Are you flying blind?

For more on this topic, go to www.dentaleconomics.com and search using the following key words: life-changing event, planning for the future, flying blind, reduce crisis impact, living will, power of attorney, health insurance, life insurance.

Life-changing events are often not in our control. However, we can control how we prepare for and manage them. What follows is my story and information that could literally save your life and your business if you take action now.

The spring morning at Burnt Store Marina started out with bright sun and light winds. The water sparkled like diamonds as I sipped my morning coffee on the foredeck of our trawler. Capt. Gene and I planned to spend our day looking over the boat in order to renew our insurance.

As we started our review, I kept feeling the need to rub my eyes to clear them. As the day progressed, I noticed the sun reflecting on the water caused pain in my eyes. Mental alarm bells went off when Capt. Gene handed me some papers to sign and I couldn't read them.

I called my wife, Jan, and we headed for the local emergency room. While we were stuck in rush-hour traffic, the pain in my eyes became so intense I could hear it like a white noise in my head. We reached the hospital emergency room about 5 p.m., and at 8 p.m. a very busy physician's assistant peered into my eyes. He did not seem to understand my symptoms.

The PA consulted with the emergency room doctor and determined that I must have pink eye. He gave me a pain pill, antibiotic drop prescription, and appointment with an ophthalmologist the next morning. By 11 p.m. we were back on the boat. The rest of the night was horrible. I was sick to my stomach from the pain and pressure in my eyes. Moreover, as the night went on, I realized I had gone blind.

As soon as I arrived at the ophthalmologist's office, he looked at me and said, "My gosh, you don't have pink eye. You're having an acute episode of glaucoma." At this point, I realized I was in the middle of a true disaster and the outcome was in doubt.

Take these steps now to reduce the impact of a crisis

1) If you are vacationing or spending any extended time away from home, find a source for urgent medical care. My experience put me in a local ER where my situation was misdiagnosed, which caused me to wait nearly a day to get initial treatment. If you want proof that our health care system is broken, spend a few hours in the ER of a small city hospital. Use local contacts and word-of-mouth to secure reliable acute care if you should need it.

2) Do you have a health-care power of attorney and "living will"? If you have these — and you should — know where they are and be sure the information is current. If you are in a situation that is life threatening or requires surgery or hospital care, you will need a living will. Buy a cheap memory stick for your computer and store these following items on it: your health insurance company, your subscriber number, and the phone numbers on the back of your insurance card. You can also store a copy of your living will and power of attorney, and your attorney's phone number. You may think of other information to store as well.

3) I've written my attorney's phone number on the back of my insurance card, and stored it in my cell phone. If necessary, someone can call him to fax items to nearly any location. All of this information now travels with me (more on this idea later). Another good idea is to program your cell phone with the letters ICE, which stands for In Case of Emergency, and put the number of your contact in this location. Using ICE helps first responders at an accident scene.

4) Review your medical coverage and limits annually. Most companies have secure Web sites that you can sign up for that allow you to review your policy in detail. Call your insurance representative if you have questions about billing or coverage. Be especially mindful about whether surgical procedures need prior approval.

5) My experience has been that health-care providers have no interest in the specifics of your insurance. Insurance to them means they will get paid. They will not discuss the cost of treatment with you unless you demand to know. Most of the time doctors have no idea what the charges will be for their service or for the hospitalization, anesthesia, etc. You should know your initial deductible, co-payment amounts, and whether or not you need to have preauthorization for surgical procedures. When in doubt, demand that providers make the necessary calls to check for you. This sounds easy, but when you have an acute need for care, it's hard to do.

6) Ask your health-care provider lots of questions. Again, this is very hard to do when you are acutely ill, but it is vitally important. If your problem is at all out of the ordinary, ask your doctor and staff about their level of experience in treating this specific illness. If in doubt about the providers, their skill or experiences, ask for a referral to a specialist. I made a serious error in not asking to see the ophthalmologist while I was in the ER. Catching the glaucoma early might have saved me months of recovery time. Explain to the provider the outcome you are looking for, and confirm that you both have the same expectations.

7) Determine how long your business can run if you are not present and working. What will your staff tell clients if you are out for a week, a month, or longer? In my case, I told the truth without details. "I had a medical emergency." As time went on and I knew more, I continued to tell the truth — with limited details. "I had to have surgery and will be out of work for several weeks."

My patients do not want to leave me. However, I owe them the truth about recovery and timing. I had made it a point to have this discussion with my office team, so we all knew what to do.

What happens to your livelihood?

What will you do about business overhead? In my case, I did have some overhead insurance coverage. Read your policy thoroughly. I discovered that I had additional coverage that would help pay for someone to work for me. Should you carry disability insurance? If you are self-employed, give this some consideration. Health-care statistics show that 70% of us will suffer some form of disabling injury by age 65.

If you are in a group or partnership, be sure you have an agreement with your coworkers to cover for one another for a specified time. No matter what your business, I suggest that you get together with a small group of friends and develop a simple agreement for coverage for one another for 30 to 60 days.

I now have ALL of my important documents in one place. This includes health, life, and disability insurance papers, as well as legal documents such as wills, trusts, and powers of attorney. I chose to keep them in a safe deposit box in the name of my business. Discuss what is best for you with your attorney. My documents are current and have proper beneficiary designations. I have phone numbers for our insurers, and policy numbers recorded on the memory stick that we carry when we travel. Your insurers can provide you with additional copies of your policy if needed as long as you have the policy numbers. I have advised my spouse and staff where to find this information.

Take a few days to think about what you will do if you have to be out of work for several months or longer. Discuss this with your spouse. What will you do with your time? Can you manage financially? What will happen with your business? After serious accident or illness, healing time and medical treatment can take months longer than anticipated.

In my case, there is no income if I"m not at work. Can you manage financially? If you have the issues discussed in place, you have a head start on financial issues. You can retrain most customers by providing basic services. By carrying a disability overhead policy you can keep staff working, meet overhead costs, and survive for a month or two. Can you manage personally if you have no income, and for how long? What things will have to change? Most of us review our finances with a focus on retirement. I suggest you also review them with the idea of a disaster plan.

Statistics indicate it takes 60 to 90 days for most people to recover from illness or accident and return to work; however, you also need a succession plan if it becomes necessary. Consider meeting with a business/practice management company. It could be important to know what they offer if you are permanently disabled. In that case, you will have only a small window of time to market and sell your business.

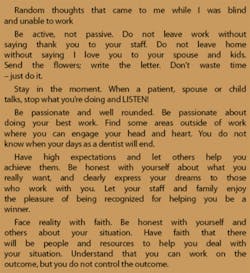

Be positive. Accept the facts. If you"re disabled, let your friends know and let them help. Be honest with and accept your spouse"s support. This is a key element in management and recovery. Get realistic timelines for recovery from doctors and plan around them. In my case, I will recover totally with time — a lot more time than I had hoped.

If possible, visit your business regularly to let staff and customers know your status. Do not be caught flying blind. Put the steps I have suggested in place to mitigate the effects of a personal disaster now, and you will sleep better at night.

Dr. Shetter is a general dentist in Menominee, Mich. In May 2007, he was stricken with bilateral acute narrow angle glaucoma while working on his boat. He was functionally blind for three weeks. After several surgeries and an extended period of recovery, he has recovered his sight and returned to work. Contact Dr. Shetter at [email protected].