Gross profit margin is an essential calculation in the business world but an underutilized tool in dentistry. In this article, Chief Editor Chris Salierno, DDS, calculates the gross profit margin for a single-unit crown to show you how this calculation can improve your practice's profitability.

What are your crown margins? I’m not talking about chamfers—I’m talking about profit margins. You know how much you charge for a crown, but do you know how much it costs you to make one? If you know how profitable your most common procedures are, you can make more educated decisions when establishing fees and selecting new dental materials.

It’s time for dentists to become familiar with gross profit margin, an essential calculation in the business world. Manufacturers, retailers, and the service industry use this as a measure of the profitability of individual goods and services. Here’s the classic formula:

( revenue – cost ) / revenue x 100 = gross profit margin.

“Cost” in this equation, also known as prime cost, is the total cost of materials and labor required to provide a service or manufacture a good. Only direct materials (e.g., lab costs) and direct labor (e.g., your chairside assistant) are to be considered here. Indirect materials (e.g., your phone bill) and indirect labor (e.g., your office manager) are important operating expenses to track, but they are not part of the gross profit margin calculation. We’re focusing on individual procedures you perform, not your overall business overhead.

Let’s roll up our sleeves and calculate the gross profit margin for a single-unit crown. First we’ll consider direct labor, which is rather simple. For this example, we’ll say that a crown takes one hour to prepare, temporize, and take an impression, followed by a half-hour insertion visit. If we pay an assistant $18 per hour, we’ll have a $27 direct labor cost.

The next calculation is a little more detailed. Direct materials can be tricky to add up, and there is a lot of variation between operators. But don’t worry. We don’t need to start counting cotton rolls. We only need to concern ourselves with the bigger costs—say, anything more than 50 cents. The total direct materials cost in our example is $149.33 (table 1).

Table 1: Direct materials cost for a single-unit crown" title="Table 1: Direct materials cost for a single-unit crown">

Consequently, the prime cost is $176.33 for a single-unit crown. If our fee is $1,250, our gross profit margin calculation would look like this:

( $1,250.00 – $176.33 ) / $1,250.00 x 100 = 86%.

A single-unit crown gives us an 86% gross profit margin. Put another way, 86% of our crown fee is our profit after paying for our assistant’s time and our crown materials. We don’t get to put that 86% into our pockets, of course; we still have to pay for all of our operating expenses. But knowing our gross profit margin for an individual procedure is still valuable information. Let’s see how we can put this to good use.

Evaluating fees

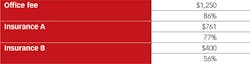

If you’ve ever considered participating with a third-party payer, you might have wondered if you could accept the reduced fee schedule and still remain profitable. Since your prime cost doesn’t change depending on your fee schedule, you can quickly calculate your gross profit margins with different dental benefit plans (table 2).

Table 2: Gross profit margins by fee schedule for a single-unit crown" title="Table 2: Gross profit margins by fee schedule for a single-unit crown">

In this example, we would lose about 10% of the gross profit margin for single-unit crowns if we were to participate with Insurance A. The idea, of course, is that we would make up for that loss by attracting and treating a higher volume of patients. Accepting Insurance B, however, would reduce our gross profit margin for single-unit crowns by 30%. We might decide that the loss is too significant to be profitable, regardless of how many new patients are brought to the practice.

Gross profit margin is also helpful for setting office fees. For complex restorative and implant cases, some dentists get an estimate of the lab fee and multiply it by a certain factor to determine a fee for the case. That calculation does not take into account the direct labor or materials, so it is not an accurate measure of profitability.

A better approach to setting fees is to consider the average fee for a service in your area and weigh that against your own gross profit margins. A dental office down the block might charge more for a given service, but that doesn’t mean it’s more profitable. Considering your prime costs enables you to lower your fees to remain competitive or raise them to recoup profit that you’ve been leaving on the table.

Increasing efficiency

Patients appreciate our ability to perform multiple procedures in a single visit whenever practical. This also makes great business sense. Performing two procedures in the same visit, compared to two separate visits, can make a significant difference in gross profit margin.

Let’s consider a patient who needs two full-coverage crowns. If we’re able to provide both services during the same visit, we can realize reductions in both materials and labor. Using Table 1 as a reference, I estimate that the additional direct materials cost for providing a second crown in the same visit would be about $125. We save a bit on materials, but more notably, the direct labor cost for the second crown is essentially $0 because we’re already paying the assistant for the first crown. If the prime cost for the second crown is only $125, the gross profit margins for our three hypothetical fee schedules are improved (table 3).

Table 3: Gross profit margins by fee schedule for a second crown in a single visit" title="Table 3: Gross profit margins by fee schedule for a second crown in a single visit">

I subscribe to Dr. Roger Levin’s definition of overhead for the dental practice: Overhead costs are everything that you don’t put in your own pocket. Achieving a better bottom line, or net profit, necessitates an examination of gross profit for our most common procedures. The calculations may seem daunting at first, but the insight you can gain is invaluable. With a better sense of our fees and our costs, we can be better stewards of our businesses.

The journey toward improving profitability is not about buying cheaper materials. It’s about improving efficiency. I have been able to significantly increase my gross profit margins by investing in technology that increases my speed without sacrificing quality.

Isolation devices

Modern isolation devices allow us to focus more on procedures and less on fighting tongues. I use DryShield to keep my patients comfortably open, to suction, and to retract vital structures. This frees my assistant to tend to her other obligations and keeps the office moving smoothly. More importantly, I have been able to join the quadrant dentistry club. Providing more restorative services per visit without sacrificing quality hinges on predictable isolation. The device is autoclavable, not disposable, which keeps our gross profit margin in check. Sizing the patient up is simple, and picking the wrong size doesn’t cost you any money.

Intraoral scanners

The benefits of digital impressions go beyond saving money on impression material. Using the numbers from Table 1, I estimate that taking an intraoral scan could reduce the material cost for a single crown from $149.33 to $134.71. That would raise the gross profit margin from 86% to 87%. Surely this is a helpful savings, but the real value of the technology is enabling a dental assistant to take over the impression process. When I use Planmeca PlanScan in my office, I am able to leave the operatory after tooth preparation and soft-tissue management are complete. My assistant can scan the necessary structures and fabricate a provisional restoration while I treat another patient in a second operatory. Delegating important clinical tasks to a properly trained assistant can significantly improve your productivity and your bottom line.

Bulk-fill composites

Bulk-fill composites have been a boon for quadrant dentistry. The ability to cure 4 mm of Tetric EvoCeram (Ivoclar Vivadent Inc.) at once has enabled me to restore multiple teeth without worrying about running out of time. I used to look at a quadrant of mesial-occlusal-distal restorations as a headache. Now I see the opportunity to provide a great service for my patients and a profitable one for my practice.