Time for some renovation!

By: Karen Norris, John F. McDonnell

In the aftermath of Sept. 11, 2001, Uncle Sam is encouraging taxpayers to invest in their businesses. If you are contemplating new equipment purchases or giving the office a "new look" through renovations and improvements, you could save thousands of dollars in income taxes by making those changes now. Whether you are just purchasing a dental practice, planning a practice expansion, enhancing technology, or even planning a practice transition, you most likely will want to consider making some capital improvements due to the new tax law. These tax benefits apply even if the purchases are financed over some period of time.

The Job Creation and Worker Assistance Act of 2002 was recently signed into law. It provides some very favorable new rules for the write-off of business assets including software, equipment, leasehold improvements, and business vehicles. The new law is retroactive and applies to qualified property acquired and placed in service during a three-year period beginning Sept. 11, 2001. If you have already filed your 2001 tax return, consult your accountant to discuss the possibility of amending it to take advantage of this new rule. This new law should be of great interest to you!

30 percent bonus depreciation

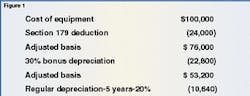

Here's how the new law works. Specifically, the law provides an additional first-year (bonus) depreciation deduction equal to 30 percent of the adjusted basis of qualified property. The extra depreciation is allowed for both regular tax and alternative minimum tax purposes for the taxable year in which the property is placed in service. A Section 179 deduction can continue to be used on property. The remaining adjusted basis will be depreciated over the asset's depreciable life. The deductions are taken in the following order: Section 179 Deduction, 30 percent bonus depreciation (calculated on the reduced basis after Section 179), and regular depreciation (calculated on the reduced basis after Section 179 and the 30 percent bonus).

Figure 1 is an example of this calculation on the purchase of $100,000 of equipment. It shows $57,440 in write-offs in the first year. If the taxpayer is in the 35 percent tax bracket, this could provide a total savings of $20,104 in income taxes. Property qualifying for this bonus depreciation includes assets with a recovery period of 20 years or less and certain leasehold improvements. Used property does not qualify.

Additional depreciation

Under prior law, the maximum first- year deduction for most cars, light trucks, and minivans was $3,060. The new law increases this deduction by $4,600. A new vehicle is now eligible for a $7,660 write-off in year one, as long as it was purchased and placed in service during the three-year period beginning on Sept. 11, 2001. Of course, if your vehicle is used less than 100 percent for business, the $7,660 maximum depreciation figure must be reduced accordingly.

Any taxpayer who purchased new qualifying business assets after Sept. 11, 2001, or who is contemplating new purchases before Sept. 11, 2004, should consider taking advantage of these new favorable tax laws.

Karen Norris is a certified public accountant (CPA) and a certified business valuation analyst (CVA). She and John F. McDonnell are two of the owners of The McNorGroup Inc., a consulting and accounting firm working exclusively with dentists. McDonnell is the founder of the firm and Norris is the chief financial officer. They are members of American Dental Sales and can be reached by phone at (888) 273-1014 or by email at [email protected].