Determining the value of a dental practice is often viewed as subjective and difficult. However, obtaining a fair and accurate value is critically important when attempting to transfer ownership, and differing views of value are frequently the source of disagreement between those involved. Indeed, one of the authors of this article, Jill A.Tanzi, DDS, experienced this firsthand when an associate of her practice left after the practice value could not be agreed upon. This article will outline how to fairly value a dental practice by using an approach frequently employed in corporate settings - discounted cash flow, or DCF, methodology.

The importance of considering the future

Most dentists focus on two figures when determining a practice value: current revenues and current net income. While other data such as patient numbers and practice assets are taken into account, revenue and net income are typically the key drivers of practice value. Frequently, rules of thumb are applied to translate these figures into a practice value. We are aware of dentists, accountants, and other valuation “experts” using a wide variety of methods and shortcuts. One expert we consulted used an approach based on the sum of tangible value (practice assets minus liabilities) plus intangible value, defined arbitrarily as 150 percent of current net income.

In addition to being arbitrary and subjective, valuation methods based on current financial figures do not consider the true source of value for any business - future profitability. The weakness of such methods may be clearly demonstrated by an example. Consider two practices each netting $100,000 this year. Imagine that one practice was started by an eager young dentist and has been growing rapidly. Another practice belongs to an older dentist who has been gradually reducing his working hours and the profitability of his practice has decreased. Should these practices be valued equally? Logic would say no. But how should these businesses be fairly assessed?

Projecting future practice profitability is essential if one seeks to assess the true value of the business. Nevertheless, some criticize the practice of projecting future profitability. Some buyers, and even some accountants, think, “Why should the value consider profits that the business hasn’t even realized?” In fact, their rules of thumb are doing just that, only simplistically and arbitrarily. More sophisticated investors understand that it is not only reasonable, but essential to project future profitability when valuing a business. For example, real estate investors presume that they will derive profits from future rental income and property price appreciation. Likewise, investors in the stock market anticipate dividend income and future stock price increases.

The DCF valuation method

How should financial projections be used in determining a dental practice valuation? We believe that valuation techniques used by corporate financial analysts in evaluating business opportunities also are relevant to dentistry. In corporate finance, decision makers most commonly rely on a DCF approach to evaluate business entities. To be clear, DCF-based valuation methodology is more complicated than the rule-of-thumb methods discussed above. However, the superior accuracy and information provided by a DCF is well worth the effort.

The underlying theory of DCF is straightforward: the value of a business is equal to the present-day value of all future profits. For a dentist considering the purchase of a dental office, the practice value results from the additional future income that would be earned from ownership of the practice. For example, a dentist’s base salary for performing dentistry may be $150,000, but the dentist may be able to earn an additional income of $100,000 as the owner of the practice. The financial value of a practice is the result of this excess practice profitability. In using the DCF approach to value a dental practice, these practice profits are projected into the future. These profits are then discounted back to present-day value to arrive at a practice valuation.

An important component of the DCF method is the translation of future profits into a present-day value. This is accomplished by discounting future profits by applying a discount rate to those profits. The discount rate is the annual percentage rate applied to convert future profits to a present-day value. For example, at a 10 percent discount rate, a $100 profit next year would be valued at $90 today. Discounting of future cash flows is compounded over multiple years, and thus $100 made several years into the future would have even less value. Discounting future profitability is done to account for two important factors. The first factor is the time value of money, or the fact that money made today has more value than that made in the future. The second factor captured in a discount rate is business risk - the chance that the business fails and the projected future profits are never realized. Because most dental offices are fairly low-risk operations, applying a discount rate used by large, stable companies would seem appropriate.

An important question in DCF models is: “How far into the future should one carry the projections?” The nature of the compounding discount rate in a DCF model causes the projected profitability in the more distant future (e.g., 20 years out) to only provide a small contribution to the current practice value. We believe that 20-year projections are generally realistic and adequate.

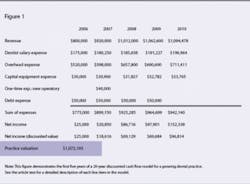

Applying DCF methodology to a dental practice is best demonstrated through a detailed example (Figure 1). Creation of such a model can be easily accomplished through the use of a spreadsheet program such as Excel. (A template model may be obtained by e-mailing the authors.) A proper valuation model should provide detailed financial projections for the practice in question. The specifics of a practice’s valuation model will vary from practice to practice, however, a number of major line items should be included in all dental office valuation models.

Revenues:

Practice revenues (i.e., actual collections) should be projected based on what is considered the most likely future scenario. Recent growth can be used as a guide for the near term, but it is important to be realistic in longer-term projections. If a practice has been growing at 30 percent a year for the past several years, this may continue for the short term, but not indefinitely. At some point almost all businesses plateau. Consider what the maximum possible throughput for your practice would be given available space and a reasonable utilization rate. However, even revenues for businesses that have reached a plateau will still increase at projected inflation rates. The practice modeled here is projected to continue to grow for several years before reaching a plateau in 2010.

Dentist salary expenses:

A practice’s profitability should be evaluated after accounting for the base salary to the practice’s dentist(s) before considering office profits. The excess practice income, after compensating the dentist for performing dentistry, belongs to the owner. The dentist and the owner may be the same individual; however, accounting for the dentist’s salary separately allows the value derived from practice ownership to be evaluated separately from that derived from dentistry. In the model shown, a dentist salary expense of $175,000 is accounted for and this figure grows with inflation.

Overhead expenses:

Office overhead (not including dentist salary) is best projected as a percentage of revenues. There are several good sources of typical dental practice overhead percentages. First, historic office expenses should be examined. Keep in mind, however, that expenses can fluctuate and that expenses, as a percentage, should decrease as revenues increase. A second good resource to estimate typical office overhead can be obtained by asking accountants who focus on dental offices. The model shown has practice overhead as 65 percent of collections.

Capital equipment expenses:

The DCF method accounts for practice assets indirectly. While current assets are not included as a line item in the model, it is necessary to include future expenses required to maintain practice assets and achieve projected revenues. Moreover, it will be necessary to purchase new practice assets, such as equipment and furniture, in the future to obtain these revenues. For an office in good physical condition, we believe it is reasonable to estimate that average office expenditures will equal 10 percent of office assets per year. While in most years expenses will be less than that amount, there will be years where major expenses will be incurred. In the example model, office assets are assumed to be valued at $300,000; therefore, we estimate that $30,000 per year will be required for office maintenance.

One-time expenses:

If revenue projections hinge on a new machine, new operatory, or other additional one-time expense, these expenses must be accounted for in the year they are planned to occur. In our example model, we plan for the build out of a new operatory in 2007 at the cost of $40,000.

Debt expenses:

If the office has additional debt expenses, these must be accounted for in the model. In the example model, the office has four remaining years of debt expense (resulting from the original office build out) of $50,000 per year.

Net income:

The annual net income is calculated as projected revenues minus the sum of the projected expenses.

Calculated practice value:

The office valuation is defined as the projected net income for each year in the model, discounted back to a current value based on the discount rate. The valuation calculated in the example model is $1,072,193, calculated as the sum of the discounted practice net income values. Figure 1 illustrates the first five years of a 20-year projection. This value is higher than what might be obtained by using a rule-of-thumb approach based on current 2006 figures. For example, using the rule of thumb of net income plus assets leads to a valuation of $325,000 - an unrealistically low figure given the projected growth of the business.

It is important to understand what the DCF valuation figure means. The practice value number calculated is the financial figure where practice ownership is financially neutral to the buyer and seller. For example, a valuation figure of $500,000 means that the buyer would make $500,000 additional income, in today’s dollars, by owning a practice. Therefore, paying $500,000 for the practice would be neutral for the buyer. From a buyer’s financial perspective, it makes sense to seek a purchase price that is lower than the DCF-derived neutral valuation, since the buyer wants to enter into a profitable business venture.

Conclusions

The DCF valuation method offers a number of important advantages to the widely used rule-of-thumb valuation methods, which are largely based on multiples of current financial figures. First, while many of the commonly used dental valuation methods are quite arbitrary, the DCF method is based on a sound theoretical framework that is widely accepted by sophisticated corporations and investors. Second, valuation based on the DCF approach accounts for projected growth, unlike static methods that typically undervalue growing practices and overvalue shrinking practices. Third, the DCF model provides both the practice buyer and seller with useful financial projections that can be helpful in negotiating transfer of ownership and future office planning. We hope that the methods described above assist both buyers and sellers in determining a mutually agreeable valuation.

Editor’s note: References are available upon request.

Giancarlo Tanzi, PhD, is a Senior Analyst at Health Advances, LLC, in Weston, Mass., focusing on commercialization of health-care technologies. He earned his graduate degree at the University of Pennsylvania in Cell and Molecular Biology.

Jill A. Tanzi, DDS, is the founder and owner of The Dentist at Hopkinton, in Hopkinton, Mass. She graduated from the Baltimore College of Dental Surgery, University of Maryland. Please e-mail questions, comments, or requests for a template DCF valuation model to [email protected].