by James R. Pride, DDS and Brian C. Hufford, CPA, CFP

In Part 1 of this series, the authors outline their steps for a well-defined retirement exit strategy.

A recent survey conducted for mutual-fund firm Strong Capital Management asked people how prepared they were for retirement. The results showed that 59 percent of Americans do not expect to cut back on their current lifestyles after retiring. However, 53 percent said that they hadn't calculated how much they needed to save for retirement. Six percent thought they'd need less than $50,000 in savings, 15 percent thought between $50,000 and $100,000, and 21 percent thought between $100,000 and $250,000. Our studies of dentists confirm this same perception. Many people expect to live well in their golden years, yet are unaware of how much money they will need to sustain what could be a 25-year retirement.

Take, for example, the case of one of our clients - let's call him Dr. Smith - who currently lives on $117,000 per year. How much money will Dr. Smith need for retirement? Retired people often spend more money than anticipated. Recreation, travel, home repairs, auto replacements, gifts for grandchildren, and other things can gradually erode a retirement nest egg. Since Dr. Smith's house would be paid off, we found that he would need only $92,000 a year at retirement. Factoring in inflation, an 8 percent return on investments and 25 years of retirement, Dr. Smith would actually need $1.8 million on the day he sees his last patient.

Calculating the amount one will actually need is the crucial - and most often overlooked - step in retirement planning. This article aims to help dentists determine the amount needed to retire comfortably and guide them in achieving their goals.

A generation ago dentists said, "I'll sell my practice and retire on that." Today's dentist understands that the profit from a practice sale is insufficient for retirement - and still saves far too little. By calculating the amount dentists will need to meet family and personal needs during retirement, we see that relying on a practice sale as even a part of a retirement strategy is risky.

Recent surveys and articles from the ADA suggest that the future value of dental practices may be declining. Statistics indicate a shortage of new dentists. This shortage will become more acute by the year 2008. Forecasts indicate that it will continue perhaps for 15 years as retiring baby-boomer dentists begin to outnumber those starting to practice. Of course you are not relying on the sale of your dental practice to retire ... are you?

How much will you need to retire, and how will you accumulate the money?

We can answer these critical questions with something dentists need, yet few have actually worked out - an exit strategy.

Designing an exit strategy

An exit strategy consists of calculating the amount of money necessary to meet one's needs during retirement, then designing a plan to attain the goal. An exit strategy differs from financial planning; the latter can determine only how much is needed, but not how to amass it. Typically, financial planners are unfamiliar with the variety of businesses engaged in by their clients and are unable to give advice on how to accumulate more money. Yet, increasing cash flow is crucial.

Spending less is not a pleasant prospect; we all want to enjoy the here-and-now before saving for retirement. As business owners, dentists are in a unique position to capitalize on laws that allow them the opportunity to save $35,000 (or more) in a tax-deductible pension plan. Few dentists participate in these plans to the full extent. Why? Dentists doubt that they can meet current family needs and save $35,000 yearly. Many haven't discovered that there is a way to do both. Finding this way is the purpose of an exit strategy.

Ideally, one should put an exit strategy in place at least 15 years prior to retirement. If you haven't, and your retirement is imminent, consider developing a plan immediately. An exit strategy consists of the following steps:

1. Increase cash flow to meet the current financial needs of your family; then, when you become free of immediate financial worries, you can increase cash flow to fully fund your pension.

2. Calculate how much money you will need during retirement to comfortably meet personal and family needs.

3. Determine which pension plans and investments are suitable to achieve your financial goals.

4. Identify your successor and enter into appropriate legal contracts.

We will cover Steps 1 through 3 in this article and address Step 4 in a forthcoming issue.

Step 1: Increase cash flow

Many dentists ask, "How can I fully fund my pension when I can't meet my current cash needs?" This is why increasing cash flow becomes essential if a dentist is to have a proper pension. Dentists and their families do not want to sacrifice present comforts for the sake of the future, nor should they have to. Yet savings must increase. Our findings show that dentists save an average of about 3 percent of their gross production; however, 10 percent is optimal. How can you increase your retirement savings without compromising your current living standards and family needs? Where will this extra money come from?

You may find increased cash either inside or outside the practice. Sources outside the practice can include an expected inheritance or spousal employment and pension. Sometimes these sources can contribute substantially to retirement goals.

Since most of our clients find the increased cash inside the practice, let's examine this source. Two options exist: decrease expenses or increase production. Should dentists try to increase their cash flow by controlling expenses? Salaries are typically the biggest practice expense. We cannot cut them; therefore, we must focus on increasing production. How much of an increase is possible? Solo dentists in America with a full hygiene schedule produce between $250,000 and $1.6 million annually in a four-and-a-half-day workweek. This wide range of productivity suggests - and our consulting experience with thousands of dentists confirms - that increases are possible. We emphasize that increased production must come not from working more hours, but by producing more per clinical hour. Here are some ways to increase production per hour:

- Raise fees. Yearly increases are important. Practices that engage in ongoing continuing education for doctor and staff should provide the clinical services, office ambience, and customer service to warrant fees in the 80th to 90th percentile for their geographic location. Raise fees according to a formula that appropriately compensates the dentist for time spent on a given procedure, rather than arbitrarily, as is typically the case.

- Improve scheduling efficiency. This involves preblocking the doctor's schedule with procedure mixes that meet production goals. The staff should inspect files and find patients who have delayed treatment and hygiene recalls. Along with new patient exams, dentists should schedule these and other significant procedures as a major part of each day's production. This will typically result in needed treatment being performed on a more timely basis. The patients also receive better care.

- Increase case acceptance of comprehensive dentistry. Proper comprehensive examinations and consultations are the first step toward building trust between doctors and their patients. Trust and quality care will increase case acceptance.

- Offer a variety of flexible, convenient payment plans. Dentistry must be affordable if patients are to accept needed treatment. Of course, payment options must be accompanied by proper financial policies to collect what you produce.

Practice management plays a pivotal role in increasing cash flow to meet current family needs and to fund retirement.

Step 2: Calculate

Determine when you will be able to leave dentistry with earnings from investments that will eliminate the need to practice. This computation has two components: Calculate the dollar accumulation and calculate annual savings needed.

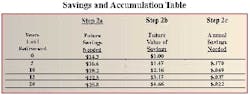

For example, let's assume 25 years of retirement, inflation of 3 percent per year, and an 8 percent per year investment return. You, of course, should determine the most appropriate assumptions for your own exit strategy. As a sample case study, let's develop the savings need of a 45-year-old practitioner with $120,000 of current net income. It is preferable to replace 100 percent of practice income in an exit strategy; however, in our example we will use 70 percent. Therefore, the income goal of our exit strategy is 70 percent times $120,000, or $84,000 per year. We wish to accumulate enough in savings to provide this annual amount for 25 years. Let's also assume that our 45-year-old doctor has amassed $285,000 in retirement savings. We'll use the following steps to perform the calculations (see also the "Savings and Accumulation" table).

Step 2a: Determine the future savings needed. Let's assume the doctor wants to retire at age 60, which is 15 years from now. We previously determined that the annual income needed is $84,000 in today's dollars. Therefore, by multiplying $84,000 times $22.3 from Step 2a of the Future Savings Needed column of the table, we determine that the doctor needs $1,873,200 in 15 years. This amount represents the funds needed in 15 years at age 60 to provide $84,000 of annual income in today's dollars for 25 years. According to the ADA's 1999 Survey of Career Patterns, the median savings of a 49-year-old dentist is $293,000. Compare this with the $1,873,200 needed at age 60 in this example to provide a somewhat minimal retirement income.

Step 2b: Determine the future value of savings. We previously stated that this doctor has accumulated $285,000 in retirement savings. To determine the future value of this amount, multiply $285,000 x $3.17 from the 15-year row of the Savings and Accumulation table. The future value of current savings would be $903,450. This leaves a deficit at age 60 of $1,873,200 minus $903,450, or $969,750. This deficit needs to be eliminated.

Step 2c: Determine the annual savings needed to eliminate the deficit. Multiply the deficit in Step 2b - $969,750 - times $.037 (from the Step 2c column of the Table). The amount is $35,881 of annual savings for 15 years to eliminate the deficit. To summarize, with a current savings of $285,000 and yearly savings of $35,881 earning 8 percent for 15 years, our dentist would accumulate $1,873,200 - enough to provide $84,000 per year for 25 years of retirement with 3 percent annual inflation.

Let's discuss the variables used above. Although current life expectancy for a 60-year-old is 20.68 years, we prefer that doctors have a cushion and use 25 years as a basis for retirement. Perhaps the biggest point of contention is the investment assumption of 8 percent per year. Had we used 11 percent per year, which is the average return of the S&P 500 Index over the past 70 years, the amount of savings needed would drop dramatically.

According to Morningstar, Inc. and others, only about 20 percent of professional money managers can match the performance of the S&P 500 Index over a 10-year period. Why not simply purchase an S&P 500 Index fund? Most of us can't handle the volatility of a 100 percent equity investment position throughout retirement.

Even the S&P 500 Index itself cannot match its own average performance for longer periods of time. We actually calculated the probability that an S&P 500 Index fund would underperform the average performance of 11 percent per year based on the past. Our results indicate that approximately 35 percent of the 25-year periods of the S&P had returns of less than 11 percent per year. This seems sensible since an average by definition lies between higher and lower sums. We consider it unacceptable to have only a 65 percent probability of achieving a comfortable retirement! Thus, we choose an 8 percent annual return for its higher probability.

Finally, in determining the annual savings needed, we have ignored the value of the dental practice. This asset should be used as a future resource for purchasing a second home or for paying off remaining debt at retirement. As previously stated, future demographics indicate that practice values may decline - perhaps dramatically.

Step 3: Determine the best investments

The average retirement accumulation needed for today's practicing dentist will typically be between $1,500,000 and $2,500,000. The best savings vehicle will be a qualified defined contribution or defined benefit plan.

IRA-based retirement plans such as Simple IRAs or SEP-IRAs do not allow for sufficient accumulation and flexibility for a doctor's retirement. In 2001, doctors can save $35,000 for themselves in a qualified defined contribution retirement plan. Doctors aged 45 and older can contribute more than $50,000 per year.

Many of our older clients are putting over $70,000 per year into a fully tax-deductible, defined benefit pension plan. Incorporation is not necessary to benefit from these sophisticated plans.

Obtaining help to design the right pension plan for your dental practice is critical. Many doctors have been told they are unable to use a qualified retirement plan, when in fact they simply didn't have a consultant with the expertise to design the appropriate plan. A consultant with the proper expertise can design the right plan for your needs.

Finally, the investment planning process is driven by the rate of return needed to accomplish the exit strategy. Select those investments with a high probability of achieving a certain portfolio rate of return within the bounds of acceptable risk.Think in terms of, "I need an 11 percent annual return to accomplish my exit strategy. How should I invest?" rather than "I think technology stocks will be hot, so I'll purchase Intel." Designing a comprehensive investment strategy will be left for another article.

With the power of practice management to increase cash flow, and the power of carefully chosen pension plans and investments, the large sum needed to retire comfortably is not as daunting. Thousands of dentists have met the challenge. So can you! The key to living well now and saving enough to retire comfortably lies in two words: exit strategy.

To enroll in the authors' popular new seminar, "Exit Strategies™" contact Pride Institute at (800) 925-2600.