Section 179 considerations for dental practices

Robert H. Gregg II, DDS

Yes, what you’ve heard is true: you may be able to save a third—33%—on the cost of a capital equipment investment by taking advantage of the Section 179 tax deduction. Now, if you’re like most dentists, you’re probably being besieged with marketing communications that encourage you to make your Section 179 purchase by the end of the year. But what part of the promised savings is true, and what part is hype?

Here are the basics: Section 179 of the Internal Revenue Code is a section of the tax law designed to encourage business owners to invest in equipment and technology. Section 179 allows businesses—such as dental practices—to deduct the full price of qualifying equipment purchased or financed during the tax year, up to $500,000, from gross income. Section 179 gives business owners a choice: apply full depreciation for the equipment purchase in the first year, or spread it out over five years.

If your practice has purchased, financed, or leased less than $2 million in new or used equipment during the previous tax year, then you may qualify for Section 179.

It sounds easy, right? Just purchase equipment and hand off the receipt to your dental accountant . . . Well, that’s only part of what you need to know. Before you decide whether you can afford that new technology you want, here are a few things you should consider.

Assess the investment potential

Every technology purchase should start with an honest assessment. Ask yourself these questions:

- Why do you want the technology?

- Will it affect the way you treat patients?

- Will your patients benefit? If so, how?

- Will it add a new revenue stream?

- Will it pay for itself?

Answering these questions helps to cut though the marketing hype. It also helps you determine if a certain technology or equipment purchase will bring an actual benefit to your practice. Regardless of the equipment cost or promised savings, understanding the value the technology brings to your practice, patients, and bottom line will help you prioritize your investments.

Section 179 = profit?

Section 179 applies to outright purchases as well as leased and financed equipment. Now, everyone knows that if you are leasing or financing equipment, you spread out payments over time. However, what you might not know is that Section 179 lets you choose to deduct the full cost of the equipment in one year. The amount you save in taxes can actually exceed the payments. This makes Section 179 a powerful deduction that benefits your bottom line.

In many cases, the deduction will actually be a “profit.” Why? Because the amount you deduct will almost always exceed your cash outlay for the year, provided you combine a properly structured equipment lease or equipment finance agreement with a full Section 179 deduction.

Time actually matters

When the marketing emails and flyers advise you not to wait, they’re right. To qualify, equipment must be purchased and put into service before December 31, 2017. If the equipment requires training, you’ll need to schedule it now for you and/or your staff to comply with Section 179. Other dentists are also looking at the same time frame, so yes, acting quickly can help ensure your spot in preferred training sessions so you can avoid spending New Year’s Eve learning a new tool.

Hidden costs

When adding technology, be aware of hidden costs. Is there an additional cost for training, or are implementation costs included? If training is included in the cost of the equipment, it can generally be part of the overall financing package. If training is a different purchase and not included in the financing package, it generally does not qualify for Section 179. In that case, not only do you pay separately for training, you lose the opportunity for a larger deduction.

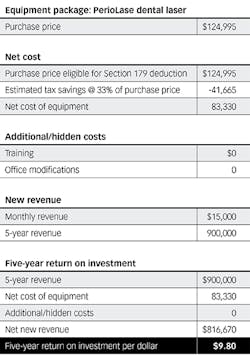

Table 1: Section 179 example

Another hidden cost comes to light when the new equipment requires a modification to meet the needs of your office. Putting in new electrical or running additional waterlines to power your purchase can be unexpected costs.

We tend to think of hard costs—dollars and cents spent—without considering soft costs or opportunity cost. Soft costs include stress and time, such as the stress to your staff and time lost when dealing with overly complicated equipment. Put another way, new technology may not improve the bottom line or productivity when you end up working harder, not smarter.

Opportunity cost can ultimately be viewed as lost revenue. If you wait to implement a technology that helps you offer a new service, attract new patients, or increase patient acceptance, you lose the revenue you could have captured if you had acted sooner.

Time value of money and interest rates

The idea of “time value of money” is straightforward, but it’s not simple. The general concept is this: a dollar is worth more in the future than it is today. That’s because you can make money by investing your dollar. So, if you invest with an interest rate of 10%, one dollar invested today will be worth $1.65 in five years. The interest rate is important, especially when you consider the average interest rates on many money market accounts today are less than one percent. That means one dollar invested now would only be worth $1.04 in five years. That’s not a huge profit.

The Federal Reserve has kept interest rates low for precisely that reason. It is more attractive to invest that dollar in technology to grow your business than it is to put that dollar in the bank. The key here is making sure the technology you spend money on will provide a return. This is why your accountant talks about return on investment (ROI).

Section 179 is a “use-it-or-lose-it” write-off that ends December 31. Will the technology you purchase today with your one dollar generate more than five cents in profit over the next five years? If so, your ROI is higher when you spend that dollar on technology than when you invest that dollar in a money market account.

Is the technology an investment?

Many capital equipment items qualify for Section 179, from computers to CAD/CAM to lasers. However, not all capital equipment items that qualify are actually investments. Investment, as the dictionary defines it, is something you purchase that you expect to produce income. If the technology brings a new revenue stream—such as adding a new treatment procedure to your office—then it is an investment. If not, it is just a purchase.

Let’s look at laser technology as an example (table 1). The PerioLase dental laser can be purchased as part of a package that includes training and equipment. The training component focuses on LANAP protocol, which has been awarded FDA clearance for periodontal regeneration treatment. By offering the LANAP protocol to your patient population with periodontal disease, you add a new revenue stream to your practice. In this scenario, you make $10.08 per dollar invested.

The takeaway

When you see “Section 179 Savings Specials” advertised through the end of the year, take another look at how Section 179 can help. This tax benefit can offset the cost of a true technology investment to benefit your practice. As with any tax issues, be sure to consult a professional tax advisor for guidance. Your advisor may know of other advantageous provisions of Section 179 that could apply to your particular situation.

Robert h. Gregg II, DDS, is the founder and president of Millennium Dental Technologies Inc. He maintains a private practice in Southern California and has been using lasers clinically since 1990. Seeking a solution for hopeless teeth, he developed the LANAP periodontal protocol and codeveloped the PerioLase MVP-7 pulsed Nd:YAG laser. In 2016, the LANAP protocol was awarded first and only FDA clearance for “True Periodontal Regeneration.”