Planning and starting early are two of the more important steps to investing for your retirement.

Elliott Brody, DDS

The key to successful retirement is planning, both on the personal and the financial sides. The more time that you have to plan, the greater the chances are for enjoying the years after your career in dentistry.

Personal Side

The personal aspect deals with when (if at all) you retire, where you would like to be and how to plan to spend your time.

When-the number of years you have for starting the next and, hopefully, exciting and enjoyable phase of your life-deals with the time frame that you have to plan for where and how you will spend your time.

Both you and your spouse should discuss this question because, often, there are differences of opinion as to how each of you feels about this subject. Often, the person working longer in his career is more likely to feel ready to retire at an earlier time than one who has taken time out to raise a family and then resumes or starts a new career.

The fear of a change to a new phase of life can be intimidating to some, and so the more time you have to plan and talk about these concerns, the better.

Where you will retire is important to address for a number of reasons. Moving to another section of the country often entails a move away from family, especially children and grandchildren, and from friends. Assessing the trade-off that this change will bring, with that of a better climate and a more leisurely lifestyle, requires consideration. You also will want to think about whether or not you would like a retirement community. Your decision to move will affect your cost of living, depending on where and in what area you choose to relocate.

Once the decisions of when and where have been decided, it would be wise to "try out" the new location by renting rather than buying a new residence, if there is some doubt about making the change. If you feel secure enough in your choice of a location, you can buy a new home or apartment and spare the intermediate extra move.

The when and where really are preludes to the most important question of how you will spend your time in retirement.

Develop outside interests, both physical and intellectual. Too much time on your hands can be very detrimental to your well-being. As practicing dentists, many of us wished for more free time, but having an endless amount of that commodity can be a disaster after an active career. Do not wait to retire and figure that you will take up this or that hobby or sport. You will find the transition much easier, with the added time that you have in retirement, if you expand your chosen interests now.

Try to spend more time with your spouse as you approach retirement because each of you has changed since you were married. Many spouses have their own careers and may have different outside interests than they did years ago, and so they spend little time together. Now is the time, perhaps, to share those interests and this can bring you closer together.

Speak to people whose personalities and interests parallel yours and who seem to be enjoying their retirement-get their formulas.

Financial Side

There are five steps to successful investing. Two of those are the same as on the personal side, namely planning and starting early. The others are the use of dollar-cost averaging, making maximum use of tax-advantaged investing and diversifying.

Planning requires having a written investment plan based on your risk tolerance and your goals. Few people would take a trip across the country without a road map, and no one would build a house without a set of blueprints. Yet, most people do not have a coherent, written outline of appropriate investments. Instead, their portfolios are a collection of investments based on information from disparate sources which lack a coherent focus that is appropriate for them.

Starting early gives you more time to reach your goals and so entails less risk that has to be taken. If you have only five years to accumulate a given sum of money, you will need higher risk investments than if you have 20 years to attain that amount.

The use of dollar-cost averaging when buying stocks or stock-mutual funds allows you to take advantage of the upward bias of equities. This means that over longer periods of time, 10-20 years or more, stock prices tend to go up, and so if you buy every year, you will find that the cost of your portfolio should be less than its value at the end of that period of time. This is because the cost of your portfolio is the average price paid over time for its acquisition and at the end, because of the increased price of the stocks, the portfolio should be worth more than you paid for it.

Making maximum use of tax-advantaged investing means making use of tax-deferred and tax-free investments. This allows for the compounding of returns without the attrition that taxes bring about. These investments include 401K, 403B, Keogh Plans, defined benefit, defined contribution, money purchase, IRAs, both deductible and nondeductible (using after-tax dollars); annuities and municipal bonds.

The use of diversification through asset allocation (how your investments are apportioned) is another important step to successful investing. This entails the proportion put into equities, fixed income (CDs and bonds), cash and other things, such as real estate, art or other business ventures. What is essential is that whatever the allocation, it should be done in such a way that it is within your risk tolerance. In other words, you should not lose sleep over your investment. So, it is essential to measure your comfort level. One way to do this is to analyze what hypothetical portfolio mix you feel comfortable with. The following ratios can give you an idea of how you can classify yourself. If you are comfortable with:

100% in fixed income (CDs, Bonds, Cash) = conservative

75% fixed income, 25% stocks = conservative to moderate

50% fixed income, 50% stocks = moderate

25% fixed income, 75% stocks = moderate to aggressive

100% stocks = aggressive

The rule of thumb is 100 percent minus your age is the amount that you should be investing in stocks. So a 30-year-old should invest 70 percent in equities and a 75-year-old should invest 25 percent in equities.

Again, that is a rule of thumb and your allocation would be based on your particular circumstances and your risk tolerance. Additionally, your assets on the equity side can be allocated by industries, countries and structured to be more or less volatile than the overall market.

On the fixed-income side, you can diversify according to maturities; i.e., having 1/3 mature short term, one-three years; 1/3 intermediate term, three-10 years; and 1/3 long term, with maturities running out 10-30 years. Another way to diversify the fixed-income portfolio is to buy bonds of various ratings. As you decrease the rating (those given by Moodys and Standard and Poor`s), you in- crease yield. The reason for this is that the bond investment has a higher risk associated with it and, to make it attractive, must offer a higher yield. So, within the four investment-grade ratings (S&P-AAA, AA, A, BBB), you increase your yield with slight increases in risk. If you go to still lower ratings, below investment grade (BB or lower), you can increase your income still further, but with greater risk of principal.

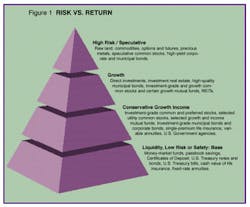

The investment pyramid indicates the way a portfolio should be structured, and its proportions will vary with the risk tolerance and objectives of the investor.

You must remember that all investments are subject to risk. By understanding risk, you can choose the mix of investments that best matchs your risk tolerance and personal circumstances.

Risk refers to the possibility that an investment could decline in value or fail to provide an investment return greater than the rate of inflation. Understanding risk and choosing your investments according to your risk tolerance will save you a lot of worry about what`s happening to your money.

The investment pyramid (see Figure 1) often is used to illustrate the concept that higher returns reflect increased risk. The investment pyramid categorizes familiar instruments, such as Certificates of Deposit (CDs), common stock and real estate, according to their relative risk level. For example, CDs found at the pyramid`s base are considered conservative and involve less risk than the other investments in the pyramid. Moving up to other investments higher in the pyramid increases risk. It is suggested that your equity-investment choices (as well as fixed income) primarily concentrate in the second and the third portion of the pyramid.

Investment Errors

1. Allowing emotions to interfere with judgment, such as "falling in love with a stock," is one of the greatest detriments to successful investing. Owning a stock that you have had for many years, which has performed well for you, is no justification for holding it if the company`s fortunes have turned negative and other suitable stocks could replace it in your portfolio.

Greed is another emotion that can override making good investment decisions. As a result, there is a reluctance to take profits when a reasonable and detached assessment would indicate it would be proper to do so. On Wall Street, there is a popular saying that sums this up: "Bulls make money, bears make money, but pigs get slaughtered."

Just as greed precludes taking profits, so ego interferes with cutting losses. It is very hard to admit making mistakes.

2. Trying to predict interest rates and the direction of the stock market can distract you from your goals. Billions of dollars are spent in media coverage which deals with these two questions and, when you get together with people who discuss financial markets, market direction and interest rates usually are the focus of attention.

However, as was stated earlier, your investment philosophy does not require a crystal ball, but rather a long-term disciplined approach that should not be whip-sawed by the daily changes in the market and interest rates. Remember, it is not timing the market; it is time in the market that counts.

As Figure 2 shows, if you are wrong in so far as your assessment of the investment climate, and are out of the market for just a few of the best days in a decade, you will cut your return substantially.

3. Many investors make the mistake of having the wrong investments in their pensions, vs. the nonpension portion of their portfolios, namely too many fixed-income investments in the pension and not enough equity exposure. Sophisticated investors look for the greatest total-return investments that are in line with their objectives. Total return means the amount that an investment changes in value over a period of time, plus the dividend or interest it pays.

Therefore, the greatest total-return investments belong in your pension, (i.e., stocks and corporate bonds) and lower- return investments, (i.e., CDs and treasuries) should be outside the pension. People tend to mentally compartmentalize and equate pension with retirement funds and feel they want to attain a certain specific, fixed amount, assured upon retirement and so their fixed-income investments go into the pension. As a result, the greatest advantage of the pension, tax-deferred accumulation, is not maximized and you lose the greatest benefits of your pension.

There is no reason, other than the wrong mindset, that you cannot also use the money outside your pension plans for retirement.

4. Another error is not enough equity exposure. As stated earlier, 100 percent minus your age is the percentage that should be in equities. This is because equities have outperformed, over time, all other categories of investments.

5. Not having a written investment plan-trying to "wing it"-does not enable you to see how each type of investment will fit the total picture needed to achieve your objective.

Information And Advice

General sources include: The Wall Street Journal, The New York Times, Barrons, Business Week, Morningstar (for mutual funds) and the Journal of the American Association of Individual Investors (for general financial information).

The one book that goes into great detail about the subject covered in this article and probably is the best single source of information for dentists is titled, Prepare and Enjoy Creative Dental Retirement, by Dr. Armend Mesrobian.

The best personalized sources for your retirement planning are your own professional advisers, your accountant, attorney and financial consultant. They know you best and should know your mindset and provide you with the type of information that will be specific for you.

I urge you not to be "penny-wise and pound foolish" when it comes to paying for advice. We have all worked hard in dentistry and, just as we expect to be paid for the services we render, so you should expect your advisers to be compensated for their time in guiding you. It is a small price to pay, relative to the sums of money we have to invest and for the peace of mind. This should allow you to be more confident that you can set and reach realistic objectives.

The retirement-planning process is and should be both rewarding and fulfilling. I urge you not to live in the past or worry about the future, but rather to learn from the past, plan for the future and enjoy the present.

T. Rowe Price said, "The difference between success and failure is more a matter of discipline than genius." I have tried to give you the sense of discipline and direction necessary to reach your retirement goals. Good luck!

The author, a retired dentist, is a financial consultant in the Staten Island, NY, office of Merrill Lynch. For 10 years he had his own business advising owners, executives and a merchant banking company on their investments, as well as being co-chairman of the economics and insurance committees of the Second District Dental Society.