3 advantages (and one disadvantage) private buyers have over DSOs

Pessimism sells. First it was in newspapers, then 24/7 TV news, and now it's in social media. Whatever the era, depressing news gets attention and clicks. In the dental industry, this pessimism often takes the form of dentists’ fear of dental support organizations (DSOs). The feeling is that DSOs are crowding out private owners and buyers. This leads some dentists to worry about finding a good practice to buy, or worse, they give up on their dream of ownership and adopt the “If you can’t beat ’em, join ’em” attitude.

Pessimism isn’t always warranted

First of all, the DSO “problem” isn’t as widespread as you may think. Current estimates are that between 10% and 15% of US dental practices are fully or partially owned by a DSO. (One issue in getting accurate measurements is knowing what counts as a DSO. Is it five practices under common ownership? 10 practices?) But the high end of the range still means that 85% of practices are privately owned by dentists who will be looking to sell someday. So, there are plenty of great practices to buy. And the majority of practice sales still go to private buyers, not DSOs.

Private buyer advantages over a DSO

1. Sellers get more money.

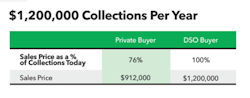

You may be thinking, “Wait a minute, I thought DSOs pay huge money when they buy a practice.” It’s true that DSO buyers throw out big numbers. The average DSO buyer’s offer comes in between 90% and 100% of the previous year’s collections. Private buyers’ offers, by contrast, average about 76%. So, if a selling practice took in $1.2 million last year, the numbers look pretty good for the DSO (figure 1).

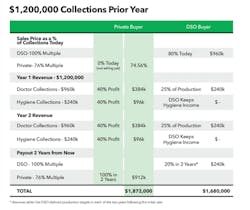

An extra $288,000 seems like a no-brainer, right? If you’re a private buyer, you’re sunk? Absolutely not. DSO purchase offers usually don’t pay out entirely up front, and they come with some serious strings attached. First of all, the seller may not be able to retire immediately because the DSO will require the person to stay on for a year or two after the sale. While working for the DSO, the “retiring” dentist will have to hit aggressive production targets. They’ll likely end up having to work even harder during their so-called retirement. Is it beginning to sound less attractive? It should. Because of those production goals and delayed payout, a seller is likely to come out behind by taking the 100%-of-collections sales (figure 2).

In this example, and I’ve seen many just like it, instead of making an extra $288,000, the selling dentist loses $192,000 on the deal and then has two years of unnecessary stress on top of that. Selling to a private buyer probably means more money over the long term, and it definitely means more money over the short term since private buyers make the entire purchase up front.

2. Your philosophies align.

My family moved away from my childhood home when I was a teenager. I went back to visit a few years later and was heartbroken to see the condition of my old house. The paint was peeling, the lawn was brown and weedy, the windows were dirty, and the fence was broken. I had spent many Saturdays mowing that lawn or painting the siding, so I felt like I had a lot of time and effort sunk into that place, to say nothing of the emotional investment. (I shudder to think how my dad must have felt.)

Dental practice owners are in a similar boat. If a gray-haired dentist is ready to sell their practice, they’ve probably put decades of their life into making it a point of pride. The patient and staff culture has been carefully crafted, treatment philosophies have been established, and pride has been rightly cultivated.

A DSO is unlikely to continue operating a practice with the same philosophy, care, and attention as the selling dentist. So, if you, as a private buyer, can assure the seller that their lawn and fence (so to speak) will be maintained in a way they can appreciate, you’ve got a leg up over the corporate competition.

3. The seller keeps control.

What’s the best thing about owning your own practice? Is it the money? Maybe for some. But when I talk to retiring dentists, the first thing they often talk about is how much they enjoyed being in control of both their career and their day-to-day operations. The last thing these dentists want to do is give up their sense of control. Selling to a DSO can mean just that.

As I noted earlier, DSOs bring lots of changes to formerly private practices. Almost certainly the seller is contractually required to stay on for a year or two, the DSO sets aggressive collections goals, the patient-first culture gives way to profit-first, the seller’s pay drops by as much as 30%, and business hours are extended. The biggest change of all? The seller is no longer the boss. Also, don’t forget that now the dentist can be fired at any time for any reason.

With a private buyer, it’s true that the seller is giving up control. That’s retirement. But they’re doing it when they want, how they want, and on the terms they decide.

The DSO advantages

It’s not a universal truth that selling to a DSO is a bad idea. While most dentists enjoy the control they have over their practices, a certain type of dentist really dislikes the management side and would rather concentrate on dentistry. If they’re not quite ready to hang up the handpiece, selling to a DSO lets dentists continue doing what they enjoy while handing off marketing, staff management, and other chores to someone else.

Perhaps a seller simply needs to access the liquidity in their practice. They need some cash now, but they aren’t ready to leave the practice for whatever reason. In this way, selling to a DSO is a bit like a reverse mortgage: the seller may not get as much cash up front as they would with a private sale, but they get a payout over time and get to keep practicing dentistry.

If nothing else, the DSO route may be good for bragging rights. (“You sold for 80% of collections? I got 100%!”) But you can’t spend bragging rights. As a private buyer, you’ll have advantages the DSO can’t match. Some of those are financial, while others are psychological or cultural. Either way, your advantages are very real. If you’re a buyer, use them.

Editor's note: This article appeared in the October 2021 print edition of Dental Economics.

Brian Hanks, MBA, CFP, is the author of How to Buy a Dental Practice and Selling Your Dental Practice. He hosts the Practice Purchased podcast and represents buyers and sellers in dental transitions nationwide. Hanks can be contacted at DentalBuyerAdvocates.com.