In this series, we’ve examined basic financial statements and what each can do for you as a business owner. Read part one here. The next step is learning how to analyze the information presented in those statements and interpret the language of your financials, so you can:

- Appreciate your practice performance.

- Find ways to generate more profits.

- Look for early clues of problems and opportunities.

- Find ways to maximize your dental practice value.

Practical financial analysis helps you to achieve significant progress and accelerate your practice growth and development. It’s not enough to just look at your financial statements—you need to be able to interpret what the data is telling you. For that, you can use financial statement analysis. Examining financial statements without proactive steps to improve your practice performance is pointless. Financial statements are designed to be analyzed and acted upon.

Read part one ... Why financial statements are the key to growing your practice and your wealth

Putting information to work

Financial analysis is a process. Decades ago, that meant hours of number crunching with a calculator or spreadsheet. Today, it’s fast and easy because most of these capabilities are built into your accounting system. But knowing how to apply financial analysis principles is a learning process; it takes training to interpret the results. The good news is learning is not a very arduous process.

This is a popular definition of financial statement analysis: “Financial statement analysis is a process of analyzing a company’s financial statements for decision-making purposes.”1

It sounds simple, but as with everything else in this world, it depends. It depends on who’s doing the analyzing and for what purpose.

While internal users (practice owners and office managers) use financial analysis as a monitoring tool, helping them manage finances and apply necessary means to improve practice performance, external users utilize it to understand the practice’s overall health and evaluate the financial performance of the business. The most crucial goal of external users is to establish the actual value of the practice as a business enterprise.

Understanding the dynamic nature of financial analysis is also important. The financial statement is a record of critical financial data that reflects significant elements of business performance. However, applying financial analysis does not just reflect historical business activities; it can be used to model future business performance. As such, it is prudent to apply financial analysis to evaluate business enterprises on a basis of historical, current, and projected performance.

Finally, accounting information compiled in the financial statements provides both external and internal users “with a starting point to understand and evaluate the key drivers of a firm, its financial position, and performance.”2

Subtraction as well as addition

As stated before, financial analysis is a process. It is part science but also part art. While the science part lies in applying analytical formulas, the art part rests with using information derived from the analysis to develop a vision of the business’ future and exploration of future business opportunities. The good news is that today, mainly due to technology, there is a lot more science and less art in financial statement analysis.

Modern-day accounting software systems provide vast options for reporting and analysis of financial data, where one can almost effortlessly generate a detailed report reflecting the company’s financial condition. However, like everything else, this analytical process requires a time investment, training, or reliance on professional expertise.

Financial analysis is a complex process, and it’s easy to become overloaded with information. While analyzing financial statements, it is crucial to understand that there is a balance between too much and too little information. Part of financial business management is understanding what to pay attention to and what to ignore. Initially, though, your job is to get familiar with everything so you can tell the difference.

An objective look at your practice

The best way to objectively analyze financial statements to derive the most benefit is to remove or suppress your emotions. Simple reliance on numbers provides an objective review of your business. Being a practice owner comes with a significant emotional toll, and it’s easy to put stories to facts and soften your approach to addressing problems. Remember that financial analysis delivers valid numbers to you unbiasedly, helping you establish reliable benchmarks of your practice profitability, overall enterprise value, and creditworthiness.

This unbiased approach to financial analysis is the best way to build the value of your enterprise, since that’s how potential buyers or investors would ultimately value your practice.3

Understanding your practice’s financial health

Reviewing your practice’s overall health using financial statement analysis is an integral part of the accounting process. Additionally, you can use these analytical techniques to reflect on your business’ strengths and weaknesses and create an opportunity to develop a solid improvement plan. In brief, financial analysis is similar to your business’ financial report card.

So, once your financial statements are prepared, how do you go about analyzing them? First, let’s briefly summarize the three documents involved in financial statement analysis:

Balance sheet: A balance sheet summarizes your practice’s assets, liabilities, and equity—in other words, what you own (assets) and owe (liabilities) and your practice’s financial value (equity) as of a specific period.

Income statement: This document details your practice’s revenues and expenses, showing how much net profit your practice is generating.

Cash flow statement: This statement shows how much cash or cash equivalent has flowed in and out of the practice in a specific period.

5 methods of financial statement analysis

Financial statement analysis is not a simple one-way process. There are different ways to do this analysis, but these are the five standard methods:

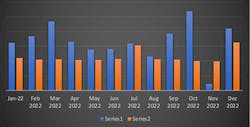

1. Horizontal analysis: Horizontal analysis compares financial information over time (figure 1). This is where you relate financial statement data from various past periods (months, quarters, and years) to see how the business performs compared to previous periods. While horizontal analysis is performed by comparing financial data from the past income statement, it is advisable also to analyze positive and negative variations, such as higher or lower earnings, to understand the reasons for those fluctuations.4

Traditionally, this data is graphed as percentage growth, so users can see the trends clearly, allowing them to quickly identify trends and forecast future results. Horizontal analysis is an excellent tool for following operational performance and profitability. It is also widely used to compare your practice to industry benchmarks to see how you are doing relative to your peers.

2. Vertical analysis: Vertical analysis is also called a common-size analysis (figure 2). This approach expresses all items on a statement as one particular value. For instance, all income statement items are expressed as a percentage of revenue, and all balance sheet items are expressed as a percentage of total assets. This accounting technique is known as “common sizing” or “normalization” and allows users to compare companies (or practices) of different sizes, providing a nonbiased representation of the practice’s performance.5 This form of analysis can also help you focus on the most critical items that are making the most significant impact on your results, particularly helping you monitor overall profitability.

3. Ratio analysis—A financial ratio or accounting ratio is a “relative comparison of two selected numerical values taken from an enterprise’s financial statements.”6 Financial analysts use financial ratios to detect a company’s performance and to compare the strengths and weaknesses of the practice in comparison to other companies or benchmarks used in the industry. Ratio analysis compares line-item data from your financial statements to show performance metrics, addressing your practice’s efficiency and profitability. It can also be used with balance sheet data to help assess your practice’s overall value and solvency. In addition, these ratios are often compared to see the change between the periods in question and help you keep a close eye on practice trends. The next article in this series will focus on ratio analysis.

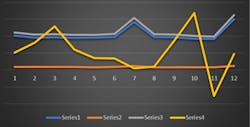

4. Trend analysis: Trend analysis is a common practice of comparing historical information to establish a pattern (figure 3). Although trend analysis is commonly used to predict the future direction of business development, it is also used to reflect on uncertain past events such as a drop in practice profitability due to annual revenue cycles or advertisement campaigns.

While trend analysis involves using historical data from your financials to forecast future performance, such projections can also be valuable in helping you better prepare for the future. Trend analysis is based on the theory that moving with a trend once in play is easier than fighting it.

5. Cost-volume-profit analysis: Cost-volume-profit (CVP) analysis is a form of break-even analysis. A critical part of CVP analysis is determining where the total revenues of the practice equal its total costs (both fixed and variable). As evident, at the break-even point, the practice posts neither income nor loss. This analysis will tell you the level of services your practice needs to provide to cover your total costs. Break-even or CVP analysis can help you better understand the relationship between your practice’s revenues, expenses, and profit. This analysis is exceptionally important for start-up practices and allows users to establish cost controls.

Make financial statement analysis work for you

Financial statement analysis is a potent tool. For many, it provides valuable information about the financial circumstances of the business cycle regardless of different objectives.7 Ultimately, others will gain from a well-run financial analysis of your practice. In many cases, other parties rely on financial statement analysis to understand your business and its ability to generate revenue or repay debt. Further, financial statements are critical when you’re looking for capital or loans. Potential lenders or investors often base their decisions on these metrics.

These analytic methods can help you evaluate your business without bias. As a result, you can objectively see your practice’s strengths and weaknesses and find ways to increase profits. Financial statement analysis is rightfully called a cornerstone of financial intelligence.8 Furthermore, it allows the user to measure financial success, understand how the numbers affect a company’s performance, and plan for the future.

Knowing how to analyze the numbers allows business owners to see financial results in the context of a bigger picture and make informed decisions about the future. Schedule time to analyze your financials at least every quarter. Use these financial statement analysis methods to identify problems and opportunities early so you still have time to act.

Disclosure: Dr. Ruvins, Dr. Stein, and Dr. Kayserman have no financial interest in any of the companies mentioned in this article.

References

- Kenton W. Financial statement analysis: how it’s done, by statement type. Investopedia. Updated March 06, 2022. https://www.investopedia.com/terms/f/financial-statement-analysis.asp

- Weiss LA. A Guide to Understanding Financial Statements. Business Expert Press; 2016.

- White GI, Sondhi AC, Fried D. The Analysis and Use of Financial Statements. 2nd ed. John Wiley & Sons, Inc.; 1997.

- Tamplin T. Horizontal analysis of financial statements. Finance Strategists. Updated March 7, 2023. https://www.financestrategists.com/accounting/financial-statements/horizontal-analysis-of-financial-statements/

- Groppelli AA, Nikbakht E, Wessels WJ. Finance. 4th ed. Barron’s Business Review; 2000:433.

- Kieso DE, Weygandt JJ, Warfield TD. Intermediate Accounting. 12th ed. John Wiley & Sons; 2007:1320.

- Page SE. The Model Thinker: What you Need to Know to Make Data Work for You. Basic Books; 2018.

- Berman K, Knight J, Case J. Financial Intelligence: A Manager’s Guide to Knowing What the Numbers Really Mean. Harvard Business Press; 2013.

Editor's note: This article appeared in the July 2023 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.