Higher production and long-awaited stability: The 2024 DE/Levin Group Annual Practice Survey

In this 18th consecutive year of the Dental Economics/Levin Group Annual Practice Survey, we are excited to share these important insights about our profession. In addition to the incredibly useful and interesting data provided by this year’s respondents, this article will also outline practical suggestions and recommendations to help you apply this information to your practice and career.

Conducted in early January 2024, respondents were all general dentists with 93% in private practice. Doctors were asked to consider their full-year 2023 practice performance for their answers.

Top-line demographics

Fifty percent of responding dentists are in solo practice, compared to 46.2% reported in 2022 by the ADA.1 The average dentist responding to our survey was 52 years old, slightly above that reported by the ADA.1 This year’s survey appears to be very representative of private practicing general dentists throughout the country.

The financials (production, profit, and overhead)

Overall, the changes were nominal from 2022 to 2023 regarding the financial numbers reported. This is reflective of private practice dentistry stabilizing after the turbulent pandemic period. As a quick reminder, 2021 was a record production year for many practices. This was due to pent-up demand from COVID and the American consumer having excess available funding because they were spending less in traditional areas like travel and restaurants. That bump stabilized in 2022 when dentistry and the entire country was hit by higher levels of inflation, which slowed things down. It appears that 2023 represented a year of more stability and normalcy.

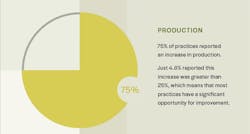

Production

The average total production (including hygiene), calculated on a per doctor basis was $977,077. If we apply the rule of thumb that the hygiene department generates approximately 25% of practice production, then the per doctor production number would suggest that the average general dentist was personally producing approximately $733,000. This is in line with expectations and represents only a very slight increase from the previous year.

The good news is 75% of practices reported an increase in production in 2023—5% more than in 2022. Interestingly, only 4.6% of the practices reported that their increase this year was greater than 25%, which means that most practices have a significant opportunity for improvement. Levin Group has consistently observed that most practices have a growth potential of 30% or more that they never access but could by implementing better business systems in the practice.

On average, production increased 6.7%, and profit went up 6.4%.

What does this production data mean?

Practices should focus on improving and streamlining systems to enhance efficiency. Keep in mind that the weakest part of any system will slow that system and make it inefficient. Anything that slows down a system needs to be eliminated so that practices can operate at peak performance. Systems today need to be monitored and updated more frequently than ever before due to the changes within the dental profession and the high turnover among staff members. Systems are one of the key factors in training the dental team and increasing staff performance and longevity.

Overhead

Sixty-four percent of practices reported higher overhead in 2023. Half of those saw a 10% (or more) increase. Only 11% stated that their overhead was lower.

The average overhead increase was 4.8% in 2023. This is down slightly from last year, but any increase in overhead is problematic and should be addressed and corrected if possible. Why? A 1% increase in overhead is the same as a 1% decrease in practice profit. This means dentists may be working harder for less income. The one way to reverse this trend is to ensure that production increases by a sufficient amount to compensate for higher overhead.

What does this overhead data mean?

Practices should focus on overhead control more now than in the past. Other than last year, overhead in dentistry has risen at a nominal rate. If we combine the last two years’ overhead increases, many practices are looking at anywhere from 10%–12% higher overhead, which would represent a 10%–12% lower profit if production remained the same. Once again, as referenced above, production is the key to compensating for increased overhead. Overhead expenses can only be lowered by so much. Eliminating unnecessary purchases, comparing prices for supplies and services, and eliminating waste are techniques that need to be applied. Another idea to help control overhead is to offer a bonus to the staff member who handles ordering for each percentage point decrease achieved.

The primary reason for the overhead increase is staffing costs, which have risen significantly since the onset of the pandemic. It is important to be aware that this trend will not reverse. This is a permanent increase that now needs to be considered as part of the overhead picture of the practice.

Outlook for the upcoming year

In our survey we always ask about expectations for the coming year. Nine out of 10 dentists are expecting to do the same or better in 2024, and most of them expect their revenue to be 10% or higher in 2024 than 2023. This is certainly good news! But there are some challenges…

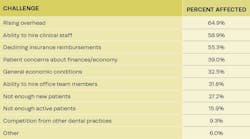

Each year we ask dentists to identify the top challenges they are facing (respondents were able to select more than one). The results can be seen in Table 1.

The top challenge for the second year in a row is rising overhead. This was selected by 65% of the dentists responding.

Fifty-nine percent of dentists find hiring new clinical staff to be a significant challenge. There are serious staffing challenges based on staff members who have left the profession for reasons ranging from compensation to burnout to people who want to work part-time from home (which does not fit a dental practice). This is not surprising given the workforce reduction and retirement intentions reported by hygienists and assistants in various industry surveys.2

Fifty-seven percent of respondents chose declining insurance reimbursements as a primary challenge (up 10 points over the previous year).

The economy, as usual, does not cooperate with economic predictions. Throughout 2023 many economists routinely advised us that there would be a recession. It didn’t materialize. They advised us that the stock market could take a big hit. It didn’t. In fact, some indices are at record levels at the time of this writing. Although there are certainly inflationary factors on basic goods and services, the overall economy seems to be strong at the moment. This may be why only 32% of dentists selected economic conditions as a concern—far below the previous year.

The ability to hire administrative staff was selected by 32% of respondents. Although it remains a challenge, it seems to be easing in that more people are going back to work. More people are running out of the savings they accrued during the pandemic. Also, accessing a job in administration is easier than accessing a job with licensure requirements (such as hygiene) so it is easier for administrative people to return to the workforce. In no way have we solved the shortage of trained administrative people, but it seems to be a better situation than for clinical staff.

Although we would like this not to be a challenge at all, 27% of dentists stated they did not have enough new patients.

What does this data about challenges mean?

Every dentist should evaluate their practice against each of these challenges. Do it as an exercise and rate how your practice is faring in each area on a scale of 1 to 10. If your answer is below a 6, develop strategies to overcome the challenge. Doing so will typically cause a commensurate increase in practice production.

The influence of dental insurance

Insurance companies do not exist to increase the income of dentists. No surprise here. They have a profit motive that is a standard part of their business model. Bashing insurance companies is not productive, but understanding them is. Many dentists seem to believe that insurance companies ignore quality of care, but this is not true. Insurance companies do not view it as their responsibility to provide quality of care. (That is why all the burden of malpractice falls on dentists and not on insurance companies.) They simply determine, based on historical analysis and statistics, how much they will pay dentists for specific procedures and services based on achieving their projected profit targets. This scenario will never change.

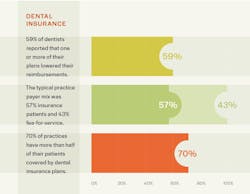

In this year’s survey, 59% of dentists reported that one or more of their plans lowered their reimbursements in 2023. Rising overhead and decreasing reimbursements creates a double whammy when it comes to practice profitability.

We also found that the typical practice payer mix was 57% insurance patients and 43% fee-for--service. This high number of insurance patients makes it difficult and scary for practices to leave insurance plans. Seventy percent of practices have more than half of their patients covered by dental insurance plans.

What does this insurance data mean?

We receive calls all year long from dentists who either want to drop insurance, go all fee-for-service, or who are frustrated but have no idea what to do. If any of this sounds familiar, the first thing to do is take emotion out of the equation. All too often dentists make decisions based on emotions, and those tend to be the worst ones we make. Start by analyzing all areas of insurance including:

- Number of patients from all plans

- Number of patients in each plan

- Revenue from all plans

- Revenue from each plan

- Number of new patients attracted in a calendar year from all plans

- Number of new patients attracted in a calendar year from each plan

- Discount levels of each plan versus practice UCR fees

- Percentage of insurance patients versus fee-for-service patients in the practice

Although this may seem like an arduous exercise, it needs to be taken very seriously, and the resulting decisions should be made carefully. Even with analysis, there remains a great deal of uncertainty if a practice drops a plan. Will patients stay? How many? If the plan is a tiny percentage of practice revenue, it is not necessarily a major or serious decision, as that revenue can easily be made up. Conversely, if the plan represents 25% of practice revenue, it is a much more serious decision and a thorough analysis is crucial.

Staffing

Of course, we have a staffing crisis—“crisis” being the operative term. It’s not a shortage, a limitation, or a sluggish hiring economy. It’s a crisis, and the numbers bear this out. More than 95% of respondents believe there is a shortage of dental staff available for hire. When 95% think that way, it’s a crisis. Or, as one doctor put it on the survey, “I’m frantically searching for new hires.”

Sixty percent of practices are currently looking to hire a staff member—about the same as last year, reflecting that this chronic condition has not improved. Fifty-nine percent of practices have at least one open position to fill right now, and only 24% of practices reported they had no staffing turnover in 2023. Wow! That means that approximately three quarters of all practices did. About 22% of practices lost three or more employees in 2023, which created a lot of unfilled staff positions.

Will this get better? Unfortunately, we expect this shortage to last for at least 7–10 years. It takes time, for example, for hygienists to graduate and pass a board. It takes time to hire and train dental assistants. It takes time to bring in and train front desk people, and although there are more front desk or administrative staff available, we also are finding that the skill set of candidates coming into practices is lower than in the past. It will get better, but probably not in the next several years.

When asking dentists what they are doing to address current staffing challenges, these are the top six answers accompanied by the percent of respondents.

- Increasing base compensation for staff (55%). Many practices originally felt almost extorted in terms of having to raise staff compensation to retain employees. Much of the American labor force has shifted to higher minimum wage levels in many states.

- Providing more bonuses for staff (31%). Make sure that the bonus system is correctly designed and that staff members are fully aware of the opportunity to earn bonuses as part of their total compensation potential.

- Offering more/better employee benefits (22%). Some people need benefits and will not take or keep positions that do not offer them. Reducing benefits is often a precursor to losing staff members.

- Adding technology for productivity enhancement (32%). This is both good for practice efficiency, practice production, and giving staff members more time to focus on other tasks. Technology should either improve quality, speed, efficiency, or provide a return on investment.

- Utilizing staffing agencies (22%). Staffing agencies can be greatly beneficial, but keep in mind that in a tough labor pool, they have the same challenges as dental practices.

- Reducing office hours (16%). This one was way up from last year, indicating that these practices are running on fewer hours because they cannot properly staff.

What does this staffing data mean?

I would suggest that dentists have at least three staff retention processes in place in the practice and measure the average tenure of each staff member. If the average tenure is improving, that is a good vital sign. If it is decreasing, then practices need to reevaluate their vision, culture, and leadership, as well as issues such as compensation, team building, and staff satisfaction.

One final miscellaneous fact

Twenty-two percent of practices reported seeing an increase in the use of third-party financing by patients in 2023. This is not surprising, as many Americans have gone back to using credit cards since their savings from the pandemic has begun to run out and inflation is affecting their day-to-day budget. Third-party financing creates a phenomenal opportunity for patients to receive dentistry and optimal care without putting off treatment. The use of third-party financing will continue to increase, and we endorse this strategy.

Make sure every patient is fully aware that third-party, interest-free financing is available. Too many practices either assume patients know that third-party financing is available or don’t really want to use it, which typically results in a lower level of case acceptance and a negative effect on practice production.

Summary

Overall, the results of the survey seemed quite positive this year. Overhead will eventually stabilize, but unfortunately, insurance carriers will continue to lower reimbursements to preserve their own company profitability. This year’s survey indicates that practices are stabilizing, and we are anticipating that 2024 will show even more encouraging results.

You may want to review this article one more time with a close look at the “What does this mean?” sections. The suggestions contained there are based on the survey data and Levin Group’s experience with increasing practice production and efficiency. All of them will be applicable to most practices. Ultimately, you want production to increase every year at a high enough level to increase profitability and to exceed, not just offset, inflation. I wish you an extraordinarily successful 2024 and hope to be able to report impressive results in next year’s survey.

References

- Vujicic M. Webinar: The changing dentist workforce. American Dental Association. March 2022. https://www.ada.org/resources/research/health-policy-institute/dentist-workforce/the-changing-dentist-workforce

- Dental workforce shortages: data to navigate today’s labor market. October 2022. https://www.ada.org/-/media/project/ada-organization/ada/ada-org/files/resources/research/hpi/dental_workforce_shortages_labor_market.pdf

Editor's note: This article appeared in the May 2024 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

Roger P. Levin, DDS, CEO and founder of Levin Group, has worked with more than 30,000 practices to increase production. A recognized expert on dental practice management and marketing, he has written 67 books and more than 4,000 articles, and regularly presents seminars in the US and around the world. To contact Dr. Levin or to join the 40,000 dental professionals who receive his Practice Production Tip of the Day, visit levingroup.com or email [email protected].