We’ve seen disinflation and historically low-interest rates for the last 40 years. And now, the devaluation of the dollar, or inflation, is back for the first time in a generation and a half and is expected to grow. According to Forbes, “On an annual basis, CPI was up 8.3% in August over the prior 12 months, disappointing expectations for an 8% figure. While that’s an improvement from July’s annualized 8.5% gain, it remains very high.”1

What does this mean for your retirement?

It’s a completely different dynamic when it comes to planning for retirement. Saving and aggregating money in various traditional retirement accounts won’t work any longer. After all, most financial advisors have never experienced inflation with continuously increasing high interest rates. They’ll just recommend that you build “safe investments” in bonds or treasuries and take out about 4% of the principal each year. However, this may pay around 1.5% today and lead to dire consequences.

Why? Because inflation rates based on the US Bureau of Labor Statistics Consumer Price Index (CPI) are at 8.5% at the time of this writing.2 However, the government tends to manipulate the numbers,3,4 and you typically need to multiply this by two. So the real number is about 17%.

Related articles

The impact of inflation and higher interest rates on practice values

Dealing with the inflation factor

Inflation eats away at your purchasing power

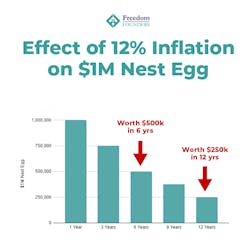

To better understand the full impact of inflation on your retirement, look at the Rule of 72. This is an easy calculation you can use to determine how quickly an investment will double.

You simply take your return on investment (ROI) and divide that by 72 to discover how quickly you can double the compounding effect of your investment.

To see how fast your wealth is decimated by the compounding effects of inflation, you reverse this calculation. For example, at a 12% inflation rate, a dollar today will only be worth $.50 in six years (72/12% = 6 years) (figure 1). This means that a million-dollar retirement nest egg will only buy $500,000 of lifestyle in six years. In 12 years, this decreases to 25%, or $250,000.

If the purchasing ability of your dollar has been cut in half at a 6% inflation rate in just 12 years, this may not be enough to support you and your family for the rest of your life, let alone provide the retirement lifestyle you’ve been dreaming about for all these years.

Inflation, “the silent killer”

When there is a significant loss on the stock market, everyone is talking about it, and you feel it firsthand as you check the numbers on your monthly statement. In contrast, inflationary losses are real but can go unnoticed if you aren’t looking for them. This is also true for your retirement savings. Do you know what is really going on with your Wall Street accounts?

Tax-deferral plan considerations: Many practitioners have been told that they need to accumulate $6 to $10M in order to maintain their lifestyle after practice. This is a very high bar for most practitioners to reach. Also, most financial advisors promote tax-deferred plans like traditional IRAs, 401(k)s, defined contribution plans, and cash balance plans. These so-called “tax-savings plans” simply defer your taxes to a later date and have several disadvantages. Specifically, once you invest, you can’t access this money until age 59.5 without a penalty.

Your funds are locked up: This means that you can’t take advantage of tax benefits like long-term capital exchange opportunities, stepped-up basis allowance for assets/generational wealth transfer strategies, depreciation, and cost segregation. And when you finally get to take your distributions, taxes will probably be higher. Plus, you’ll be in a higher tax bracket converting your long-term capital gain profits (lower taxation) into ordinary income (higher taxation).

Will you have enough to live on?

Due to time constraints, most dental practitioners simply hire a financial advisor and review their statements on a regular basis. But with all of the economic changes going on, this “standard” practice doesn’t work any longer. By giving all of your hard-earned money for retirement over to someone else, you don’t receive any kind of knowledge about investing or how to use the right assets to secure the retirement lifestyle you want. If you just stick with the status quo and avoid learning about what to do with your money for the future, you may end up working much longer than expected with no end in sight. Yes, change can be scary, but right now, it’s a necessity, and there are alternatives to the Wall Street roller coaster.

To start, learn about real capital assets that provide an inflation index hedge to keep up with the cost of living and provide cash flow. With cash-flow assets, you avoid reducing your principal by 4% per year and having inflation take it down by another 12%–15%.

But how do you get cash flow assets if your money is stuck on Wall Street?

You have options.

The Roth conversion: When you convert to a Roth IRA, you pay taxes on your current rate. However, this will probably be less than paying taxes at ordinary income tax later on. As noted in a recent Kiplinger article, “… under the new IRA rules, combined with the 2026 increasing tax brackets, the ‘pay-as-late-as-possible’ approach will result in the most tax revenue for the IRS. If you want to reduce your family’s overall tax bill, you should be acting now.”5 Most financial advisors aren’t telling you this.

The J-curve strategy: This is when the value of a private equity portfolio starts out at a specific amount, bottoms out, and then increases rapidly. If you’ve experienced a market loss, you’ll want to be aware of this lesser-known strategy often used with alternative assets.

For example, let’s say you want to convert a noncash asset from a traditional IRA plan to a Roth IRA. Have a qualified appraiser validate whether or not the asset has had a temporary market value loss. If so, that decreased value will proportionately lower the amount of taxes due at the time of the conversion. You won’t take a net loss in the asset value because the asset’s decreased valuation is based on facts known in advance and a planned value-add to the asset.

Only your account will take a net loss for the time involved in the conversion. Not only can you save hundreds of thousands of dollars using this strategy, but by switching to a Roth, your assets will increase for tax-free distributions in the future.

Most financial advisors will never discuss alternative investments. They’ll tell you that you’ll have enough money to retire as long as there isn’t some kind of market/economic correction in the first few years after your retirement, because that will significantly reduce your principal balance.

That’s pretty scary because we have all heard the nightmare stories about retirees who lost all of their savings via the stock market and had to return to work to pay the bills. Even with a great track record and fantastic testimonials, no financial advisor has any idea what will happen with the markets in the future. This is why it’s important to learn and be prudent about how you look at your financial future rather than rely on someone else.

Sure. You can wait to see what happens. You can continue to work hard and save for a future date. But without having control over your retirement savings, do you really know when you’ll be able to stop working and if you’ll have enough money to do so?

Instead, be your own financial advocate and determine how you invest your money. Create a clear path today so that you can enjoy a worry-free retirement lifestyle in the years ahead.

Editor's note: This article appeared in the January 2023 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

References

- Tepper T, Curry B. Why is inflation so high? Forbes Advisor. Updated November 10, 2022.

https://www.forbes.com/advisor/investing/why-is-inflation-rising-right-now/

- Consumer Price Index. US Bureau of Labor Statistics. September 19, 2022.

https://www.bls.gov/cpi/

- Palmer B. Why is the Consumer Price Index controversial? Investopedia. Updated October 1, 2022. https://www.investopedia.com/articles/07/consumerpriceindex.asp

- McGriff J. The Consumer Price Index and the truth about inflation. The McGriff Alliance. September 22, 2016. https://www.themcgriffalliance.com/blog/the-consumer-price-index-and-the-truth-about-inflation

- Singer K. Don’t be tricked into voluntarily paying higher taxes on your IRA. Kiplinger. July 4, 2022. https://www.kiplinger.com/retirement/retirement-plans/iras/604878/dont-be-tricked-into-voluntarily-paying-higher-taxes-on