It’s Sunday morning, Memorial Day weekend, 2018. Jayden, my older son, is 12 years old. He sees me sitting next to his bed.

“Dad,” he asks with his voice barely above a whisper.

“Yeah, bud?” I lean over and put my ear over his mouth to make sure I can really hear him. He then says three words I’ll never forget.

“Am I dying?”

Twelve days earlier, Jayden came home with a stomachache. Three days after that, he was at the Children’s Hospital getting ready for emergency surgery due to appendicitis that turned septic.

29 days in the hospital.

19 of them in the ICU.

Eight straight days of sedation, going back and in and out of the operating room five times.

Following the intubation, my son received methadone and morphine to help ease his pain. My heart was broken as I watched my 12-year-old son coming down from a high like a heroin addict. If that’s how he looked, I can’t even imagine how he felt. So maybe it’s no wonder that the very first question he would ask me, and only me, bared those three little words: “Am I dying?”

In my first breath, as I heard my child utter those words, I wondered if I had heard him correctly. I took a second breath and cautioned myself: Do not lose it right now. I looked him square in the eyes and said, “No, you’re not dying. You’ve had prayers from thousands of people all around the world, and you’re going to be just fine.”

He looked back at me. I could tell he felt ease. He always trusted me and knew that, especially now, I was telling him the truth. My words were the only thing that got him to close his eyes to get more rest. I walked outside the hospital room, and then felt like it was my turn to come down from all the past month’s events. I broke. More importantly, I also realized that I had already been broken.

I had already been miserable. I was burnt out from dentistry. Even before the hospital stay, I was taking out my lack of joy and purpose on everyone around me. As soon as I broke outside my son’s room that day, these are the thoughts that flooded me:

If life is this fragile and I’m this unhappy with the path I’m on, burn the ships. It’s time to start over.

And that’s what I did. I sold my dental practice—the one that never collected over a million dollars in a single year. In September 2018, I walked away from the dental chair and the handpiece. In the darkest of moments, in the hardships that followed, those three little words that my son whispered were what kept me going. They were and are the reason for why I’m writing this today. I made a choice to arrange my financial life differently with what I now call The New Rules of Finance. Those rules are the only reason I was able to walk away from dentistry. I realize today that having learned these rules and now teaching them is my gift, my talent. My purpose, as I define it today, is to give what I have learned to you.

A $24 mortgage payment

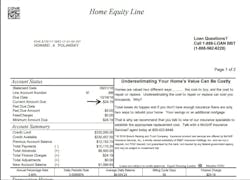

What exactly is meant by arranging one’s financial life differently? Well, it’s a mindset shift on viewing how money moves through life. I want to teach you how to think outside the box and how to look at your balance sheet differently. Still skeptical? If your house payment became $24.19, like mine did, might you be willing listen?

As you look at Figure 1, you’ve examined the proof and now skepticism has turned into amazement, hasn’t it? How is any of this possible?

It’s all about being open to a different perspective. Right now, when you look at your financial life, you see assets and income on one side and expenses with liabilities on the other, all independent of one another. What if there were a way to marry the assets to the liabilities and have them offset each other, reducing monthly payments and having access to the cash at the same time? See The New Rules of Finance in Figure 2.

5 points of a financial plan

Let’s talk about what makes this idea so radical. Let’s start with a basic understanding of financial planning. We all try to maximize our income. We know that we are dependent on what we do every day.

We determine how much and how hard we work. In dentistry, for example, we may have a better chance for financial success by maximizing our productivity per hour. We can do this by changing our service mix or adding additional providers under our roof, as one example.

Then, we pay our bills without much thought. We do what we were taught to do, what we are supposed to do. We pay our bills in full, as much as we can, and on time.

Once we have money left over from those liabilities, we go to a financial advisor to gain insight on where to invest the leftover money and for how long. With the advisor’s oversight, that stake is protected. And finally, with the money used to pay expenses, with some savings going into the stock market or mutual funds, we flow into structuring our chosen lifestyle.

But it seems that in all our financial planning we didn’t give much consideration to minimizing expenses. This is where arranging our finances differently becomes useful. This is where the shift in mindset takes place. No one has really been able to figure out how to pay less for how we already live—at least not effectively. If we can manage to minimize expenses while living the same lifestyle, that would be the magic formula.

I am not here to dictate that we must eat ramen noodles for the rest of our lives, cut cable, switch to a burner phone, and live in a cave to save money. That would be both self-defeating and soul-crushing. Instead, I am here to share with you what I believe to be that magic algorithm: a simple, guided system for increasing the value of future assets by minimizing expenses. The future can be supercharged by:

- Lifting the burden from fixed debt payments

- Expanding cash reserves

- Deploying extra dollars into assets

When we’re done with this implementation, we maintain our lifestyle, keep more money each month, and achieve our dreams that much faster.

The power of an LOC and simple interest

So, what allows a person to have financial flexibility? It begins with understanding the usefulness and the power of a line of credit (LOC). An LOC it is a tool through which money flows. The best example of that is a credit card. Let’s say we get approved for a $10,000 limit. We purchase $3,000 of goods and services. At the due date, if we do not pay $3,000, we have $7,000 available in the line. I call that $7,000 “access to cash.” Once we pay the $3,000, we’ll have access to the full $10,000. Money is flowing in and out; it’s flowing through this tool. A home equity line of credit (HELOC) is the very thing that allowed me to get my house payment down to $24, as shown above.

When people consider debt, most think in terms of fixed and equal payments, or a mortgage, known as amortized debt. It’s logical but the debt is inflexible. Imagine a few slow months of collections at the office … what does that do to our personal cash flow? Or worse, what if we get injured and can’t work? Another pandemic? Those fixed debt payments are still coming every single month with no reprieve, with significantly reduced deposits.

Simple interest debt is different from amortized debt, in that the payments on that loan are variable. When one has a loan with simple interest like an LOC, the only payment required is covering the interest. You don’t have to pay anything toward the balance but have the option every day to do so. One fear people have is that the interest rate moves with zero control and no real prediction. The Fed dropped rates to 0% in March 2020, which was fantastic. It was less than fantastic when they raised rates all through 2022.

The idea of having variability in the payment due to interest fluctuation causes anxiety in people, because now the fixed budget is no longer fixed. What we thought of as inflexible payments are now flexible. Let me show you a distinction, though.

When I had an amortized loan, a mortgage, my fixed house payment was about $2,200 a month. When I changed to a HELOC loan, things drastically changed.

- In 2021, with interest rates low, utilizing my HELOC, my house payment averaged $350 a month.

- In 2022, with all the interest rate increases, my average house payment was $500 a month.

- In 2023, in the high interest rate environment, my house payment “skyrocketed” to $600 a month.

I ask you this: Which would be easier to pay? My flexible, variable-rate house payment of up to $600 or the fixed house payment I had of $2,200? I understand and appreciate the risks involved; I also accept and understand the risk knowing that the reward is a far lower cash burn.

Case study

Look at Figure 3. Before working with me, the family budget of a dentist--breadwinner was $16,900 a month. Around $10,000 of that was fixed debt payments (with no flexibility). It included a mortgage ($4,200), student loans ($4,636), and a car payment ($1,400). With some financial engineering and the use of a HELOC, the fixed debt payments went from nearly $10,000 a month to $3,350 ($2,600 for the mortgage and $750 for the student loan now inside the HELOC). The lifestyle box (in blue) remained exactly the same, meaning the family did not change the way they live—no ramen noodles, no cutting cable, and no burner phone. Yet, $6,886 a month (or $82,000-plus a year) was now freed up from the budget for whatever purposes the family might choose. Imagine the relief from that kind of burden!

Achieving financial freedom faster

In the case study, we witnessed the lifting of burdens wrought by fixed debt payments—a transformation achieved through the strategic use of an LOC. This maneuver not only expanded cash reserves but also facilitated a significant reduction in remaining debt, enhancing both the speed and efficiency of financial management.

Such strategic financial navigation has not only brought solace but has gifted families with nights of peaceful slumber. With the newfound liberation in cash flow and access to funds, we can strategically reallocate surplus dollars into assets, initiating a pivotal step toward optimizing lifestyles. The adoption of these New Rules of Finance has been a beacon of hope, offering a path to freedom from debt without forsaking the small pleasures, such as a simple Starbucks coffee. The shift toward lowering expenses paves the way to attain financial freedom at a pace previously unimaginable.

This epiphany has radically altered my own perspective on life and family dynamics, fostering a heartfelt wish that the liberation it has granted our family—the precious gift of time and the ability to live and love more fully—can similarly transform your life. My hope is to convert personal adversity into a wellspring of opportunity for others, embodying the lesson that the hardest of times can indeed pave the way to a prosperous and fulfilling life.

Editor's note: This article appeared in the May 2024 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

Howard Polansky, DMD, MBA, a Navy dentist-turned-practice owner, hung up his dental handpiece in 2018. He transitioned to a role helping families and business owners dramatically reduce their debt. To work with him as a cash flow optimizer, visit financiallyled.com or text him at (512) 608-1020.

Maggie Augustyn, DDS, FAAIP, FICOI, is a Dawson-trained practicing general dentist, owner of Happy Tooth, faculty member at Productive Dentist Academy, author, and inspirational speaker. She speaks nationally bringing attention to the importance of authenticity and self-discovery and igniting audiences toward a journey of a less tainted self-actualization.