Transitions Roundtable

We ask two experts the same question to give you two different answers on a complex issue

QUESTION I had a valuation prepared one year ago. I am hiring an associate with the intent of selling my practice in two years. How do I adjust the value of my practice to reflect the increase in value caused by the associate’s production?

Guy Jaffe, MBA

The practice was valued one year ago and this will serve as the baseline value. A second appraisal should be done immediately before the associate purchases the practice, by the original appraiser using the same methodology.

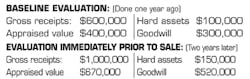

The results of the two appraisals are as follows:

The value of the hard assets increased $50,000, which went to purchase a newly equipped operatory for the associate at the time he began. The entire cost of the new equipment will be adjusted or passed through to the associate dentist.

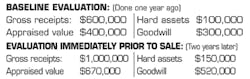

The practice’s goodwill increased $220,000 ($520,000 - $300,000) during the two years of the associateship. The goodwill will be adjusted based upon how many new patients came to the practice to see the practice or senior dentist, and how many came to see the associate during the two years of the associateship. The new patient numbers are as follows:

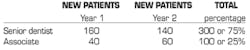

Based upon how many new patients each party generated, the adjustment of goodwill between the senior dentist and the associate is as follows:

Immediately before the sale, the valuation of the practice was adjusted to reflect the associate’s contribution to the increased value of the practice’s goodwill.

Guy Jaffe, MBA, is a principal of ADS Midwest and past president of American Dental Sales. He provides brokerage, appraisal, and consulting services in St. Louis and eastern Missouri and central and southern Illinois. You can reach Mr. Jaffe at (800) 221-6927 or [email protected].

QUESTION I had a valuation prepared one year ago. I am hiring an associate with the intent of selling my practice in two years. How do I adjust the value of my practice to reflect the increase in value caused by the associate’s production?

Tom Snyder, DMD, MBA

We typically recommend that a baseline practice valuation be prepared within the first year of employment. So, if you had a valuation prepared and your associate is employed, for example, by midyear, we recommend updating that valuation at the end of 2012. This would serve as a baseline value for the future sale.

In our experience, creating valuation baselines is the fairest approach to motivating and incentivizing an associate. When it is time for the sale, we adjust the practice’s value to account for changes in both the tangible and intangible portions of the baseline value. We update the tangible assets (equipment, technology, etc.) by reappraising them as they will be in use for two more years and thus are worth less due to additional “wear and tear.” However, if new assets have been purchased over the period, their fair market value will be added to the tangible asset value.

Next, we update the intangible asset value (goodwill, etc.) by referring to the Bureau of Labor Statistics Inflation Calculator to get the current value of the intangible assets. To make things constant, we calculate the current value of the dollar. If this is not considered, you will be effectively discounting the intangible asset portion of your practice’s value as the dollar will be worth less in two years. For example, let’s assume that the intangible asset value of your practice was worth $500,000 at the end of 2009. Currently, that intangible asset value based on the Bureau of Labor Statistics Inflation Calculator would be $527,252.

We have followed and tracked numerous deferred buy-ins and practice sales and have found that, in most instances, the host/owner’s personal net income has shown a marked increase over the period of time the associate has been employed. Effective financial management of your practice should yield a 30% to 35% profit margin for your associate. So, effectively you will be getting “prepaid” the value differential that you feel that you may have lost had you elected to delay the practice valuation prior to the sale. Most importantly, the associate does not feel that he or she has been paid for the growth your practice should experience during the associate’s employment phase.

Tom Snyder, DMD, MBA, is the director of transition services for The Snyder Group, a division of Henry Schein. He can be reached at (800) 988-5674 or [email protected].

Past DE Issues