The changing state of the cosmetic dentistry industry: What does it mean for your practice?

J. A. Reynolds, DDS, AAACD

When it comes to judging the state of our national economy, there’s no lack of information available. But when it comes to the microcosm of the economy that is cosmetic dental practices, little information is available to help individual dentists determine how their practices are performing relative to other cosmetic practices. To address this need for industry-specific data, the American Academy of Cosmetic Dentistry (AACD) has been conducting a biennial State of the Cosmetic Dentistry Industry survey for the past fourteen years. The invitation to participate is primarily offered via email to the AACD membership at large, but also distributed to nonmember dental professionals through social media and dental media partners to provide an outside‐in view of nonmember dental practices that derive income from cosmetic procedures. The hope is that dentists can use the survey data to better understand the dynamics of the cosmetic dentistry market and then make informed business decisions based on relevant data.

Demographics:

More urban, but still prevalently solo or small group

Over the last fourteen years, we’ve found the demographics of the industry are changing. There has been a shift away from suburban and rural practices to urban ones. The percentage of practices in urban locations increased fifteen percentage points over the last ten years but increased six percentage points in the last two years alone. Urban practices (40%) now outnumber suburban practices (38%) for the first time, with dentists under thirty-five years of age being the most likely to be in urban practices.

Also, the majority share of the cosmetic dentistry market remains with solo/group practices. Over half (55%) of respondents indicate they work in a solo practice, with another 33% indicating they work in group practice. Corporate groups have yet to take over a significant share of the cosmetic dentistry market. In my area of Tennessee, there has been an increased corporate presence that provides good general care, but most specialty cosmetic dentistry is still provided by those who have received advanced training and offer the stability of a small, relationship-based practice. This survey data supports my belief that extensive cosmetic procedures are relationship based and sustained by one-on-one long-term care. Solo or small group practices are well suited for this delivery model.

Technology:

CAD/CAM use is up

The way cosmetic dentists do business is changing as well. Up six percentage points from 2015, 34% of practices report using a chairside CAD/CAM system, while another third (32%) are considering purchasing one. Fewer practices report no interest in chairside CAD/CAM (34% in 2017 compared to 40% in 2015). Adoption of CAD/CAM technology really comes down to practice model, as CAD/CAM dentistry requires a different workflow and staff support, but this growth trend is likely due to the quality restorations, convenience, and lower costs of CAD/CAM milling.

Despite the increase in the number of respondents using CAD/CAM in their offices, dental laboratories remain an important part of the business of a cosmetic practice. Most respondents (59%) indicate using two to three dental laboratories, and 83% of those who use more than one lab say they use multiple labs due to their specialty nature. This suggests that, like many dental practices, labs are finding their strengths and seeking advanced knowledge and technology to provide the highest quality product to remain productive and profitable. However, even with laboratory trends toward specialization, we’ll likely see the commercial dental lab footprint shrink as use of CAD/CAM grows.

The financials:

Survey suggests considerable benefits to AACD membership

The profitability of performing cosmetic procedures shows some variability from 2015 to 2017, with total revenue from all dentistry (cosmetic and noncosmetic) being down, but the amount spent by the average cosmetic dentistry patient being up. In 2015, the average total revenue from all dentistry was $1,195,000, compared to the 2017 average of $1,081,000. But the amount the average cosmetic dentistry patient spent on services at respondents’ practices increased from $4,116 per patient in 2015 to $5, 477 per patient in 2017.

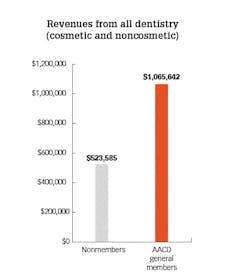

This same breakdown for AACD members, and especially AACD-accredited members, suggests that there is significant economic benefit to membership. Nonmembers reported average total revenues of $523,585 from all dentistry (cosmetic and noncosmetic), while AACD general members averaged twice that ($1,065,642). AACD-accredited members’ revenues averaged $1,602,823, and 71% of AACD-accredited members who responded are in practices with more than one million in revenues.

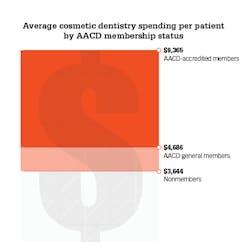

Member type also had a large impact on the amount the average cosmetic dentistry patient spent on services in 2017. Nonmembers averaged $3,644 per patient, general members averaged $4,686 per patient, and accredited members averaged $9,365 per patient. This difference may be attributed to the fact that AACD members charge more for the same procedures and accredited member practices perform on average more than twice as many cosmetic procedures as nonmember practices. General members report charging 40% more than nonmembers for cosmetic procedures, and accredited members report charging 90% more than nonmembers for cosmetic procedures.

From my perspective, this revenue differential is entirely the result of the AACD accreditation journey. As an examiner and former accreditation chair, I have mentored many successful candidates and witnessed the technical and philosophical growth that comes along with the process. One looks at cases in a more comprehensive way and the additional confidence equates to patient awareness and greater treatment acceptance. I realize this sounds hokey, but it is true, and the data proves it.

I’ve only scratched the surface of what the 2017 survey covers, and when the current data is linked to the preceding years of information, it becomes a powerful tool. The AACD uses this data to better understand the dynamics of the cosmetic dentistry market and then make informed business decisions for its members. For example, data collected concerning student loan debt resulted the addition of a student loan refinancing option to AACD preferred pricing partners. Data concerning the number of patients that respondents saw for cosmetic dentistry procedures drives AACD consumer awareness efforts and member benefits such as the AACD Find-A-Dentist website (aacd.com/profiles) and the new consumer Instagram account @yourdreamsmile.

Hopefully, dentists will use these survey results to make informed business decisions for their practices, whether it is expanding services, investing in new technology, or pursuing a credential such as AACD accreditation or fellowship, the benefits of which are well documented in the numbers. The trends illuminated here can help those looking to the future—which overall looks bright for cosmetic dentists.

J. A. Reynolds, DDS, AAACD, is a graduate of the University of Tennessee Health Science Center. He achieved AACD accreditation in 1998 and is the current president of the AACD Board of Directors. He is cofounder and past-president of the Tennessee Academy of Cosmetic Dentistry and donates dental services through the AACD’s Give Back A Smile program. Dr. Reynolds maintains a private practice in Franklin, Tennessee, focusing on comprehensive restorative dentistry and esthetics.