The Practical Investor

Make bear markets part of your investment strategy.

by Marvin Appel, PhD, and Brian Hufford, CPA, CFP

Although it seemed that the worst was over for the stock market after September 21, the New Year started off poorly. Very few commentators predict a down year for stocks in 2002 - which would be a third consecutive year of losses - in part because three-year losing streaks have been rare in the United States (the last was 1939-1941). Also, investment professionals generally give optimistic arguments more weight because business is better when the public is enthusiastic about stocks.

Many people save by adding a fixed amount to their investments every month or quarter, no matter what the investment climate. It turns out that this rote approach, called dollar cost averaging, has held up reasonably well even during bear markets. Dollar cost averaging can be an excellent strategy for many of you who are in the early stages of saving for retirement.

How it works

In order to build savings with dollar cost averaging, add a fixed amount to your investments on a regular schedule (such as every month or every quarter). When stocks are high, your fixed investment buys relatively fewer shares than when stocks are low.

As an idealized example, consider investing $150 each period. Initially, your stock might be $10 per share, so you buy 15 shares. Next time, the stock is $15 per share, so you buy 10 more shares. After two purchases, you have invested $300 and own 25 shares of stock.

Later, if the stock price crashes to $5 at your next scheduled buy date, you would purchase 30 more shares. You now have purchased a total of 55 shares for $450, or $8.18 per share. Note that your average cost per share is closer to the low end than to the high end, and that if the stock recovers even just to the middle of its range (where it started), you will have earned a profit. The profit results because you buy a greater number of shares at lower prices; a dollar per share gain from your cheaper purchases results in more profit than a dollar per share loss from your expensive purchases.

The unspoken assumption is that the investment you are buying (for example, an S&P 500 index fund) will eventually recover beyond your average cost, if only you wait long enough. Under this assumption, investing during market declines with a sufficiently longer horizon would amount to buying low. Though the U.S. stock market has always recovered in the past, there is, unfortunately, no guarantee that this will always be the case, especially with individual company stocks. (Consider one-time blue chips such as Xerox or Polaroid, or the overall Japanese stock market.)

Low-overhead mutual funds or 401 K plans are ideal for dollar cost averaging. Stocks are potentially less ideal because, unlike no-load mutual funds, you incur a separate brokerage commission every time you buy more shares. Also, if your savings plan entails purchasing fewer than 100 shares at a time, your purchase will get executed as an "odd lot" order at a relatively unfavorable price.

How frequently should I add to my investments?

Ideally, some of your purchases will occur during market dips so that you can buy at good prices. Most market declines usually are quicker and steeper than market advances, so if you wait too long between making new investments, you are more likely to miss favorable buying opportunities.

Over the past 50 years, the market has risen during 58 percent of monthly, 65 percent of quarterly, and 73 percent of yearly intervals. Quarterly investing is a minimal frequency. Investing monthly, or with every payroll, is better.

What about bear markets?

If you happened to start investing right at past market tops, you would indeed have lost money during bear markets. But your investment would have recovered more quickly than the market did, because some of your holdings would have been purchased near the ultimate market bottom (even if you did not realize it at the time).

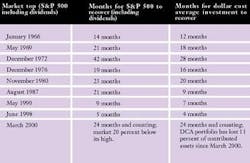

Table 1 shows what would have happened to a hypothetical investor who invested in the S&P 500 monthly, starting at market tops. In every case, the severity of the bear market was mitigated by dollar cost averaging.

If you are starting to save for retirement and are concerned about whether the bear market is over, a dollar cost averaging plan may put your mind at ease. Even if you start investing and the market falls further, you will end up ahead, provided the market eventually recovers to the level at which you started investing.

Does dollar cost averaging work with bonds?

Doallar cost averaging is subject to the same assumptions as with stocks. Your bond investment should have little or no transaction cost, and you may have to wait long enough to cover a full cycle of rising and falling interest rates. Inflation and interest rates currently are low compared to much of the past 30 years, so if you do start investing in bonds now, you might be starting near a bond market top. (Inflation-indexed bonds are near their historical midpoint, and are likely to be safer.)

What's the catch?

Regarding bear market protection, the caveat is that after you have been saving for a long time, your accumulated investments will be large relative to the amounts you are adding. At that point, your risk is basically the same as that of the market. Bottom line: The longer you have been saving regularly, the greater the market danger to your financial security. To the extent you are invested in stocks, there is no sure antidote for risk.

Always remember to check where your savings stand relative to your ultimate retirement goals. If you are fortunate enough to have accumulated sufficient savings to retire, consider moving some assets from stocks into safer assets, especially if you are within five years of retirement. (Remember, the market required 3 1/2 years to recover from the terrible 1973-1974 bear market - even longer if inflation is counted! A 60-year old in 1972 hoping to retire in five years might ultimately have achieved that goal, but only at the price of considerable financial uncertainty in his last five years of employment.)

A final note about taxes

If you dollar cost average in a taxable account, you will have to keep track of your cost bases over the long term for when you ultimately start redeeming it. This can be a major undertaking; keeping organized records from the onset can be a big help. Some mutual fund companies can assist you by calculating average cost bases for your holdings; however, in a rising market, it will likely be advantageous to redeem first the shares you purchased most recently. As with any multi-year holding strategy, if all else is equal, tax-efficient funds are the best vehicle.