Pension Law ChangesWhat every dentist must know!

New tax laws make retirement plans more affordable for small employers. Act now to reap the maximum rewards.

by James R. Pride, DDS, and Brian C. Hufford, CPA

The ideal income tax system would consist of paying no income taxes at all! If that were impossible, the next best tax system would consist of paying taxes on lifestyle expenditures, but not on income that is saved.

By significantly increasing the amount we contribute to tax-deductible retirement plans, the new pension laws almost make it possible to save as much as we want without paying taxes. As business owners, dentists are in a unique position to take advantage of dramatic changes in the pension law. Don't let these opportunities pass you by!

Changes in defined-contribution plans

One avenue for tax-deductible savings is a defined-contribution plan. This type of plan allows you to make annual tax-deductible contributions that are based on a percentage of your annual payroll. Examples of these plans are: money purchase plans, profit-sharing plans, and 401(k) plans. For the longest time, the maximum annual savings per individual in a defined contribution plan was $30,000. This limit increased to $35,000 in the year 2001. Under the new tax law, the limit will be raised to $40,000 in the year 2002, Better yet, the maximum limit now will be raised more frequently with inflation. So the first piece of good news is that, in a defined-contribution plan, you have a higher ceiling on tax-deferred savings.

Regarding 401(k) plans, there is more good news. These plans stem from Section 401(k) of the tax code. This law allows employees to contribute money from their own salary to their tax-deductible retirement account, with this contribution coming in addition to that made by their employers on their behalf.

Until 1999, 401(k) plans were rarely used by dental practice. The reason was a doctor often could not make the maximum allowable tax-deductible contribution to his or her retirement savings due to restrictions in the plan. In 1999, new legislation allowed a "safe-harbor" exception in which the doctor could contribute up to the maximum in his or her pension plan by making a small, "safe harbor" contribution to the employees' retirement (see "Change is Good," in the April 2000 issue of Dental Economics).

Now,, with the latest changes in the tax law, the 401(k) will likely become the retirement plan of choice for doctors in their 30s and early 40s. The reasons for this are two changes which greatly increase the attractiveness of 401(k) plans. In the past, the employer and employee contributions were limited to 15 percent of the total payroll. Under the new law for 2002:

(1) The limit is increased to 25 percent of total payroll and

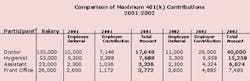

(2) Employee savings does not count against the 25 percent of pay limit, but is in addition to this amount. This is a great improvement, as the table at the top of the page shows.

This table presents the problems encountered by doctors in designing retirement plans that work well. First of all, the compensation of the doctor in our table ($135,000) is not significantly greater than the total compensation of the staff, which is $102,000. Therefore, a retirement plan which would have a formula requiring the practice to contribute 25 percent of the payroll for everyone would give $33,750 to the doctor and $25,500 to the staff, as in our example. The doctor's share would be only 57 percent of the total retirement contributions ($33,750 plus $25,500) in this case. This is not a good result.

The 401(k) feature in the table improves the total percentage that the doctor receives, since the doctor is allowed in the year 2001 to contribute a maximum of $10,500 of his or her own money to the 401(k) retirement account. However, total retirement contributions cannot exceed 15 percent of total payroll (staff plus doctor) in the year 2001. After all the various computations are made (which, for the sake of simplicity, we will not explain here), the doctor in our example is limited to receiving only $17,648 in retirement contributions. Since the goal for the doctor is to save the maximum allowed under the law ($35,000 in 2001), this benefit is too little.

Under the 2002 law, the doctor can receive a full $40,000, even though $40,000 is greater than 25 percent of the doctor's payroll of $135,000. The doctor can attain the $40,000 level of savings because the employee's contribution (in this case, the doctor's) of $11,000 maximum in 2002 is not counted as part of the 25 percent ceiling on contributions. In addition, in 2002, the doctor in our example receives nearly 68 percent of the total retirement contributions that the doctor/practice has paid into the plan ($40,000 divided by [$40,000 + $9,958 + $4,324 + $4,885], or $40,000 divided by $59,167).

This result is much better than the 57 percent that would be the case in a straight percentage-of-pay retirement plan. Furthermore, if the doctor were older than the staff, this percentage could be improved even further by adding an age-testing feature.

Under the new pension laws, both the doctor and the staff are big winners. In the past, because of the old limit of 15 percent of total payroll, 401(k) savings by staff frequently restricted the amount of money that the doctor could put away. For this reason, many doctors used a different type of retirement plan.

The old system was either win/lose or lose/win. With the new law effective in 2002, the system is win/win. Both the doctor and staff can contribute the maximum amounts, and employee deferrals do not count against the 25 percent-of-pay limit. In fact, an employee may contribute up to 100 percent of his or her payroll provided this does not exceed the maximum deferral amount of $11,000 in 2002. Another advantage is that the 401(k) limit on employee contributions increases by $1,000 each year for the next four years to a maximum of $15,000 by the year 2006.

Participants in 401(k) plans who are age 50 and older may make additional "catch-up" contributions. Beginning in 2002, older participants may contribute an additional $1,000. This amount is increased to an additional $2,000 in 2003, $3,000 in 2004, $4,000 in 2005, and $5,000 annually thereafter. Another attractive feature of profit-sharing and 401(k) plans is their discretionary option of allowing a participant to contribute the maximum amount in one year and nothing the next year. In other words, the employer and employees are not "locked-in" to contributions.

Early action required

In order to take the maximum benefit from the new 401(k) rules, you will need to implement some changes before 2002. If you wish to allow your employees to contribute more to your 401(k) plan, you should announce this before December 31, 2001. In addition, "safe-harbor" decisions must be communicated to employees within the 30-to-90-day period before the beginning of the plan year. This means that actual changes cannot wait until 2002.

Defined-benefit plan changes

Unlike defined contribution plans, defined benefit plans limit the maximum benefits that may be received by a participant. Two changes in the new law have greatly increased the size of contributions that an older doctor can make to a defined benefit plan. The first change is the increase in annual benefits, while the second change involves the age for which the maximum benefit may be calculated.

The maximum annual benefit a participant may receive 89has been increased from $140,000 to $160,000. With a defined-benefit plan, older participants, who have a shorter amount of time to fund their benefits, can make significantly larger contributions to their plans. For example, with a targeted age of 62 for retirement, a 50-year-old participant only has 12 years to fund a maximum benefit, while a 22-year-old has 40 years. This means that an older participant-doctor can contribute very large annual amounts to this type of plan.

Under the old law, the normal retirement time was the "social security retirement date," which is 65 for full benefits. Under the new law, the maximum benefit can be received at 62 years old. This means that a 45-year-old doctor might be able to contribute as much as $80,000 annually to a defined benefit plan. Think of the income-tax savings available for older doctors who wish to catch up by contributing large amounts to defined benefit plans.

With defined-benefit plans, a large amount of planning and monitoring are required by the doctor and actuary. One complexity, for example, is that changes in staff ages from younger to older might create very large changes in the annual contributions required. Also, defined benefit plans are beyond the capabilities of many retirement-plan administrators because of the need for an actuary. However, do not be fooled by retirement-plan "experts" who say these plans are too complicated. They may only want to keep your retirement assets under their investment control. They may have a vested interest in not recommending defined-benefit plans. Ask that a study be prepared of a defined-benefit plan for your examination. If your advisor cannot prepare the study, perhaps he or she does not have the capability to offer this type of plan.

Other pension law changes

Roth IRAs have been very popular in recent years. In a Roth IRA, the contributions are not deductible; however, the tax-deferred growth may be taken out free of tax at retirement. In the year 2006, participants may designate that all or a portion of their elective deferrals to a 401(k) plan be after-tax "Roth contributions." Amounts designated as Roth contributions and the investment growth of those contributions would not be taxed upon withdrawal at retirement. The laws that govern the new Roth contributions will require assets to be segregated from other plan investments and the record keeping will be more complicated.

Plan loans to owners of up to $50,000 will now be allowed after the year 2001 to S Corporation shareholders, partners, and sole proprietors. In the past, a plan loan to an owner was only allowed in a C corporation. Of course, it is not to your benefit to borrow from your retirement plan. However, with a loan provision as a safety feature, you might be more aggressive in funding the plan. Congress is also trying to help fund more in retirement plans by offering to help pay for establishing the plan via a 50 percent credit for start-up costs to design and implement a new retirement plan after 2001. This credit is limited to $500 for small employers in any tax year and may be taken for qualified costs incurred for the first three years. Of course, there are special rules for obtaining this credit, which a knowledgeable professional can handle for you.

And finally, those onerous "user fees" which we paid the IRS to obtain a "determination letter" on the status of a qualified retirement plan have been repealed for most small employers.

This offer won't last forever!

As you can see from these important changes, Congress is trying to make retirement plans affordable to small employers. Now, it's up to us to take advantage of these opportunities. Our decision to look into these matters can profoundly affect our quality of life in retirement.

However, we must do so urgently because, in a bizarre twist, the new tax law sunsets in the year 2011. This means that without an act by Congress, the whole law will be repealed in 2011 and we will be back to the less advantageous rules that existed in 2001.

So, buy now, while you can; this offer may not last forever! We owe it to ourselves and our families to strengthen our reserves for what can be, and ought to be, comfortable, secure and contented golden years.

Memo to spouse:

Would you like a raise?

In the past, because of social security taxes, many doctors underpaid spouses who worked in the dental office. This occurred because the advantage of the tax deduction on retirement benefits could not typically overcome the disadvantage of paying additional social security taxes on the spouse's wages.

Now because of the 100 percent-of-pay deferral limit, it might be possible to pay your spouse $11,000 or more next year and take advantage of the maximum deferral.

You will need to strategize with your retirement plan administrator before taking this course of action, however, to be sure that you do not run afoul of other criteria for the 401(k) plan.