5 financial myths debunked

Andy Upchurch, RHU, REBC

Throughout my career, I have dealt with a number of preconceived notions regarding “prudent” financial decisions. But as the title of this article suggests, many of these widely held beliefs are not entirely accurate. The following are five of the biggest myths I have dealt with among clients and prospective clients in the past 25 years.

“Market timing is the way to go. Buy low and sell high.”

I’ve often told clients, “If there were actually a formula for successfully timing the financial markets, there would be a lot more rich people.” I once heard Peter Lynch, one of the most famous institutional investors of our time, say, “I can’t recall ever once having seen the name of a market timer on the Forbes annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think someone would’ve made billions by doing it.” It’s hard to argue with that logic.

What is the solution here? Long-term, properly-diversified, and disciplined investing. Take advantage of institutional investment platforms that are available to you. Those platforms can help you obtain a level of diversification that is nearly impossible for the individual investor to capture alone. In a recent portfolio review for a client, I was able to show how he could invest in a portfolio that would own more than 11,000 different securities, 35% of which were outside the United States. These types of platforms are available for as little as a $10,000 investment, and they take market timing out of the equation. They offer you the ability to diversify your portfolio both globally and with an increased number of holdings, which is very difficult to achieve alone.

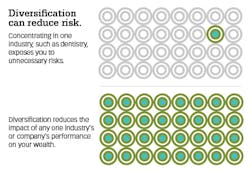

“I’m just going to invest in my own practice. That’s what I know.”

Dentistry is a great business. You should invest in yourself. As with any investment, however, having all of your eggs in one basket does not always prove to be a prudent choice. This philosophy does not rise to the level of diversification that most advisors would recommend for your portfolio. Without naming names, the financial landscape is littered with companies and industries that were once darlings of the investment world, but now no longer exist.

Aside from the diversification issues, it is important to note that there are many great businesses and industries around the globe. Limiting your portfolio to what you know—dentistry—limits your ability to participate in the successes available to you in a global economy.

“I only invest in real estate. They aren’t making any more of it!”

On the surface, this sounds clever. The dirt we have now is the only dirt we are going to have. Many investors feel an elevated level of safety when they invest in real estate because of the belief that it is a finite natural resource. Historically speaking, how accurate is this perceived level of comfort?

As a point of reference, the Dow Jones US Real Estate index (ticker: DJUSRE) illustrates a 0.33% 10-year annualized rate of return as of July 3, 2017, sitting at 319.84. On October 10, 2007, this index hit 313.68, and on March 9, 2009, the index reached a low of 86.13. This is a decline of more than 70% in an index that tracks the broader US real estate market. This also illustrates that the current index has just eclipsed it’s closing valuation from October 10, 2007, meaning the index has been basically flat over the past 10 years. To be fair, the Dow Jones Industrial Average (DJIA) plunged during the same time period, falling from 14,078.69 on October 10, 2007 to 6,547.05 on March 9, 2009. It’s important to note that even with this similar decline, the DJIA has not been flat over the past 10 years, closing at 21,479 on July 3, 2017. This surpasses its October 2007 high by more than 50%.

The purpose of this example is not to say real estate is bad and stocks are good. The point is that real estate carries market risk, much like other investment classes, and should be diversified. Real estate might very well have a place in your portfolio—it just shouldn’t be your portfolio.

Other risks to consider when investing in real estate

- Interest rate risk—Rising rate climates make it more expensive to buy or sell.

- Credit risk—In a tight credit environment, securing financing for buyers or sellers becomes more difficult.

- Government and regulatory risk—Zoning and tax treatments can change, possibly leaving you with an illiquid asset in your portfolio.

- Liquidity risk—Real estate can be harder to convert to cash when needed.

“I will be in a lower tax bracket when I retire.”

This is a broadly accepted tenet of financial planning that is not always accurate. It’s the basis for the recommendation many advisors give their clients: defer as much income and earnings taxation as possible.

My experience has been otherwise. Clients don’t necessarily want to decrease their standard of living in retirement. They’ve worked and saved hard, and at least early on in their retirement years, many spend at least as much as they did during their working years, if not more.

Tax laws change. Few things are more politically charged than taxes. As different parties are elected in each election cycle, taxation (income, estate, capital gains, etc.) is usually up for debate. For example, it’s entirely possiblethat money you invested in your 401(k) plan at a 28% tax bracket deduction could be taxed at 40% when you spend it in retirement—based solely on tax law changes. To be fair, it could also work to your advantage as well, but the point is that we have no idea what the tax climate will be in four years, let alone 20.

Here’s the solution: Diversification is the correct play, although not in the same sense as we’ve discussed previously in this article. In this case, we are talking about diversifying your accounts based on tax treatment as opposed to investment mix. Make sure you strike a balance between traditional tax-deferred retirement plan assets, such as 401(k) and individual retirement accounts (IRA), and after-tax investment accounts. This will give you flexibility and options in your income planning regardless of the current tax climate. Avoid becoming “retirement plan poor,” meaning too many of your assets are tied up in those traditional tax-deferred vehicles, reducing your liquidity and tax options in retirement.

“I only need life insurance until I accumulate enough assets.”

This is a common misconception promulgated by many popular self-help personalities. In 2014, one of the largest life insurance transactions in history occurred when a well-known (yet anonymous) billionaire tech investor purchased $201 million of life insurance. The sheer size of the policy required the collaboration of 19 different insurance companies and an annual cost in the single-digit millions. While the details are rightfully private, this is yet another example of a very wealthy person with plenty of assets who is using life insurance as a planning tool. In my 25 years of practice, I’ve personally worked with many older, wealthy professionals who still had large life insurance positions for a variety of reasons.

Life insurance is a very individual and complex financial topic far beyond the scope of this article. When personally working with a client, I cover a lot of both personal and financial ground to determine the appropriate amounts and types of life insurance. Suffice to say that the reasons some dentists purchase/own life insurance at age 65 are completely different than the reasons they purchased it at age 35.

As with most things in life, there are very few situations that call for “black or white” solutions. Historical reference, diversification, and individual circumstances are truly the keys to making intelligent, long-term financial decisions.

Andy Upchurch, RHU, REBC, is the president of Continuum Financial Solutions. Based in Charlotte, North Carolina, Andy travels throughout the United States as a dental- and medical-specific financial advisor. Andy can be reached at (317) 701-2226 or A[email protected]. You can read more about Andy and the type of work he provides for his clients at ContinuumFinancialSolutions.com.

Disclosures

Andy Upchurch is a registered representative of and offers securities, investment advisory, and financial planning services through MML Investors Services, LLC. Member SIPC. Supervisory Office: 4000 Westchase Blvd, Suite 400, Raleigh, NC 27607. Tel: 919-755-3100. Continuum Financial Solutions is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio or that diversification among asset classes will reduce risk. Indices are not available for direct investment. CRN#201910-219558