After working with dentists for 30 years, I’m well acquainted with their allergic reaction to all things financial. As soon as I say terms like P&L or KPI, even the most financially savvy dentist breaks into a cold sweat. But it’s not the dentist’s fault! Dental school never prepared you for the business side of the practice, so dealing with the financial nitty-gritty on your own is downright intimidating.

A big draw toward DSOs for a lot of dentists is just that—getting out of the business mess and letting someone with a business degree handle it. But here’s a little secret: to get to that nonbusiness nirvana, you’ve got to wrestle with some pretty big acronyms along the way, starting with EBITDA.

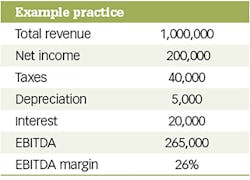

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. Basically, it’s the cash remaining before you pay taxes and interest. It’s the standard way investors and banks assess the profitability of a business.

Where DSOs come in

For a long time dental practice value was based on collections. But with DSOs came bigger financial muscle. Private equity firms interested in buying practices wanted to gauge their profitability based on something they were already familiar with: EBITDA.

Like it or not, DSOs are bringing dental practices into the business world. Luckily, the EBITDA acronym also brings along some pretty incredible financial benefits.

Up until the DSO revolution, most dentists exited their practice by selling it to another dentist—either an associate, partner, or someone completely new. Private buyers usually got their money to buy the practice through a bank loan. Banks would generally only loan private dentists 80%-90%1 of the practice’s value (based on collections), which meant you’d rarely exit with 100% of your practice’s worth. It was lousy, but that’s how it worked.

You may also be interested in ... The Advisor Advantage: I'll buy your business for 25x EBITDA

But with the backing of private equity, DSOs have a lot more cash lining their pockets, and they’re more interested in the practice’s overall financial health and profitability, especially compared to its total revenue (a calculation called the EBITDA margin).

How to calculate EBITDA

Find the net income (also known as profit) in your P&L and add in total taxes, depreciation, and interest paid. To find the EBITDA margin, divide total revenue by EBITDA and multiply by 100. Generally, DSOs and their private equity groups are interested in investing in practices with a 20% EBITDA margin or higher.2

EBITDA figures into the DSO offer too. Practice owners can usually expect to get an offer somewhere around seven times their EBITDA. In this example, the DSO offer could be $1.855 million, while a private buyer might offer $900,000. The better your EBITDA, the better your offer.

You may be thinking, how do I increase my EBITDA and get the 7x offer? This is a great question with a long answer, but this is the sum of it: You raise EBITDA by lowering overhead and increasing your net income. (Hint: Your practice likely has a huge revenue source hiding in plain sight among your current patients.)

Getting the 7x offer lies within DSO 3.0. When you group together with like-minded practitioners and sell your practices as a package, you’ll not only get a single payout for your individual practice, but a second payout when the group sells as a whole.

EBITDA could be the key to creating generational wealth for your family. If your EBITDA is low, take time now to improve your profitability now.

You may also be interested in ... The question on everyone's mind: "Should I stay or should I go?"

Editor’s note: NextLevel Practice is a recent financial supporter of Dental Economics. This article appeared in the August 2023 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

Author’s note: Confused? NextLevel Practice is offering free 30-minute strategy sessions and a live, educational event August 24-25 for a deep dive into DSO 3.0. Register for the workshop.

References

- Cumbus KG. Is the value of your practice higher than you think? Compendium of Continuing Education in Dentistry. November 2019. https://www.aegisdentalnetwork.com/cced/2019/11/is-the-value-of-your-practice-higher-than-you-think

- EBITDA analysis. Aligned Dental Partners. https://aligneddentalpartners.com/ebitda-analysis/