Growth by acquisition

by Peter Mirabito, DDS

For more on this topic, go to www.dentaleconomics.com and search using the following key words: ADS, growth by acquisition, increase patient base, economics, Peter Mirabito.

In these difficult economic times, one of the best ways to grow your practice is “growth by acquisition.” Growth by acquisition is a strategy to increase your patient base by acquiring another practice and merging it with yours.

The best candidates for this strategy are practices small enough to comfortably accommodate additional patients, and those that don’t have a lot of value in the equipment. Also, the practice needs to be close enough to the dentist’s existing office so that distance is not a problem for new patients to transfer. In a metropolitan area, the rule of thumb is no more than about five miles. Any psychological and physical barriers should also be taken into consideration. Some examples are major bridges, interstate highways, or lack of reasonable access by car or public transportation.

The economics of such an endeavor are sound. When a dentist acquires a practice, the only overhead expenses he or she will incur are the variables. Since fixed expenses are covered, the overhead should go up only from the increases in expense items related to the increase in production.

Practice fixed expenses such as rent, insurance, accounting, telephone, dues and subscriptions, and utilities will remain the same. Increases can be expected in such variable expenses as lab, dental and office supplies, repairs, and possibly staff. Depending on the size of the practice acquired, an assistant and/or a part-time hygienist may need to be hired to accommodate the increased patient flow.

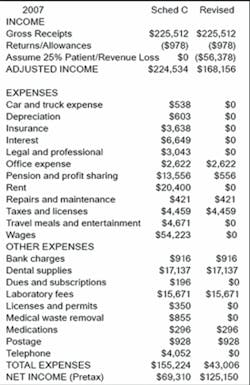

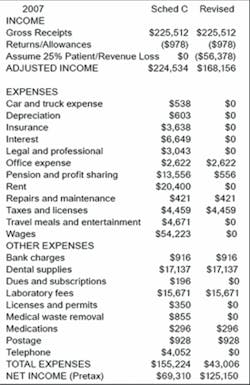

In the chart is an example of a growth by acquisition sale that we recently completed. We assumed that 25% of the patient base would not transfer, just to be conservative in our projections. The expense items that will not be incurred by the buyer were adjusted out to show what the true net income from this transition could be. As shown, over $125,000 or 74% of collections is net profit.

This practice sold for $77,000. In this example, even with a 25% loss in patient revenue, the buyer can recoup his investment in less than one year.

There are some caveats for those who buy one of these “growth by acquisition” practices. One is that the buyer should do a chart audit of the patient records to ascertain where the patients live. Any patient that travels a long distance to the seller’s practice will probably not be retained by the buyer. Those patients will most likely take the opportunity to find a dentist closer to their home or work.

Another caveat is that the patients who subscribe to a capitation or PPO dental insurance plan in which the buyer does not participate will not transfer to the buyer’s practice.

We have facilitated quite a few of these “growth by acquisition” transitions, and, because it was so successful, every buyer has later asked us to keep them in mind if an opportunity to acquire another practice becomes available.

When prudently selected and with the appropriate characteristics, a practice purchased for a “growth by acquisition” strategy is a predictable and effective method to grow a practice.

Peter Mirabito, DDS, is a partner with Jed Esposito, MBA, in ADS Precise Consultants, a dental practice transition consulting and brokerage firm in Denver, Colo. Dr. Mirabito is also a founding member of American Dental Sales. He can be contacted by phone at (800) 307-2537, or by e-mail at [email protected].