Editor's note: This is the final article in a four-part series on the future of dental practice. Previous articles in the series can be found here:

Part II: Dental workforce trends

* * *

Patients, professionals, and procedures

The first three articles in this series explored trends in dental education, how they have impacted dental workforce trends, and dental economic trends (see sidebar). We saw how major shifts in dental school enrollments eventually translated into changes in the number and demographics of dentists. The data on dental economic trends documented the expansion of the dental service industry during the second half of the 20th century, then a leveling off over the next decade.

This article looks at demographic trends in both patients and professionals, and explores the links between workforce, economics, and the practice of dentistry. We anticipate how these trends and other issues may influence the future practice of dentistry.

Dental Practice Trends

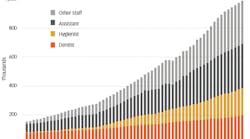

Major changes have occurred in the number and distribution of dental personnel over the past 60 years (Figure 1). We have moved from a model typically comprised of one dentist and one assistant per practice to one with a much larger and more diverse group of personnel. In 1950, there were approximately 155,000 dental personnel, which included dentists, dental hygienists, dental assistants, and other staff (e.g., receptionists, office managers, bookkeepers, sterilization assistants, laboratory technicians). Just over 50% of these individuals were dentists. By 2012, the total number of dental personnel had risen to almost one million, nearly a sixfold increase.1

Despite a 250% increase since 1950, the number of dentists in 2012 was just fewer than 200,000, representing 20% of all dental personnel. The Bureau of Labor Statistics estimates that there were almost 190,000 dental hygienists in 2012.2 Dental hygienists were rarely found in the 1950s, but obviously have experienced marked growth since then. There was also an estimated 303,000 dental assistants in 2012, up from about 55,000 in 1950. The most significant growth, however, was in dental personnel who are not involved in direct clinical care. From fewer than 20,000 in 1950, these types of positions have grown to an estimated 300,000 in 2012.3

Dentists have hired these additional staff only out of necessity, which I will discuss further below. Adding personnel increases cost and impacts the net revenue of a dental practice. In 1950, practicing dentists employed an average of one additional staff member and had a net revenue of 58.4%. By 2010, the average number of employees in dental practices had risen to five, and net revenue had fallen to 27.4%. These new personnel were hired to accommodate a significant shift in the range of services provided in the dental office.4,5

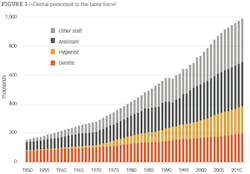

The mix of services provided in the dental office has changed substantially over the past 50 years (Figure 2). In 1959, examinations and prophylaxis represented 42% of all services in the dental office, amalgam restorations accounted for 41% of services, and dental extractions made up an additional 13%. A typical visit to the dentist in the 1950s was comprised of an examination, a cleaning, an amalgam or two, and the occasional extraction. By 2005, this profile of services for the general practitioner had changed considerably. Examinations and prophylaxis represented 78% of all dental services provided in the dental office. Restorations comprised 14% of the procedures, and there were far more plastic restorations than amalgams. The remaining 9% of procedures were comprised of other specialty-type procedures (e.g., prosthodontic, endodontic, periodontic, orthodontic, oral surgery).

Clearly, there has been a shift from disease-based practice, focused on repair and replacement, to practice rooted in routine check-ups and oral health maintenance. The dramatic decline in childhood caries is likely responsible for much of this change. In 1971, children aged 5-17 had an average of 7.1 diseased, missing, or filled tooth surfaces (DMFS) in their permanent teeth. By 2004, the average DMFS in children had fallen below 2.0. Extensive fluoridation of the public water supply has had a major impact on this decline; however, there has also been a change in public attitudes toward oral health care.6

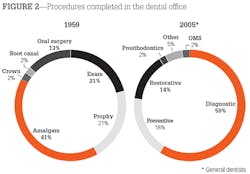

During the latter half of the 20th century, Americans established a tradition of regular dental visits. However, recent trends suggest the frequency of annual dental visits may be declining for certain age groups (Figure 3). The frequency of annual dental visits for children increased for the first three years of the 21st century, then appears to have leveled out. Nevertheless, children have regular dental visits more frequently than adults. As we have noted previously, there has been an increase in funding for dental services from government sources. This funding generally benefits children, and it appears that an increasing percentage of eligible children are taking advantage of these funds. According to a recent government report, the percentage of Medicaid children with dental visits increased from 26.6% in 2001 to 39.9% in 2009.7 The Affordable Care Act has expanded the number of children eligible for government supported dental care. Hopefully, it will also expand the rate at which they take advantage of this benefit.

The percentage of adults with routine dental visits increased through most of the latter half of the 20th century.8 This trend continued until 2003, when the frequency of adult visits began to decline. The decline in the rate of routine adult dental visits is consistent with the declining incidence of dental disease discussed above. We will likely continue to have low rates of childhood dental disease. At least to some extent, the lower incidence of childhood dental disease will carry over into their adult years.9

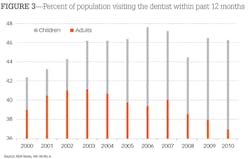

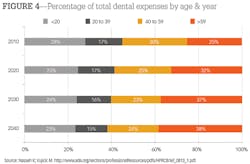

Demographics, dental disease, and personnel trends shape the future of the dental practice. The projection of these trends can be seen in the estimates of dental spending over the next quarter century (Figure 4). Dental spending has two major components: frequency of visits and cost of services. In 2011, older adults had significantly higher dental expenditures per capita than other dental patients-$767 for older adults and just under $650 for other dental patients.10 In addition, older adults were visiting the dentist on a more frequent basis.11

Combined, we see an aging population becoming the financial core of dental practice over the next 25 years. By 2040, 62% of dental expenditures are expected to come from patients who are at least 40 years old. Expanding government programs will likely increase the overall number of children with regular dental visits, but low reimbursement levels in these programs will control the overall level of expenditures there. Young adults (20-39 years old), with a reduced dental disease experience as children and limited financial means, will continue to shrink as a source of dental expenditures.12

The Growth of Corporate Dental Practice

Before we delve into a discussion of the potential growth of the corporate form of dental practice, we should define the various modes of practice arrangement. Below is a minor adaptation of a classification scheme proposed in the Journal of the American College of Dentists.13

• Traditional: Dentist owns and manages practice, provides clinical care

• Dental Management Service Organization (DMSO): Dentist owns practice and provides clinical care; a service organization provides management

• Corporate: Dentist provides clinical care with corporate ownership and management

• Nonprofit: Ownership by government agency or educational institution; dental care is provided by employees, students, and faculty

The key element in the classification scheme is ownership, because ownership status has implications for the dentist's freedom to determine the course of clinical treatment.

Many of the trends we have explored in this series of articles portend the growth of DSMOs and the corporate form of dental practice. An increasing number of dental and dental hygiene graduates will supply the workforce requirements. These recent graduates have high levels of educational debt and a dearth of alternate career choices. In addition, the retirement rate for baby boom-era dentists will increase over the next decade, and they will want to sell their practices. Corporate entities have more ready access to capital resources to purchase these practices than recent graduates with high debt loads and limited practice experience.

In addition, corporate practices have an advantage in pricing. The rising cost of services creates an environment where corporate entities can cost-compete with traditional practices in a variety of locations. The ability to provide care to walk-in patients and accept government insurance gives many of the corporate practices an advantage in a variety of practice settings. Populations in traditionally underserved and working-class areas often do not have steady sources of income and find it difficult to set up appointments weeks ahead of time. Corporate practices have been successful in many of these areas. Patients benefit from this trend due to the increasing number of traditionally underserved areas that now have relatively easy access to dental services. In corporate practice settings, the convenience of walk-in service and potentially lower cost for service can be advantageous as well.

The Future of Midlevel Dental Providers

Much discussion in dental circles over the past decade has been focused on the development of midlevel providers. The driving force behind this effort has been a desire to better assist the nation's underserved dental population. A noble gesture no doubt, but is it a viable strategy? To address the needs of the underserved, these midlevel providers will need to be capable of carrying out procedures that only dentists are now able to perform. Otherwise, it is difficult to see the advantage of creating this new class of provider.

However, one wonders what niche in the marketplace these new providers will fill. Because the graduates of these programs will have high levels of debt, they will need to find jobs. Who will be the most likely employers of these new graduates? I believe large dental practices will be in the best position to employ these graduates. There is a potential economic benefit here. These large practices can assign less complex dental procedures to the midlevel providers (within the scope of their licensure) and the more complex procedures to the dentists. That strategy could potentially reduce their labor costs significantly. Unfortunately, it is not clear how the underserved population will benefit in this scenario.

Perhaps some attention should be given to the question of how we can provide appropriate treatment to the patient of the future. Increasingly, dental patients will be older, have more complex medical issues, and take routine medications. To treat these patients properly, dentists will need to have an extensive knowledge of the relevant clinical sciences, including the foundational basic and medical sciences. Rather than emphasizing the training of dental care providers with an abbreviated educational experience, we might want to consider more extensive training to meet the more complex needs of the dental patient of the future.

Demographic Challenges

Many of the current trends point to a more competitive dental marketplace in the future. Some of these trends include:

Workforce: An increasing number of dental and dental hygiene graduates, the potential development of training programs for midlevel providers, and baby boom-era dentists working longer.

Dental economics: Stagnation in the growth in spending for dental services, a shift in spending toward government payers. The rising cost of dental services, and dentists' incomes not keeping pace with inflation.

Dental practice: A shift in the types of dental services provided toward routine and preventative care, a decline in the frequency that adults seek routine dental care, and older adults increasingly providing the financial backbone for dental income.

The future of the private practice model will hinge on how these types of practices are able to respond to the challenge of a more competitive marketplace. Demographics, especially the baby-boom generation, will play an influential role in deciding the extent to which the private practice model will share the dental marketplace of the future. Currently, about 42% of all dentists were born during or before the baby boom. Over the next decade (2015-2024), many of these dentists will retire.14 As they sell their practices, the degree to which these practice sales go to corporate entities could have a major impact on the proportion of private practices in the marketplace.

The second demographic challenge comes in the next decade (2025-2035) with the aging of the baby boomer patients. As retirees on fixed incomes, will they continue to demand the same level of dental services? In addition, there will be some population loss in this age group as well. The loss of these patients or a reduction in their demand for dental services could have a major impact on the profile of dental services provided and the aggregate amount of income going into dentistry. Once again, a more competitive marketplace will provide a challenge to the private practitioner.

The brilliant futurist William Gibson said, "The future has already arrived. It's just not evenly distributed yet." We have looked at many aspects of the history and current practice of dentistry. Only time will tell which of these trends portend the future of dental practice.

References

1. Various sources were used to compile Figure 1, including: Sixth Report to the President and Congress on the Status of Health Personnel in the United States, the American Dental Association's Survey of Dental Practice, and The Bureau of Labor Statistics.

2. Dental hygienists. Occupational Outlook Handbook, 2014-15 Edition. Bureau of Labor Statistics, U.S. Department of Labor website. http://www.bls.gov/ooh/healthcare/dental-hygienists.htm. Published January 8, 2014. Accessed March 3, 2015.

3. 2013 Survey of Dental Practice, American Dental Association Health Policy Resources Center.

4. 1959 Survey of Dental Practice, American Dental Association Health Policy Resources Center.

5. The 2005-06 Survey of Dental Services Rendered. American Dental Association Health Policy Resources Center. http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/05_sdsr20140404t121935.ashx. Published August 7, 2007. Accessed March 3, 2015.

6. Questionnaries, datasets, and related documentation: 1997 to the present. Centers for Disease Control and Prevention web site. http://www.cdc.gov/nchs/nhis/quest_data_related_1997_forward.htm. Accessed March 3, 2015.

7. U.S. Department of Health and Human Services, Centers for Medicare & Medicaid Services. Use of dental services in Medicaid and Chip. Centers for Medicare & Medicaid Services, September 2011.

8. Solomon ES. Dental workforce. Dent Clin North Am. 2009;53:435-49.

9. Eklund SA. Trends in dental treatment, 1992 to 2007. J Am Dent Assoc. 2010:141:391-9.

10. Wall T, Nasseh K, Vujici M. U.S. dental spending remains flat through 2012. American Dental Association Health Policy Resources Center. http://www.ada.org/~/media/ADA/Science%20and%20Research/Files/HPRCBrief_0114_1.ashx. Accessed March 3, 2015.

11. Oral and dental health. Centers for Disease Control and Prevention website. http://www.cdc.gov/nchs/fastats/dental.htm. Updated May 2014. Accessed February 9, 2015.

12. Nasseh K, Vujicic M. Dental expenditure expected to grow at a much lower rate in the coming years. American Dental Association Health Policy Resources Center. http://www.ada.org/~/media/ADA/Science%20and%20Research/Files/HPRCBrief_0813_1.ashx. Accessed March 3, 2015.

13. Chambers DW. The money structure of dentistry. J Am Coll Dent. 2013;80:2-3.

14. Munson B, Vujicic M. Supply of dentists in the United States is likely to grow. American Dental Association Health Policy Resources Center Research Brief. http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_1014_1.ashx. Accessed March 3, 2015.

Eric S. Solomon, DDS, MA, is a professor of public health sciences at Texas A&M University, Baylor College of Dentistry. He earned his bachelor's degree, master's degree, and dental degree from the University of Maryland. He also completed a general dentistry residency from the University of Rochester, a certificate in conflict resolution from the Texas A&M University System, and a graduate certificate in geographic information systems from the University of Texas at Dallas. He has published more than 130 articles in scholarly journals and has frequently been invited to speak on a wide variety of topics related to dental education and the future of dentistry.