S Corporation tax benefits become more beneficial with the new Affordable Care Act

by Blake Hassan, JD, CPA, and John McGill, JD, CPA, MBA

As many doctors are well aware, there have been rumblings from the White House and Congress for a number of years about subjecting S corporation profits to self-employment taxes (SE Tax) as a way to raise revenues. So far this has not happened, and operating as an S corporation still affords the opportunity to save taxes versus operating as a C corporation, sole proprietorship, general partnership, or limited liability company (LLC).

By way of review, a C corporation is a taxable entity and any remaining profits at year end are taxed at a flat 35% rate in personal service corporations. As a result, C corporations will generally zero out their profits before year-end, by paying out bonuses or other compensation to the shareholders. This zeroing out eliminates any tax payable by the corporation, but the bonuses paid are subject to payroll taxes.

In contrast, an S corporation is a pass-through entity and does not pay income taxes. It still prepares an income tax return; however, its profits and losses are reported to the shareholders via Schedule K-1, and the income/losses are reported by the shareholders on their personal tax returns. Any resulting taxes are then paid by the shareholders in connection with their personal tax returns. The shareholders are required to pay themselves reasonable compensation (which is subject to payroll taxes) for the services they provide; however, any corporate profit over and above such reasonable compensation may be paid out as dividends (which are not subject to payroll taxes).

In noncorporate forms (e.g., sole proprietorships, general partnerships, and LLCs), all profits are subject to SE Tax, and in computing the profits subject to SE tax, there is no deduction for health insurance premiums or retirement plan contributions for the owners. In contrast, those items are not subject to payroll taxes in corporations, except for voluntary deferrals by a shareholder-employee into a retirement plan.

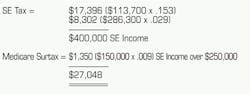

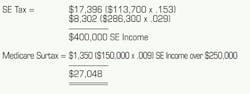

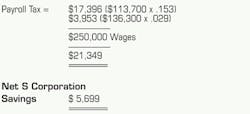

For 2013, the SE/payroll tax is computed as 15.3% up to $113,700 of SE income or wages, plus 2.9% of SE income or wages over $113,700, plus .9% of SE income or wages over $250,000 (on a married filing joint return). This latter .9% is a result of the new Medicare surtax added by the Affordable Care Act (sometimes referred to as Obamacare).

The following shows a comparison of the payroll taxes generated under an S corporation versus an LLC, assuming $400,000 of income. Note that the amount of income tax payable in either case will be the same; however, there is a difference between the SE Tax paid with the LLC versus the payroll tax paid with the S corporation. Both examples ignore the effect of the income tax deduction allowed for half of the SE Tax or the payroll tax.

LLC – Total income = $400,000 (including owner's retirement plan contribution of $49,000 and health insurance premiums of $12,000).

S Corporation – Total income = $400,000 (including owner's wages of $250,000, $23,000 of which is deferred into a retirement plan, employer's matching contribution into retirement plan of $26,000, owner's health insurance premiums of $12,000, and $112,000 dividend).

In the case of the S corporation, a portion of the retirement plan contribution, all the health insurance premiums, and all the dividends escape payroll tax, resulting in significant tax savings versus the LLC.

The good news is that it is not expensive for an existing LLC to elect to be taxed as an S corporation, and such an election can be done without the inconvenience of getting a new tax identification number. Also, it is not expensive for a C corporation to elect to be taxed as an S corporation. If you find that you are not currently using the tax advantages of an S corporation, you should discuss switching to an S corporation with your CPA or tax attorney as soon as possible. This could save you tens of thousands of dollars in SE/Payroll taxes throughout your career!

Blake Hassan provides practice buy-in/buy-out and other legal services through McGill and Hassan, PA, Attorneys at Law, an affiliate of the McGill & Hill Group, a one-stop resource for tax and business planning, practice transition, legal, retirement plan administration, CPA, and investment advisory services. John McGill provides tax and business planning exclusively for the dental profession, and publishes The McGill Advisory newsletter through John K. McGill & Company, Inc., a member of the McGill & Hill Group, LLC. For more information, visit www.mcgillhillgroup.com or call 877-306-9780.

Past DE Issues