You have devoted countless hours to honing your craft and building your dream dental practice. It can be hard to imagine a time in which you aren’t caring for your patients every day. But eventually, you’ll turn the page and start a new chapter of your life—whether it’s enjoying a peaceful retirement or pursuing a new venture. If your goal is to sell your practice to a new dental practitioner or peer upon your exit, then knowing the true value of your practice is essential.

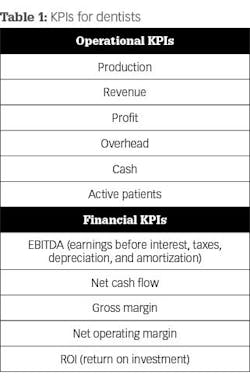

In the first part of this article series on financial and business planning for dentists, we discussed the importance of key performance indicators (KPIs) and which metrics you should be tracking on a regular basis to build a valuable, profitable practice.

In this article, we’ll be taking the topic a step further and exploring the distinct components that comprise a practice valuation and how you can make the most out of what you’ve worked so hard to create. But before we dive in, let’s first review how KPIs factor into your practice valuation.

Quick recap: The top operational and financial KPIs for dentists

It’s important to incorporate both operational and financial KPIs into your valuation process to appropriately drive your practice’s value. Once you have set up the necessary accounting measures (including a dental-specific chart of accounts, your practice’s historical performance, and your ongoing budget and goals), then you should measure the KPIs in Table 1 to help you develop a more profitable practice and get a better handle on valuation.If you properly track your operational and financial KPIs and maintain a solid accounting structure, you will increase your chances for success and fully maximize your practice’s value. At this point, you can confidently move forward with deriving your practice’s value and take the appropriate next steps.

KPIs for dental practices: Management by statistics

What comprises a practice valuation?

This sounds like an obvious question, but it’s an important one. You need to have a solid understanding of the valuation process before you start navigating it, including the most common valuation methods and key terminology.

In general, valuation is the process by which the value of a company is determined. The value of your practice must correlate with the specific attributes of your practice. Simply applying numbers you’ve heard about from another valuation to your specific practice can be dangerous without knowing why the factors applied to the valuation were determined.

For instance, if the value of a car were determined only by the number of tires, then all cars would be valued the same. By addressing the specific attributes of each car (e.g., a Ford Pinto versus a Bentley), then the exact value can be determined for each car. The same concept applies to practice valuations.

Practice valuation methods

Process-wise, most valuations are determined using one of three methods:

- Asset method: This method generally is calculated by determining the value of the assets of the business and subtracting the liabilities of the business.

- Earnings method: This method is based on the concept that the value is centered around the income or cash flow generated by the business and is indicative of the future value of the business.

- Comparable transaction method: This method is focused on comparing your business to transactions of similar businesses that were sold recently.

You should also be aware of a different type of valuation method called the rule of thumb. This method generally is used in small-business transactions and is based on the comparable transaction method. The rule of thumb is often applied to the top-line collections or revenue of a practice. Typically, this method is considered less sophisticated, and valuation experts only rely on it as a guiding principle of value.

Other key terms you should know

As you embark on business valuation, you’ll be inundated with many terms and methodologies, so it’s crucial to get up to speed on the most important keywords to ensure you’re fully informed and engaged in the process.

Aside from the valuation methods described above, another term you’ll come across frequently is fair market value. This is the price at which two parties agree to do business when both have reasonable knowledge of the relevant facts and neither party is being compelled to act. In simple terms, fair market value is the number you could expect to see if you put your practice out into the marketplace today. This will be one of the most important numbers to calculate for your practice, as it will be used as the baseline standard of value in your valuation report.

Another important term to know is EBITDA (earnings before interest, taxes, depreciation, and amortization). If you read the first part of our article series, then you’re likely already familiar with EBITDA as a financial KPI you can track to help boost the profitability of your practice. EBITDA is commonly used to describe the cash flow generated from a business and is available to an investor in a business; it’s often used in calculating the value of a company.

In addition to EBITDA, your valuation team will also work with you to calculate the seller’s discretionary earnings metric. This calculation of earnings is adjusted to represent only the level of earnings that are truly business-related and not impacted by the seller’s irregular or nonbusiness-related expenses. This calculation will also be a feature of your valuation report and will help provide an insider’s look into your practice’s balance sheet.

As you’re putting together your valuation report, understand that no valuation process exists in a vacuum. It’s important to be mindful of the professional standards of valuation, which are agreed upon by valuation organizations and represent the minimum levels of knowledge related to valuation and procedures deemed relevant to the science of completing business valuations. The purpose of these standards is to ensure that the quality of the valuations provided by certified or licensed professionals is reliable.

Applying valuation best practices to your dental practice

When you start the valuation process, you can expect to cover three steps. For this article, I’ve boiled them down into these summaries:

- You’ll ideally work with a professional team to determine the value of your practice for a potential purchase or sale. Your team will help you understand where the negotiations should begin and help you prepare for them appropriately.

- You’ll identify the strengths and weaknesses of your practice, which both correlate to the value of the practice. This exercise will allow you to devote time to activities focused on protecting the value of your practice for a prospective, future sale.

- Your team will guide you through personal estate planning, which is essential to protecting the value of your personal assets, ensuring your own personal financial success postsale, and safeguarding your legacy for years to come.

This list is far from exhaustive, but it should give you a glimpse into what you’ll be facing as you embark on practice valuation. As you may imagine, the process is exciting yet full of complexity. That’s why it is critical for you to partner with an experienced, credentialed team to help take the reins on the process and ensure that you are not only maximizing the full value of your practice, but also ensuring the future financial stability of yourself and your family.

Editor's note: This article appeared in the October 2021 print edition of Dental Economics

Trent Watrous is a partner in Aprio National Dental Practice’s Nashville, Tennessee, office, serving dental clients in a range of roles, including oversight of practice transitions and start-ups, methods to improve cash flow, strategies to minimize taxes, and exit planning. He speaks regularly to groups across the nation on a variety of topics. His knowledge of accounting coupled with compassion for people makes him a go-to resource for his dental clients. Contact him at [email protected].

Justin M. Schafer is the director of practice transitions for Aprio National Dental Practice. He is a dental industry leader with more than 12 years of experience in practice transitions, real estate, banking, debt restructuring, and finance. Through those experiences, he has witnessed every type of transaction and understands the various needs of buyers and sellers alike. Prior to working in the dental industry, Schafer was a health-care attorney for a large law firm.