Did you know that 43% of dental hygienists were considering looking for a new job within the next year, and one third had actually applied for a new job in 2019?1 Clinical team member dissatisfaction was at a tipping point. And then came COVID-19.

These are surprising numbers for any industry’s labor market, but it’s particularly important to note for the dental industry. Aside from the pandemic itself, which is reducing patient volume, the number one concern in the industry currently, and in the future, is finding and retaining quality dental professionals.

So what can we do about it?

There’s much we can do to overcome challenges when it comes to transforming our approach to recruiting, hiring, managing, and retaining our dental teams, but we can start by understanding and listening. To better connect dental professionals to one another, provide perspective, and improve dental teams, DentalPost has been surveying its community of 900,000 dental professionals, tracking and sharing job trends and the pandemic’s effect on dental hiring.

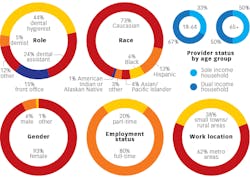

Together with RDH magazine, DentalPost conducted its annual salary survey of dental professionals nationwide. The industry’s most comprehensive survey included 10,890 respondents from all 50 states and was conducted over a six-week time period from September 1, 2020, to October 15, 2020.

Dental professionals weighed in on everything from compensation and employment conditions to their general sentiments and outlook on the industry, including how they’ve been impacted professionally by COVID-19.

Dental hygienists

The majority of full-time hygienists earned between $51,000 and $70,000; however, more than 15% earned over $80,000 a year. These numbers are well above the median income for full-time working females in the US, which in 2019 was $47,299.2

Thirty-two percent reported earning some type of bonus. In the free-form response section of the survey, many RDHs reported they were dismayed at the elimination of their bonuses this year due to the practice shutdown or slowdown.

By state, average compensation ranged from $42,000 to $91,000, with Alaska, California, Maryland, and Delaware being the highest. At the other end of the spectrum, Alabama, Mississippi, West Virginia, Michigan, and South Carolina had the lowest average income for RDHs. Fifty-nine percent reported receiving a pay raise in the past two years. Still, there was general dissatisfaction with both pay raises and how those raises were calculated. Less than 15% of respondents were satisfied with either.

Key takeaways

- The majority of RDHs (70%) were married, with 75% of respondents indicating they were in a joint income household. Of the 25% of RDHs who reported being the sole income provider, a large percentage (45%) were aged 65+.

- On average, dental service organizations (DSOs) were twice as likely to pay RDHs a percentage of production earnings compared with private practices.

- 65% of dental hygienists worked full time. While most dental hygienists were satisfied with their current work schedules, 25% would prefer to work fewer hours. As they age past 50, the number of part-timers increased.

Dental assistants

Most assistants made between $21,000 and $50,000, with the slight majority making between $31,000 and $40,000 annually. Twenty-eight percent earned less than $30,000 per year, and just over 10% earned $50,000 or more annually. Thirty-two percent indicated they received some type of bonus. Sixty-five percent received a pay raise in the past two years. Still, 52% were unhappy with their base compensation, and 60% were as dissatisfied with the process to determine the raises as they were with the raise itself.

Dental assistants claimed average salaries of more than $40,000 per year in fewer than half the states. The highest salaries were in Montana, North Dakota, Minnesota, Massachusetts, California, and Nevada, while the lowest paying states for dental assistants were West Virginia, Nebraska, Oklahoma, Louisiana, and Mississippi.

Key takeaways

- 10% of respondents were currently unemployed. This is a high number compared with just 4% of responding RDHs who were currently unemployed, indicating that during the pandemic, dental assistants were the category of employees laid off or furloughed most.

- This is the most dramatic turnover position in the industry. 67% had been working at their current practice for fewer than five years. And most surprising, almost half of the respondents had applied for at least one new job in the past year.

- Most worked between 36 and 40 hours a week and were paid hourly. Almost 30% of respondents worked 31 to 35 hours a week, and 28% worked fewer hours than they did before the pandemic. 18% were working more hours, and nearly 20% of respondents said they would prefer to work more hours. If their hours were reduced, they were much more likely to look for another job.

Front-office staff

Forty-eight percent made less than $40,000 per year, and another 38% made $41,000–$60,000. This went up, as one would expect, with the number of years of experience, but rarely did these team members make more than $70,000 a year.

Key takeaways

- Nearly a third were the sole income providers in their households.

- 82% were paid hourly. One-third received a pay increase in the past three years.

- 14% worked for a DSO or group practice.

- 57% had more than 15 years of experience in dentistry, and nearly 30% fulfilled some sort of clinical role as part of their job with direct daily contact with patients, including periodontal exams.

- 2% had been with their current employer less than three years.

Income varied considerably by state, which makes sense given the cost of living and the range of insurance reimbursement rates throughout the country. New Mexico came in at the very bottom of the pay scale, with Idaho, Louisiana, and Nevada close behind.

The younger they were, the more likely respondents were to be considering applying for jobs somewhere else within the next year. Overall, more than one-third of those under age 54 had this on their minds. And of those who did intend to apply for a new job, 27% planned to do so within the next 30 days.

Dentists (associates/employees)

The majority (60%) of dentist respondents reported having 20-plus years of experience. Forty percent estimated their annual income for 2020 as being more than $200,000, suggesting that many of the respondents were possibly also practice owners. Fourteen percent of respondents’ salaries ranged between $126,000 and $150,000, 11% between $151,000 and $175,000 and 8% between $176,000 and $200,000.

Key takeaways

- Thirty-six percent of dentists surveyed said they had taken a pay cut this year. Though this group represented the smallest number of survey participants (5%), there were interesting takeaways for dentists (associates/employees).

- 40% were female.

- Two-thirds worked in metropolitan areas.

- 25% of dentists between 25 and 34 years old were planning on seeking a different employment situation within the next six months, indicating that they were associates who had joined either a private practice or a DSO.

- Highest paying states were Colorado, Maine, Montana, and Kansas.

- Lowest paying states were Alaska, New Mexico, Washington DC, Hawaii, and Connecticut.

COVID-19 effects on dental employment

Employee turnover: Of those for whom COVID-19 had reduced their working hours, 35% intended to find a new job within the next year. 7.5% planned to wait until the environment is safer.

Compensation

- 36% of dentists were being compensated less now versus pre-COVID-19.

- Dental hygienists were slightly more likely to be compensated more post-COVID-19 compared to pre-COVID-19.

- 11% of dental professionals who were working more hours were being compensated less than pre-COVID-19.

- 73% reported making the same income compared to pre-COVID-19, while 15% reported making less income compared to pre-COVID-19.

While the majority of respondents did not report a wage reduction post-COVID-19, a number of respondents qualified their statements in the free-form response section, with many stating that they were required to use paid vacation time and sick time to cover the period of office shutdown, during which time they received no payment.

Hours worked

- Over 60% reported working between 31–40 hours a week post-COVID-19.

- Over 55% reported working about the same as they did pre-COVID-19.

Respondent outlook and sentiments

2020 was an exceptionally challenging year for dental professionals and clinicians. Amid circumstances that included aging parents, at-risk family members, or young children at home, some were reluctant or unable to come back to work once dental offices reopened.

In 2019, 43% of dental hygienists cited not feeling valued or respected and not receiving acceptable compensation as the primary reasons they would seek a new job within the next year. In 2020, COVID-19 and its effects appeared to compound this sentiment.

While the majority of respondents did not report a wage reduction post-COVID-19, a number of hygienists included write-in commentary in their survey responses indicating their concerns were not related to wages, but rather work conditions and their overall compensation as it related to their contribution to production and in relation to other industries. Following are some of the common themes and sentiments based on respondent comments:

- Employees were not happy about being required to use paid vacation time and sick time to cover the period of office shutdown, during which they received no payment.

- Those who returned to hygiene faced longer production days due to additional PPE change out, spaced out patient appointments, and more rigorous safety protocols to prevent infection spread.

- Respondents cited a more physically demanding workday with additional PPE and manual hand scaling to reduce aerosols.

Conclusions

The survey results support employee retention and recruiting being the dental industry’s greatest challenges today and in the foreseeable future.

DentalPost/RDH magazine surveys in 2019 and 2020 indicate COVID-19 didn’t create the dental employment issues we have today. It exposed them further and applied pressure, leaving wide-open holes that require attention.

The dental industry as a whole is not keeping pace and is not commensurate with other industries in terms of compensation and benefits, especially with other clinical fields. Predominantly, hourly compensation and part-time employment contribute to the instability of the dental team.

One striking result of the survey is the relative lack of diversity in race and gender among the respondents. Practice performance can benefit from building more diverse teams, whose members bring diverse perspectives and can better attract diverse patients.

Team member retention is paramount. Hiring is always a challenge, and replacing clinical staff will always be difficult. Screening, recruiting, and onboarding new team members slows production. Thus, reducing turnover is critical for yielding better production efficiency, less downtime, and a more consistent patient care experience.

While there is some staff migration away from practices where the team members don’t feel safe, the predominant reason why they are leaving is dissatisfaction with their compensation.

What to do about it

Communicate and show team appreciation: This one costs nothing except your mindfulness and discipline in doing it on a regular, consistent basis. Intentionally take steps to create a culture in which team members feel valued, appreciated, and respected.

Offer production bonuses: Practices need to consider bonus plans that are aligned with the success of the practice. Despite the almost uniform recommendation of all dental consultants, more than 65% of team members are not part of a bonus plan. This may be another reason why job turnover is so high in the dental industry and why so many respondents say they plan to look for a new job. Data has consistently shown that investment in a bonus plan will increase production and generally pay for itself, because team members feel a partnership with the success of the practice rather than treating it as just a job.

Provide more transparency: Along with improving hiring skills, dentists and owners need to get better at the process of calculating and explaining raises, either with more transparency and fairness, or with bonuses that are aligned with the success of the practice. The fact that people are uncomfortable with the process of how pay increases are determined, as much as the increase itself, indicates that this needs to be improved.

Increase benefits: Increasing benefits offerings will help to improve retention and satisfaction and offer more parity with the job market in general. Whether it’s vacation time, sick leave, childcare, or health benefits, these offerings can serve to both attract and retain the best employees.

Prepare for impacts of the gig economy: While the short-term temp market may be momentarily stalled, it will gain appeal to more dental professionals in the future as the broader global economy continues to gravitate toward the flex, work-from-home, and gig economy. Temping will continue to appeal to a certain percentage of employees, and this number may increase in the coming years as people find it more convenient and serving their lifestyle as we evolve to a more work-from-home economy. Of course, dentistry is not a work-from-home business, but as the culture leans toward self-employment, this will affect dental staffing, recruiting, and team management.

Invest in your team: Continued learning keeps teams inspired and challenged to do more. Show your team you value them and think they are worthy of investment. Give them the opportunity to take on new responsibilities or create innovative programs. It keeps dentistry exciting and fosters trust.

Provide a safe operatory: While dental professionals are trained experts in infection control and spread, many practices had become complacent regarding safety protocols. COVID-19 has exposed that complacency and ushered in what will now be more stringent and permanent applications and enforcement of safety protocols. The significant number of team members who have changed jobs for safety reasons indicates a problem that will not solve itself, but will cause a shift in team members, and a subsequent shift in patient base.

Use data to hire smarter: The solution is not just more money; it’s putting the right person in the right position. That’s why DentalPost includes DISC, core values, workplace culture, and emotional intelligence assessments as part of their unique candidate and employer matching process, along with skills and experience data. Improving hiring by bringing in the right team members pays long-term dividends.

References

- The state of the RDH career in 2020. RDH magazine. December 1, 2019. https://www.rdhmag.com/career-profession/article/14073700/the-state-of-the-rdh-career-in-2020

- Semega J, Kollar M, Shrider EA, Creamer J. Income and poverty in the United States: 2019. United States Census Bureau. September 15, 2020. https://www.census.gov/library/publications/2020/demo/p60-270.html

TONYA LANTHIER, RDH, is the founder and CEO of DentalPost, the dental industry’s premier and largest online and mobile job board. A registered dental hygienist turned entrepreneur, Tonya has gained acclaim industrywide for her passion to improve lives and help dental professionals build teams that excel through metric-based career matching tools, including personality tests and values, skills, and work culture assessments.