Bye, bye Managed Care!

Looking for freedom from the chains of managed care? Follow these steps to maintain and improve practice profitability!

Photo: ©Paul Avis at FPG International

by Charles Blair, DDS

The growth of managed care in dentistry has slowed in recent months, thanks to a number of market forces. As a result, we are helping more doctors than ever bail out of managed care participation on a cost-effective basis. In this article, we'll examine current managed-care trends, methods to evaluate these plans, and how to develop a strategic plan to eliminate or drastically reduce your participation in managed care.

In the medical world, patients are voicing an increasing number of complaints against managed-care plans. Most resent limitations on patient care, restrictions on access to their preferred doctor and/or specialist, long waits, and highly impersonal service. Participating physicians are fed up with declining practice incomes, longer working hours, demands for increased efficiency, and growing restrictions by managed-care companies. They are beginning to take action in increasing numbers.

Many older doctors are simply electing to retire early. A recent survey of 300 physicians at least 50 years old showed that as many as 38 percent plan to retire within three years and another 10 percent plan to change careers. Most blame managed care for their decisions. Meanwhile, the American College of Radiology said retirement by its member-doctors doubled to about 800 between 1995-1998, as job satisfaction plummeted due to managed care.

Citing low reimbursements, administrative headaches, and intrusions in the doctor-patient relationship, an increasing number of physicians remaining in practice are ditching managed-care plans. In return for cash payments, these doctors are offering a higher level of service, uncrowded waiting rooms, uninterrupted office visits, and a more personalized relationship with the doctor and staff. Most of these doctors also have eliminated insurance company assignment. This means the patient, rather than the doctor, must accept whatever the insurance company provides.

I believe the growth in managed-care participation has peaked in dentistry as well, for many of the same reasons. Most patients are hesitant to sever the personal relationship with their dentist and simply do not want to incur the additional costs, hassles, and uncertainty in moving to a new provider. Employers are spending a relatively small percentage of their health-care dollars in dentistry. The potential savings simply has not been significant enough for them to jump on the managed-care bandwagon. Moreover, many dentists have become fed up with increased intervention by managed-care companies. In Minnesota, for example, Delta Dental froze fees for a large number of providers, allegedly based on results of its utilization studies.

The growing disparity between the number of dentists looking to retire and those entering practice full-time has resulted in an accelerating decline in the overall level of competition in dentistry. This has made it much easier to establish a new practice — or grow an existing one — without managed-care participation. As a result, fewer dentists have had an incentive to sign up for managed-care programs recently. I also see many more dentists who are looking for assistance in eliminating managed-care participation in their practices rather than determining how to join these plans.

Establishing the vision

The first step in getting out of managed-care participation is for the doctor to develop a vision for a full fee-for-service practice — without write-offs and insurance company restrictions — and with less stress and hassles and more satisfied patients. To accomplish this vision, the doctor must exert strong leadership and show a true commitment to spending the time and energy to make it happen.

Along with the doctor, the staff must be fully committed and involved in the process and training required to make the transition. Develop a step-by-step action plan and related timetable for the process. Regularly schedule staff meetings to check progress — hold the practice accountable for reaching its goals within the prescribed time period. The best time to make this change is while the economy is strong and a number of viable options are available for maintaining and increasing practice profitability. You will need these options to counter any temporary drop-off in practice volume as a result of exiting managed-care plans.

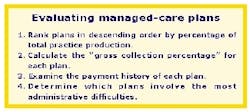

Evaluating current plans

Compare all managed-care plans that the practice participates in to determine the order in which you will terminate participation. First, rank plans in descending order by their percentage of total practice production. It is much easier to immediately drop those plans that comprise only a small portion of the total office production. As a general rule, plans that contribute less than 10 percent of the total office production usually can be easily dropped with only a negligible effect on the practice.

Next, calculate the "gross collection percentage" for each plan. Divide the total collections for a particular plan by the charges for the same plan, based on the doctor's regular fee schedule. Make sure you show the percentage fee discount involved. Obviously, those plans with the lowest gross-collection percentage usually are dropped first.

Also examine the payment history of each plan. Calculate the "net collection percentage" for each plan by dividing the actual collections for the plan by the net charges (gross charges minus fee adjustments). A low net collection percentage (below 90 percent) will indicate that the plan is making very slow payments. This may mean that the contract is not being honored, that claims are not being followed up on promptly, that the plan simply does not have the money to pay its claims promptly, or it does not have the needed infrastructure to process claims on a timely basis. The fourth and final area to evaluate when deciding which plan(s) to drop is the administrative difficulties involved with each.

Carefully review each of the criteria discussed above to determine the appropriate drop sequence. Before taking any action, assign a "drop sequence order" to each and every managed-care plan in which the doctor participates.

As a general rule, plans contributing the lowest percentage to the practice production — and with the lowest gross- and net-collection percentages and the highest administrative hassle factor — would be dropped first.

Once you have determined the proper order in which to drop participation in managed-care plans, you still face a "moment of truth." Unless you establish a definitive game plan on how to make up for the lost production, you simply won't "pull the trigger."

As a prelude to dropping participation in specific managed-care plans, doctors should first seek to freeze or greatly reduce participation. Maintaining current practice volume — based on the existing levels of managed-care participation — but stop accepting new managed-care patients. In this way, you can build up the volume of full-fee new patients, thereby diluting the impact of managed care on the practice over time.

Unfortunately, the contractual language in some plans does not permit this freezing action. In such cases, the flow of new managed-care patients can be diminished by decreasing new-patient exam slots allocated to managed-care patients.

Doctors must be aggressive in establishing specific strategies to implement in the wake of dropping managed-care participation.

Adjust full-fee schedule

The first and most critical step doctors should take to successfully transition into a high quality, full fee-for-service practice is to adjust their fee schedule. Most doctors practice with a "schizophrenic" fee schedule, with some fees below the 50th percentile for their zip code, while other fees are at or above the 95th percentile. Determine a specific percentile goal for all practice fees, based upon the quality of care provided. Move all fees below that percentile up to the selected level, while maintaining fees that are above the desired percentile level at their current level. Independently establish your full-fee schedule; do not set fees at levels approved by Delta Dental or other managed-care companies.

In most cases, the additional collections and related profitability from properly increasing fees will more than offset the decreased volume associated with dropping all managed-care participation, making for a fairly easy transition.

Expand available services

Once fees have been properly adjusted, the next step is to expand the number of services available to the doctor's existing base of full-fee patients. Through proper training, improved instrumentation, and case selection, I've seen many dentists generate $30,000-$50,000 of endodontic services annually in their practice, up substantially from years past. Doctors also should consider investing in new technology and continuing education to increase the cosmetic services they offer, including veneers and onlays.

Other doctors have successfully increased their full-fee volume by adding implants, bruxism appliances, oral surgery, and perio services. Furthermore, many practices have been able to substantially increase hygiene department production by implementing soft-tissue management programs, bleaching (whitening) procedures, and bad-breath center services. In addition to expanding the service mix, doctors should work hard to eliminate fee miscoding. Furthermore, it's critical that protocols be established for X-rays, fluoride, etc. The idea, obviously, is to provide more needed dentistry on the doctor's existing full-fee patient base.

Improve case presentation

Ditch the "high-volume, low-fee" managed-care mentality to improve practice profitability. The clinical goal should be both a high-dollar, per-hour rate and a high-dollar, per-visit rate. As you make the transition away from managed care, increase the time you spend with each new patient so that you can do a comprehensive exam and thorough diagnosis using the intraoral camera.

Furthermore, many doctors have been successful in improving patient communication (and case acceptance) using the CASEY system for educating patients about their dental needs. More importantly, doctors must offer flexible payment arrangements to increase affordability for bigger-ticket procedures. Offer patients the flexibility to automatically charge the patient-payment portion of their dental bill on general credit cards (VISA, MasterCard, American Express, etc.) each month to increase affordability and avoid internal billing and collections problems. Alternatively, zero-interest programs are available through several third-party financial companies including American General Finance, Wells Fargo Financial, and Care Credit.

For dental cases in excess of $1,500, use third-party financial sources that allow patients to begin treatment with no money down and then extend monthly payments over a longer period at reasonable interest rates.

Retain in-office consultant

Use an in-office consultant to pinpoint and improve areas of practice-management weaknesses before dropping participation in managed- care plans. In some cases, a consultant can improve productivity by over $10,000 a month by implementing an effective soft-tissue management program, improving scheduling, reducing broken appointment and cancellation rates, effectively replacing all the income projected to be lost through dropping managed-care plans. Other practice management consultants have improved doctors' scheduling and increased capacity by adding an emergency/overflow operatory to achieve the same result, he notes.

Consider practice merger

Currently, there are more sellers than buyers in the practice-transition marketplace. This condition may worsen over time. While the situation bodes poorly for doctors seeking a large "cash-out" sale, it provides a profitable growth strategy for potential buyers focused on increasing profits.

By treating more patients in an existing space, purchasing doctors have generated incremental profits of 60-70 percent on the additional volume before debt service. This is possible because there are no extra facility costs; incremental labor costs are generally minimal.

Accordingly, purchasing an existing practice in your local market can easily provide the additional patient volume necessary to drop managed-care participation while maintaining profitability.

Increase internal marketing

Another highly profitable strategy is to increase the doctor's internal marketing efforts. Become more aggressive in asking satisfied patients to refer their family members, friends, and colleagues to the practice. Reward such patient referrals with a handwritten thank-you note, flowers, gift certificates, etc. Doctors also should pursue referrals to specialists they refer to, thereby establishing a two-way flow of new patients. Doctors should encourage staff members to refer new full-fee patients from their family, friends, and colleagues through a bonus program. You should also be more aggressive in recommending needed treatment to existing patients.

Finally, make a concerted effort to encourage managed-care patients to remain in the practice, out of network. This effort should begin at least six months prior to dropping a given plan.

Expand external marketing

The next priority is expanding the doctor's external-marketing program. Doctors should consider a direct-mail campaign with a high- quality brochure, mailed to targeted demographics (by zip code), to stimulate patient growth. In addition to the ideas previously discussed for building a general dental practice, consider increasing Yellow Pages ad exposure, possible local newspaper ads (not viable in metro areas), and utilizing new patient referral services such as 1-800-Dentist.

Make practice improvements

You must invest in new technology to expand practice volume and related profitability on a tax-favored basis. Many tax write-offs are available to subsidize technology purchases, including the $20,000 expensing election, special five-year, high-tech write-off, and the $5,000 ADA tax credit. Many doctors can boost case-acceptance rates through proper use of the intraoral camera. Others are increasing efficiency, avoiding lost charges as well as improper coding by utilizing clinical-area computerization, and increasing efficiency with digital X-rays and electronic-claims submission.

In many cases, upgrading or remodeling the existing practice facility is a wise investment. Upgrading a facility often can change patient perceptions of a practice. Patients are more apt to increase their acceptance of upper-level procedures when the environmental surroundings match the quality of dentistry offered.

Eliminate unprofitable associates

Many doctors make the huge mistake of maintaining a highly paid associate to perform lower-level procedures under reduced-fee, managed-care plans. These doctors should cut their losses by terminating these money-losing associateships and simply maximize their productivity by concentrating on more profitable upper-level procedures.

Consider a new location

Some doctors may be simply practicing in an area with poor demographics (growth, income level, managed-care coverage, etc.). Fortunately, there are numerous opportunities in most states for doctors to develop and maintain a profitable practice in more attractive locations with better demographics. In some cases, it will be necessary for the doctor to sell his or her existing practice (and real estate) and invest in a new practice area, which can usually be done on a tax-free basis. In other situations, it may be possible for the doctor to simply move the current practice to a new location with better demographics. By doing this, the doctor can maintain some or all of his existing patient base, while taking advantage of the improved opportunities to grow new full-fee patients.

Recognizing the negative impact that managed-care fee schedules have on the doctor's profitability is only the first step. While determining the proper order to drop managed-care plans is important, few doctors will actually follow through with their transition out of managed care, unless they have a well thought-out written game plan to maintain practice volume and profitability.

Implementing the 10 steps discussed in this article will assure virtually every doctor that he or she can transition out of managed care and into a higher quality, full-fee-for-service practice, while maintaining or improving practice profitability.

For more information regarding Dr. Blair's nationally-acclaimed Revenue Enhancement program and Profits Plus workshop, contact Debbie Hains at (704) 424-9780.