Dealing with a high tax burden can be a common challenge and headache among dentists. As incomes grow, so does the tax bill to Uncle Sam. This can be difficult to overcome, especially with a lack of time to focus on financial aspects while balancing practice, personal, and family matters. Of course, it’s important to remain focused on ways to not only grow your personal balance sheet but also keep more money in your pocket.

While investment returns garner much of the attention and excitement in terms of financial gains, effective tax-planning strategies can play a pivotal role in this endeavor as well. Whether you are an associate dentist or a dental practice owner, there are seven tax-advantaged strategies you should consider.

No. 1: Invest efficiently

Boosting investment returns gets the main spotlight when it comes to portfolio management, but managing your taxable portfolio (e.g., brokerage or trust accounts) in a tax-efficient manner can potentially help reduce your tax liability.

You may also be interested in ... How to keep inflation from destroying your future

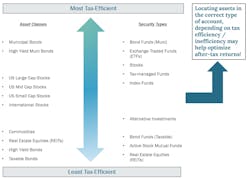

Tax loss harvesting1 is one example where you strategically sell securities at a loss to offset securities sold at a gain, which potentially reduces capital gains tax owed. Asset location2 is another strategy where you sort (or “locate”) investments into different account types (e.g., taxable or tax-advantaged) depending on the tax-efficiency or inefficiency of the asset, which can help optimize after-tax returns (figure 1).

Direct indexing3 can also be an effective way to enhance tax-efficiency, which is a strategy akin to creating your own, personalized index fund where you own a subset of individual stocks that track a benchmark index. Owning multiple stocks can provide for more opportunities to tax loss harvest.

No. 2: Maximize qualified retirement plan and HSA contributions

Whether you have an SEP IRA, SIMPLE IRA, or 401(k), maximizing contributions can help reduce your taxable income for the year while providing a vehicle for potential tax-deferred growth over the long haul. For 401(k) plans,4 you can defer up to a maximum of $22,500 in 2023 (and an additional $7,500 in catch-up contributions if age 50 or over).

You may also be interested in ... 6 dental practice KPIs to measure success and streamline systems

You may also consider contributing to a health savings account (HSA)5 if you have a high-deductible health plan. An HSA offers pretax savings for medical expenses, reducing your taxable income. HSA accounts are also considered “triple tax-deferred,” because you can contribute pretax dollars, pay no tax on earnings, and withdraw money tax free if used for qualified medical costs. Further, once you turn 65, you can make withdrawals for any reason (including nonmedical) penalty free; only income tax would apply.

No. 3: Consider backdoor Roth IRA contributions

Given dentists’ high level of earned income, it is likely that you are not able to make a regular contribution to a Roth IRA. However, an alternate strategy is to utilize the backdoor method for a Roth IRA6:

- Make a nondeductible contribution to a traditional IRA.

- Leave the funds in cash in the IRA for a reasonable period.

- Convert the balance to your Roth IRA.

If there were no earnings while the contribution was held in the IRA, then the conversion will be a nontaxable event. You can contribute a maximum of $6,500 into a Roth IRA for 2023 (with an additional $1,000 catch-up contribution if age 50 or over). Be mindful of the pro-rata rule before proceeding with this strategy if you have existing pretax IRA balances.

No. 4: Maximize contributions to 529 college savings plans

For those with children or grandchildren, contributing to 529 college savings plans7 not only helps support their dreams for higher education, but also offers tax benefits. First off, any growth within these accounts is tax-deferred, and future withdrawals made to pay for qualified education expenses are tax free as well. Second, over 70% of states across the country provide some form of tax deduction on contributions, which may help lower your overall state tax liability.

No. 5: Make charitable contributions (direct or through a DAF)

For those philanthropically inclined, gifting to charities not only feels good but also provides charitable deductions on assets donated of up to 60% of adjusted gross income (AGI),8 depending on the type of contribution and organization. In years of high-earned income, the tax-savings potential can be enhanced further through a strategy called “bunching,” where you combine multiple years’ worth of charitable gifts into one.

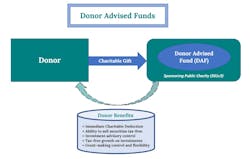

You may also want to consider Donor Advised Funds (DAFs).9,10 A DAF is a personalized, charitable investment account that provides a simple and flexible way to manage charitable giving (figure 2). You can maximize the size of a gift into a DAF, providing an immediate charitable deduction, but allowing you to make grants to the charity of your choice either now or in the future. Any potential growth on assets that remain in a DAF is tax free as well.

No. 6: Capitalize on deductions

Identifying and claiming all eligible deductions11 on business expenses—such as office supplies, uniforms, professional dues, and malpractice insurance premiums—can be valuable. Remember to maintain organized financial records to track and document all deductions accurately. If you are a practice owner, there are other possible deductions to consider such as deducting costs of tangible property purchased and used for business purposes (e.g., dental chairs and x-ray machines).

Depreciation is also a potential deduction for equipment, allowing practice owners to spread the cost over several years, effectively lowering current tax liability. Additionally, the qualified business income (QBI)12 deduction allows eligible self-employed and small-business owners to deduct up to 20% of their qualified business income (subject to several requirements and depending on your legal structure). Be sure to consult with a qualified tax professional who can provide personalized guidance for your situation.

No. 7: Establish a cash balance pension plan if you own your practice

In addition to a 401(k), dental offices could stand to benefit by creating a cash balance pension plan.13, 14 A cash balance plan is a unique version of a defined benefit (DB) plan. It is essentially a hybrid of a DB and DC (defined contribution) plan as it comes with all the usual DB requirements but looks and feels more like a DC plan (yet with much higher contribution limits). A cash balance plan can offer the best of both worlds because dentists can potentially triple or quadruple their annual retirement savings as well as receive a tax deduction for the business. For example, a dentist born in 1970 may be able to make a maximum contribution13, 14 of more than $215,000.

Consult with trusted professionals

Navigating the complexities of tax planning can be challenging, so it is important to consult with qualified financial, tax, and legal professionals. Ideally, partnering with financial planners who specialize in working with dentists and dental practice owners can help tailor a comprehensive strategy for your unique financial situation while maximizing your tax-savings potential.

References

- Melchiorre K. What is tax loss harvesting? Tenet Wealth Partners. December 6, 2022. https://tenetwealthpartners.com/insights/videos/what-is-tax-loss-harvesting/

- Prince D. How asset location can help minimize taxes and maximize returns. iShares by BlackRock. April 19, 2023. https://www.ishares.com/us/insights/asset-location-taxes

- Direct indexing: is it worth it? Orion. May 18, 2023. https://orion.com/wealth-management/blog/benefits-of-direct-indexing

- Retirement topics – 401(k) and profit-sharing plan contribution limits. IRS. Updated August 29, 2023. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

- Grubka R. Do you realize the power of HSAs? Probably not! Kiplinger. May 27, 2022. https://www.kiplinger.com/personal-finance/insurance/health-insurance/health-savings-accounts/604736/do-you-realize-the-power

- Marquit M. Backdoor Roth IRA guide. Forbes. February 24, 2023. https://www.forbes.com/advisor/retirement/backdoor-roth-ira/

- Andersson D. Unlocking the benefits of 529 plans. Tenet Wealth Partners. May 13, 2023. https://tenetwealthpartners.com/insights/unlocking-the-benefits-of-529-plans/

- About Publication 526, Charitable Contributions. IRS. Updated February 17, 2023. https://www.irs.gov/forms-pubs/about-publication-526

- Wetters K. Personalizing your philanthropic goals with DAFs & QCDs. Tenet Wealth Partners. December 6, 2021. https://tenetwealthpartners.com/insights/personalizing-your-philanthropic-goals-with-dafs-qcds/

- What is a donor advised fund? American Endowment Foundation. Accessed September 18, 2023. https://www.aefonline.org/what-donor-advised-fund

- Credits and deductions for businesses. IRS. Updated June 21, 2023. https://www.irs.gov/credits-deductions/businesses

- Tax Cuts and Jobs Act: a comparison for businesses. IRS. Updated June 8, 2023. https://www.irs.gov/newsroom/tax-cuts-and-jobs-act-a-comparison-for-businesses

- Maximum contribution calculator. FuturePlan by Ascensus. Accessed September 18, 2023. https://www.cashbalancedesign.com/resources/maximum-contribution-calculator/

- Cash balance plans. FuturePlan by Ascensus. Accessed September 18, 2023. https://www.futureplan.com/plans/cash-balance-plans/

Editor’s note: This article appeared in the December 2023 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

Kevan Melchiorre, CFP, is cofounder and managing partner at Tenet Wealth Partners, an independent wealth management firm. Kevan is a certified financial planner with more than 15 years of experience. He was recognized nationally by Forbes as a top wealth advisor in 2019 and 2021, and he has been quoted in national publications for his expertise and insights, including Forbes and Barron’s. Contact him at [email protected] or call (217) 281-4251.