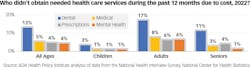

In any given year, about half of the population in the US visits a dentist. The main reasons Americans give for not going to the dentist more often are overwhelmingly financial; more than one-third (36.1%) of patients forgo necessary dental treatment due to financial constraints. In fact, dental care has the highest level of financial barriers to care compared to other types of health-care services.1,2

The root cause of dentistry’s affordability problem stems from the fact that many Americans, especially older adults, lack dental insurance. But even for those with dental insurance, dental care is still cost-prohibitive due to annual maximums, co-pays, and procedure exclusions that result in high out-of-pocket costs. The current dental insurance model is not true insurance as beneficiaries are prevented from getting the dental care they need.

As the US population ages, a larger share of seniors is searching for ways to pay for dental care. With the growth of Medicare Advantage plans, more than 90% of which offer some type of dental benefits over traditional Medicare, one might think that more seniors are getting into dental homes.3 However, most of these Medicare Advantage plans exclude important services and have annual limits and co-pays.4

Due to the shortcomings of dental insurance plans, dentists are increasingly looking for alternatives to the current dental care financing model. Postpandemic, more and more dentists report dropping out of dental insurance networks due to low reimbursement and administrative burdens. Data from February 2023 indicate one in five dental practices plan to drop out of some insurance networks this year.5 As an alternative, some dentists offer in-office plans for their patients. As of July 2023, 26% of dentists report they offer an in-office dental plan, and another 22% said they were considering offering one.6 See Figure 1 for a look at affordability challenges patients face.

Dental insurance plans boast low deductibles, but maximum benefits tend to be significantly limited, ranging from $1,500 to $3,000 per year. This coverage proves insufficient to meet the costs of many dental procedures. Adding to this challenge, dental insurance providers are progressively reducing reimbursement rates, impeding health-care access and delivery. Unsurprisingly, medically necessary dental treatments such as periodontal care, implants, full-mouth reconstruction, trauma-related interventions, sleep-related therapies, and treatments for temporomandibular disorders command reimbursements in the tens of thousands of dollars.7

Given the high procedure costs, out-of-pocket expenses, and limited coverage of dental insurance plans, complex dental care is out of reach for many patients. Medical insurance could bridge this gap and allow for needed and timely care—a win-win for both patients and health-care providers.

Medical insurance is a viable financing option for patients

The average dental patient does not have $60,000 on hand for a full-mouth reconstruction. Many, if not all, patients requiring this kind of procedure have underlying medical conditions that have contributed to their oral health issues.

Dentists are sometimes required to bill their patients’ medical insurance when dental treatments intersect with medical conditions. The synchronization between dental and medical insurance involves directly invoicing medical insurance for adjunctive dental procedures that exhibit medical necessity due to their connection with underlying health conditions.

The advantages stemming from the integration of medical billing into dental practices are extensive. Primarily, integration facilitates patients’ access to essential care. In addition, embracing medical billing serves as an effective mechanism for generating referrals and ensuring the participation of multiple providers in patients’ treatment plans.

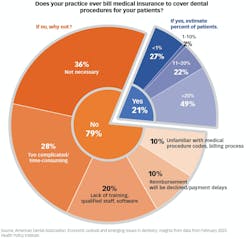

Despite the advantages for both providers and patients, only a small percentage of dentists bill dental procedures through patients’ medical insurance (about one in five, according to a recent panel).8 Among dentists who do bill through medical, half say they only do so for 1% or less of their patient base (figure 2). Some dentists hesitate to bill through medical insurance due to lack of training or familiarity with medical codes and lack of proper software. Without these resources, frustration on the part of dental practice staff understandably arises. When considering software for medical billing, dental practices need to focus on facilitating the platform, onboarding staff, and providing ongoing support for their administrative teams. While there is a learning curve, the process will become more straightforward, and patients will be able to access the dental care they need.

Case study

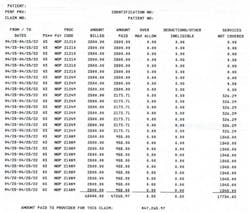

This case study showcases a successful integration of medical billing. A 37-year-old patient with type 1 diabetes and a recent pancreas transplant suffered from severe xerostomia (dry mouth) due to antirejection medication (figure 3).

The health-care provider completed a full-mouth restoration, and medical billing provided the following benefit: of the $65,000 fee, insurance covered $47,265.97, leaving the patient with an out-of-pocket responsibility of $17,734.03 (figure 4). Though the patient’s responsibility is still high, dental insurance and financing can conceivably cover the rest.

The ROI for the dental office

In addition to facilitating patients’ access to essential care, medical billing can augment a dental practice’s productivity, resulting in added monthly output ranging between $15,000 and $20,000 (exact figures are subject to case specifics and volume, according to Devdent).7

Most dental practices can attest that they may have hundreds of thousands of dollars in unscheduled treatment plans. It is a fair assumption that a significant portion of that is driven by the inability of patients to afford needed care. By utilizing medical billing, providers can start addressing the affordability crisis and reconnect with patients who have unmet dental care needs.

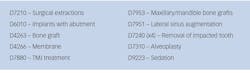

To see the difference, you need to view fees as apples to apples. Figure 5 is a sample listing of fees with the CDT to the cross-code of CPT, with medical insurance paying more for the same procedures.9

Figure 6 shows a list of more frequent procedures that can be billed to medical insurance.

Policy reforms to consider

Dental coverage today has many limitations, such as frequency limitations that do not coincide with patient care. Medical billing can connect patients to the complex, expensive dental procedures they need.

For medical billing to be used more widely in dentistry, medical and dental providers must share specific terminology of procedures. In dentistry, for instance, when a diagnosis of “cracked tooth” is used in the chart notes, it is often attributed to trauma, making treatment 100% medically necessary.

Beyond changes within the dental practice, dentists also need to expand their understanding of laws and regulations over licensure. Any licensed professional—DDS, DMD, MD, or DO—can perform any medical procedure that falls under the scope of their license if it is in line with state and federal guidelines.

Conclusion

In a landscape where patients are struggling to get access to needed care and dental practices are grappling with rising costs, reduced insurance reimbursement, and declining revenues, medical billing emerges as a transformative solution. It is a vital bridge to close the affordability gap that patients often face when seeking necessary dental care. This alternative not only allows patients to access treatments otherwise out of reach but also bolsters the practice’s financial performance. Additionally, medical billing fosters a more integrated approach to health care, emphasizing the crucial link between oral health and overall systemic well-being. Doing so promotes better patient outcomes. Adopting medical billing is a win-win, offering financial relief for patients and increasing revenue for dental practices.

For more resources on medical billing in dentistry, please visit Devdent and the ADA.

Disclaimer: The views and opinions expressed in this article do not necessarily represent those of the ADA. The ADA does not have any financial ties to Devdent or DE4 Consulting. The data presented in this article are for illustrative purposes only.

You may also be interested in ... How to create better patient records with nonclinical CDT codes

Editor's note: This article appeared in the February 2024 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

References

- Vujicic M, Fosse C. Time for dental care to be considered essential in US health care policy. AMA J Ethics. 2022;24(1):E57-E63. doi:10.1001/amajethics.2022.57

- Vujicic M, Buchmueller T, Klein R. Dental care presents the highest level of financial barriers, compared to other types of health care services. Health Aff (Millwood). 2016;35(12):2176-2182. doi:10.1377/hlthaff.2016.0800

- Freed M, Damico A, Neuman T. Medicare Advantage 2022 spotlight: first look. Kaiser Family Foundation. November 2, 2021. Accessed November 20, 2023. https://www.kff.org/medicare/issue-brief/medicare-advantage-2022-spotlight-first-look/

- Medicare Advantage: plans generally offered some supplemental benefits, but CMS has limited data on utilization. Government Accountability Office. January 2023. Accessed November 21, 2023. https://www.gao.gov/assets/gao-23-105527.pdf

- Economic outlook and emerging issues in dentistry: insights from data from February 2023. American Dental Association. Health Policy Institute. Accessed November 20, 2023. https://www.ada.org/-/media/project/ada-organization/ada/ada-org/files/resources/research/hpi/feb2023_hpi_economic_outlook_dentistry_slides_2023.pdf

- Economic outlook and emerging issues in dentistry: insights from data from July 2023. American Dental Association. Health Policy Institute. Accessed November 20, 2023. https://www.ada.org/-/media/project/ada-organization/ada/ada-org/files/resources/research/hpi/july2023_hpi_economic_outlook_dentistry_slides.pdf

- Proprietary data. Devdent.

- Economic outlook and emerging issues in dentistry: insights from data from September 2023. American Dental Association. Health Policy Institute. Accessed November 20, 2023. https://www.ada.org/-/media/project/ada-organization/ada/ada-org/files/resources/research/hpi/sept2023_hpi_economic_outlook_dentistry_slides.pdf

- Consumers estimate your healthcare expenses. FAIR Health Consumer. https://www.fairhealthconsumer.org/

Dmitry Edelchik, MBA, is head of business development at Devdent and the vice president of sales and marketing at DE4 Consulting. He is a senior marketing executive with extensive experience in established technologies and start-ups, driving product commercialization, sales enablement, branding, and upstream and downstream marketing in the dental sector. Contact him at [email protected].

Laurie Owens, CPB, CPC, COC, director of medical billing education at Devdent, has more than 20 years of experience in speaking and educating dental practices on billing medical insurance along with the techniques to get claims paid. Contact her at [email protected].

Marko Vujicic, PhD, chief economist and vice president of the American Dental Association Health Policy Institute, is a health-care policy thought leader and researcher focusing on providing data-driven insights on the future of dentistry. Contact him at [email protected].