If you are like other business owners across many industries during the past couple of years, in response to the Great Resignation driven by COVID-19, you found it necessary to start providing a more attractive employee compensation package to recruit and retain talented team members. Unfortunately, you’re also continuing to face inflation at a 41-year high, rising overhead due to continued supply chain issues, and insurance premium increases projected at 4% in 2023.1 You’re so worried about the impact of all that on your business that you may have already made the decision to hold the line on wage increases this year.

As concerned as you are about your bottom line, your team members are more concerned about putting food on the table and gas in their cars. You may think the solution to your problem is the polar opposite of the solution to theirs, but it doesn’t have to be. Performance incentives drive business revenue while simultaneously providing opportunities for employees to increase their earnings. Structured and executed properly, incentives are a win–win that can work effectively in any dental practice.

It’s math, not magic

Incentives allow dentists to manage their largest fixed overhead expense—payroll—more effectively and profitably. The ideal office averages about 70% fixed payroll and 30% variable, incentive-based pay. This ensures overhead increases only as business increases. The magic behind this math is that incentives focus the entire team on what matters most to meet business goals. They drive behavior, create a performance-based culture, and motivate achievement.

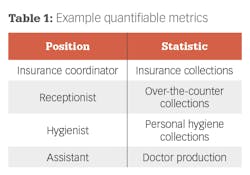

Create incentive-based compensation based on analysis and planning: Tie each incentive to a consistent, quantifiable metric the person has control over and can influence so they can be held accountable (table 1). These are obvious examples, but incentives should be applied to everyone, including those in back-office positions (and associates, of course).

Determine the historical average on which to calculate growth (e.g., average new patients or average hygiene production).

Set a baseline goal above the average, which is where you would begin to make incentive payments. We advise clients to set the baseline goal 10%–20% higher than the average—an attainable target that also drives growth. Additionally, you can set incremental “stretch targets” above the baseline as a tiered incentive plan that allows your team to make even more money as the business grows.

Clearly communicate the win–win objective of new incentives, emphasizing that you appreciate their hard work, couldn’t run the practice without them, and recognize the impact of tough economic times. You want to provide opportunities to increase one’s total compensation by helping grow the business. In other words, if they help you make more money, they’ll make more money. Then explain the mechanics, one on one if necessary, to ensure each individual fully understands their particular incentive and baseline, demonstrates buy-in, and is prepared to take ownership.

Track progress using performance data that is accurate, timely, and impossible to manipulate. Stats must also be easy to track so people always know how they’re doing against their goals. Pay earned incentives after the additional revenue has been collected; celebrate the win–wins in a big way!

Build on momentum by involving the team in setting new targets that will continue to drive business growth while providing opportunities for even higher compensation. This also preempts any misunderstanding that fixed salaries have risen to a new level. If payouts aren’t earned, don’t allow the team or yourself to feel defeated; show appreciation, motivate them to build on what you all learned, and rerun the incentive with adjustments, if warranted.

Address your own financial concerns in a way that also addresses those of your team. An incentive-based culture brings out the best in people, motivating them to go above and beyond their daily performance to help boost the bottom line of the business while boosting their own income.

Editor's note: This article appeared in the January 2023 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

Reference

1. What are the projected 2023 health plan cost trends? The Segal Group. September 21, 2022. https://www.segalco.com/consulting-insights/2023-health-plan-cost-trend-survey