Production: The key to associate dentist and hygienist performance

Thomas Climo, PhD, and Jill Nesbitt, MBA

Owners of dental practices often use overhead analysis to keep a practice on an even keel, and to assess the operating and financial performances of their businesses. The subject of overhead analysis in dentistry is a concept discussed by the ADA and in the literature, but without sufficient guidance as to its impact on the operating and financial performance of associate dentists.1

This article is intended to condense the discussion on overhead analysis and focus it in the direction of one of only four methods available for allocating expenses against associate dentist revenue. This discussion is also applicable to the hygienist team, which will be addressed later in this article.

The four available methods for allocating expenses against associate dentist revenue are: (1) dividing expenses evenly, (2) dividing by hours worked, (3) dividing by collections, and (4) dividing by production. Clearly, the most logical and best functioning of these methods is the fourth choice-to divide expenses according to the production of each provider team. Unlike the first two choices, which deliver unfair competitive analyses, and unlike the third choice, in which corruption of analysis occurs through subpar performance by the front office staff or owing to medical insurance delays, allocating expenses based on production delivers a clear, even, and fair distribution for assessing the performances of associate dentists.

Practice owners can use this financial assessment as a regular monthly or quarterly discussion with their associates to accomplish several important objectives:

- To open the door to a regular discussion on the business side of dentistry, which educates associates and increases their willingness to share financial concerns. (Hopefully aiding in avoiding associate turnover, too.)

- To share the impact that expenses have on the bottom line, and to create an ally in the associate dentist to keep these outlays under control.

- To clarify the impact of staff compensation beyond the associate's primary assistants, and to communicate benchmarks important for practice performance.

Here is a sample agenda for a monthly/quarterly meeting between the owner and the associate dentist:

Agenda: Financial review for associate dentist Dr. ______

1. Supplies and lab expenses: Are they in line with benchmarks?2

2. Staff compensation: Is it in line with benchmarks?

3. Production/collections contribution

4. Personal items

In the first agenda item, supplies and lab expenses, the owner first shares the total supplies expense for the entire group and for the office(s) where this associate sees patients. For example, showing a $25,000 per month supplies expense for the entire group will help the associate dentist understand the sheer size of the budget. Next, drill down to the offices where the associate works and show the supplies expense in dollars and as a percentage of income compared to the industry benchmark. If the supplies expense is above the range of 6% to 7%, then include a list of all the supplies purchased that month and ask the associate to review the list for suggestions to cut costs.

Next, share the total lab expenses for the group and the specific office. Again, display these numbers in both dollar value and percentage of income. This allows the associate to see the performance against a benchmark. It is helpful to show each month's performance, which enables the associate to see trends in expenses.

Once the supplies and lab expenses are reviewed, this is a great opportunity for the owner to congratulate and show appreciation for the associate dentist for managing these expenses successfully. Conversely, this could be a time to open the associate's eyes to a financial issue that needs to be addressed.

In the second agenda item, staff compensation, the owner shares the total staff compensation in dollars to the entire group. Frankly, this number should make an impression on even the most seasoned dentist. Share the staff compensation for the office in dollars and percentage of income. If the staff compensation is above the range of 25% to 28%, then providing a list of the staff and their earnings for the month may help the dentist understand where money is being spent. Often an associate dentist thinks only about his primary assistant when he thinks about staff compensation. Looking at the entire staff helps the associate dentist realize just how many mouths there are to feed, and how this one expense impacts the profitability of the practice.

The third agenda item, production/collections contribution, covers these items for the month. The owner also shares the associate's production and collections for the entire year, broken down by month, again helping the associate to identify trends and helping the associate see his or her financial performance in black and white. Following this, the associate's contribution to the group is shared. It is understood that determining the contribution of each dentist toward the profitability of the group is based on the method of allocating expenses. Production is the preferred method for allocating expenses, given the reasons stated above.3

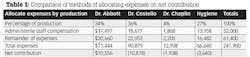

Table 1 shows the division of allocating against net contribution for the three associated dentists (Drs. Abbott, Costello, and Chaplin) and hygiene providers.

By using production as our method to allocate expenses, we have chosen the most reasonable option that treats associate dentists fairly. It also treats the hygienist team fairly, as shown in the table. Looking at the total production for the group and then determining the percentage for each dentist and hygiene team provides the percentage that will be used to allocate expenses.

The logic is that if each dentist produced "x" percent of the total, then it can be assumed that they also use that same "x" percent of the staff and general expenses to accomplish this level of production.

Considering table 1, we start with the total expenses for shared staff (administrative and sterilization), and use the percentage of production to determine the burden on each provider. The same holds for the rest of the expenses. In other words, the "net contribution" is a calculation from the expenses provided because we need to know specific lab and assistant/EFDA (expanded function dental auxiliary) expenses that do not parse equally over percent of production, as some associates do not incur these expenses. (This is why, unlike most tables of this kind, the last row in table 1 does not appear to be correleate with the rest of the data.) To determine net contribution, take the provider's collections less their specific lab and assistant/EFDA salaries and less their portion of the shared expenses. Quickly, the owner and associate dentist see the impact of these shared expenses on the provider's profitability. This often leads to the question by the associate dentist that culminates in, "What are we spending all that money on?!" (Which, for once, is the right question!)

The owner should smile broadly when hearing this question because the associate dentist is beginning to see how the business side of dentistry works. The owner may want to bring a copy of the income statement to these financial meetings in order to help the associate understand the laundry list of expenses eating away at the profitability of the group. This is the perfect time to encourage the dentist to be on the lookout for waste so that profitability can increase. This is also the perfect time to refocus the associate on what he or she has "contributed" to the group in terms of profitability and at this level of expenses. It also presents the owner an opportunity to thank the associate dentist for a great month and encourage him or her to keep up the good work, or, alternatively, to discuss how the performance is below a set goal.

Finally, the fourth agenda item, personal items, exists to cover any personal financial questions the associate dentist may bring up as a result of the meeting. This is a great time for the associate dentist to ask about financial topics that are sensitive and difficult to address through the course of a busy day. For a successful associate, perhaps there are questions about additional bonuses or buying into the group. For a struggling associate, he or she may want to know if the other dentists in the practice are doing a better job financially, and if so, why. This is an excellent discussion point that can lead into operational changes and impact the results reviewed in future financial meetings. The goals of this part of the meeting are for the owner to ensure the associate dentist feels valued, that the associate dentist understands a few basic numbers that reflect financial performance, and that lines of communication are kept open on difficult financial matters.

The monthly financial meeting need not last more than 45 minutes over a lunch hour. Sitting down together at the end of the month to review this breakdown is the only time dentists really look at the expenses required to run the practice. When you consider dentists spend every day creating treatment plans and looking at the income side of the practice, a dentist-owner quickly realizes that helping associates see expenses is essential in their maintaining a rational understanding of what it takes to keep everything flowing smoothly, and how to lead the practice into profitability.

Not only is this monthly evaluation of financial performance helpful for associate dentists, it also serves the dentist-owner. Thanks to a set method of determining net contribution, a dentist-owner can understand which associates should be congratulated and which should be coached. The dentist-owner can then make decisions about support staff and lab fees, along with major expenses that add up and affect a dentist's profitability in the group. This will also help to determine which associates deserve to have an extra operatory on certain days or who may need additional clinical support staff.

As dentist-owners are responsible for clinical direction and overall management directed at the financial performance of the practice, having a set approach to determining profitability of associate dentists assists greatly in the decision-making process. A clear understanding of the contribution of each dentist in the group allows for more successful strategy and goals to be established that move the practice toward the vision the dentist-owner has established for the group.

Notes & References

1. ADA Survey Center, 2010 survey of dental practice: Income from the private practice of dentistry, available at: http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/10_sdpi.ashx. The only article we know of that directs overhead attention directly to the operating and financial performance of associate dentists was written by us, "How Do You Assess the Performance of Your Associate Dentists?" DrBicuspid.com, 10/15 and 10/22, 2014 and "How Profitable Are Your Associate Dentists?" DrBicuspid.com, 10/8, 10/29, and 11/5, 2014.

2. Operating cost benchmarks can be found in various places regarding group practices, e.g., the American Association of Dental Group Practice (AADGP) in AADGP, 2012-2013, Group Practice Benchmarking Survey, 2014, available by fee. For solo practices, see Climo T, White Paper: Standardizing the Financial Reporting of Dental Practices, January 2014, available at: www.dentaleconomics.com.

3. Also outlined in our Dr. Bicuspid series, referenced above.

Thomas Climo, PhD, writes and consults on the topic of Dental Economics, specializing in organizing practice management groups for solo practitioners and in the standardization of accounting for and valuation of dental practices. He can be reached at [email protected].

Jill Nesbitt, MBA, is a group practice dental consultant working in partnership with Dentrepreneur Solutions Inc. to provide management support to emerging groups. She offers free practice management resources and an online dental staff training program at www.dentalpracticecoaching.com.